- Australia

- /

- Metals and Mining

- /

- ASX:DVP

Earnings Rebound and Director Share Buy Might Change the Case for Investing in Develop Global (ASX:DVP)

Reviewed by Sasha Jovanovic

- Develop Global Limited recently reported full-year results for the period ended June 30, 2025, posting sales of A$231.47 million and net income of A$72.39 million, reversing the previous year's net loss.

- In addition to the earnings turnaround, director William James Beament increased his shareholding by acquiring 253,450 ordinary shares through the exercise of performance rights, highlighting confidence in the company's progress.

- We’ll explore how the combination of strong earnings growth and increased director ownership shapes Develop Global’s evolving investment narrative.

AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

What Is Develop Global's Investment Narrative?

For investors considering Develop Global, the central narrative has centered on its strong sales and profit turnaround, underpinned by the company’s focus on mining and infrastructure solutions. The recent full-year results marked a significant shift from prior losses, and the sizeable increase in director shareholding suggests increased board alignment with shareholder outcomes. Previously, short-term catalysts such as expected revenue and earnings growth, along with progress at the Sulphur Springs project, shaped sentiment. However, the latest updates meaningfully reduce immediate questions about profitability and management’s confidence, potentially brightening the near-term outlook. Still, while share price gains have been sizeable year-to-date, past equity raisings mean shareholder dilution remains a risk if further funding becomes necessary. The impact of high non-cash earnings also bears watching, as it shapes the quality of profits being reported and could be relevant if operating performance changes unexpectedly.

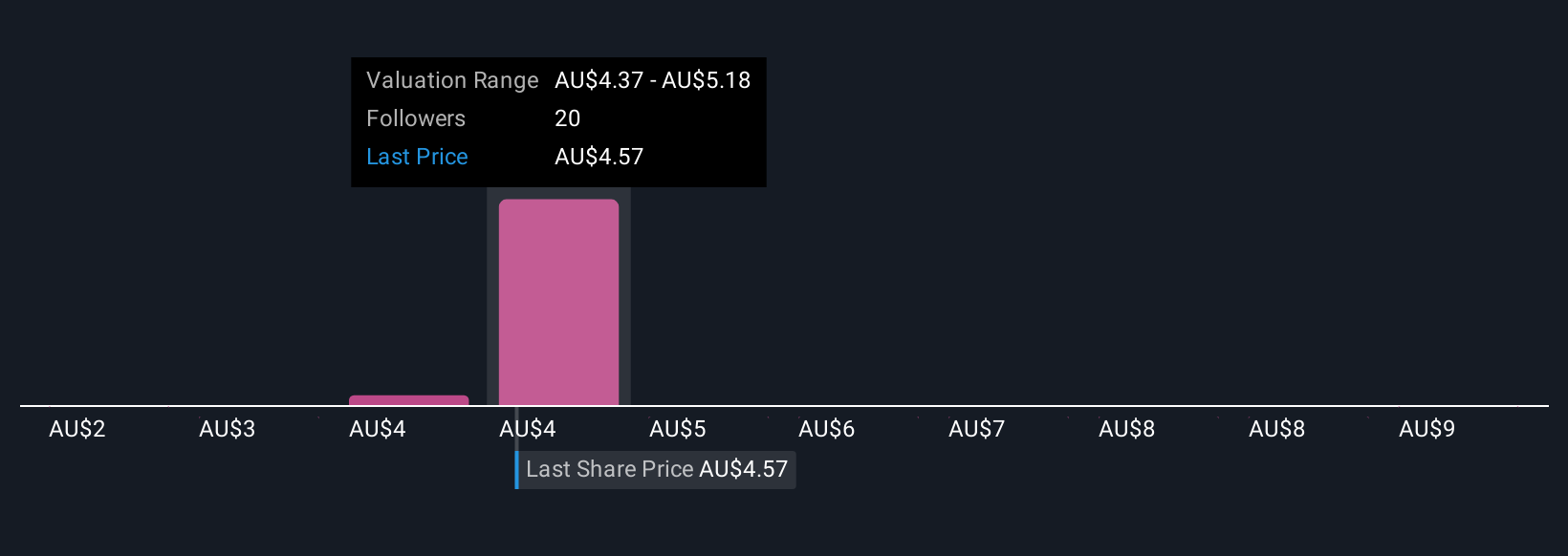

Yet despite the jump in sales, recent dilution is a practical risk worth staying alert to. Insights from our recent valuation report point to the potential overvaluation of Develop Global shares in the market.Exploring Other Perspectives

Explore 6 other fair value estimates on Develop Global - why the stock might be worth less than half the current price!

Build Your Own Develop Global Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Develop Global research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Develop Global research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Develop Global's overall financial health at a glance.

Seeking Other Investments?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Rare earth metals are the new gold rush. Find out which 35 stocks are leading the charge.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:DVP

Develop Global

Engages in the exploration and development of mineral resource properties in Australia.

High growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives