- Australia

- /

- Metals and Mining

- /

- ASX:DVP

ASX Growth Companies With High Insider Ownership

Reviewed by Simply Wall St

As the ASX200 prepares for a lower opening, influenced by global market reactions and local corporate developments, investors are keenly observing how these factors impact their portfolios. In such a fluctuating environment, growth companies with high insider ownership can offer a unique advantage, as they often reflect strong internal confidence and alignment with shareholder interests.

Top 10 Growth Companies With High Insider Ownership In Australia

| Name | Insider Ownership | Earnings Growth |

| Hartshead Resources (ASX:HHR) | 13.9% | 102.6% |

| Cettire (ASX:CTT) | 28.7% | 26.7% |

| Acrux (ASX:ACR) | 14.6% | 115.6% |

| Clinuvel Pharmaceuticals (ASX:CUV) | 13.6% | 28.1% |

| Liontown Resources (ASX:LTR) | 16.4% | 69.7% |

| Catalyst Metals (ASX:CYL) | 17.5% | 75.7% |

| Hillgrove Resources (ASX:HGO) | 10.4% | 49.4% |

| Adveritas (ASX:AV1) | 21.1% | 103.9% |

| Plenti Group (ASX:PLT) | 12.8% | 106.4% |

| Change Financial (ASX:CCA) | 26.6% | 77.9% |

Let's explore several standout options from the results in the screener.

Develop Global (ASX:DVP)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Develop Global Limited (ASX:DVP) engages in the exploration and development of mineral resource properties in Australia, with a market cap of A$572.88 million.

Operations: Revenue from mining services amounts to A$109.75 million.

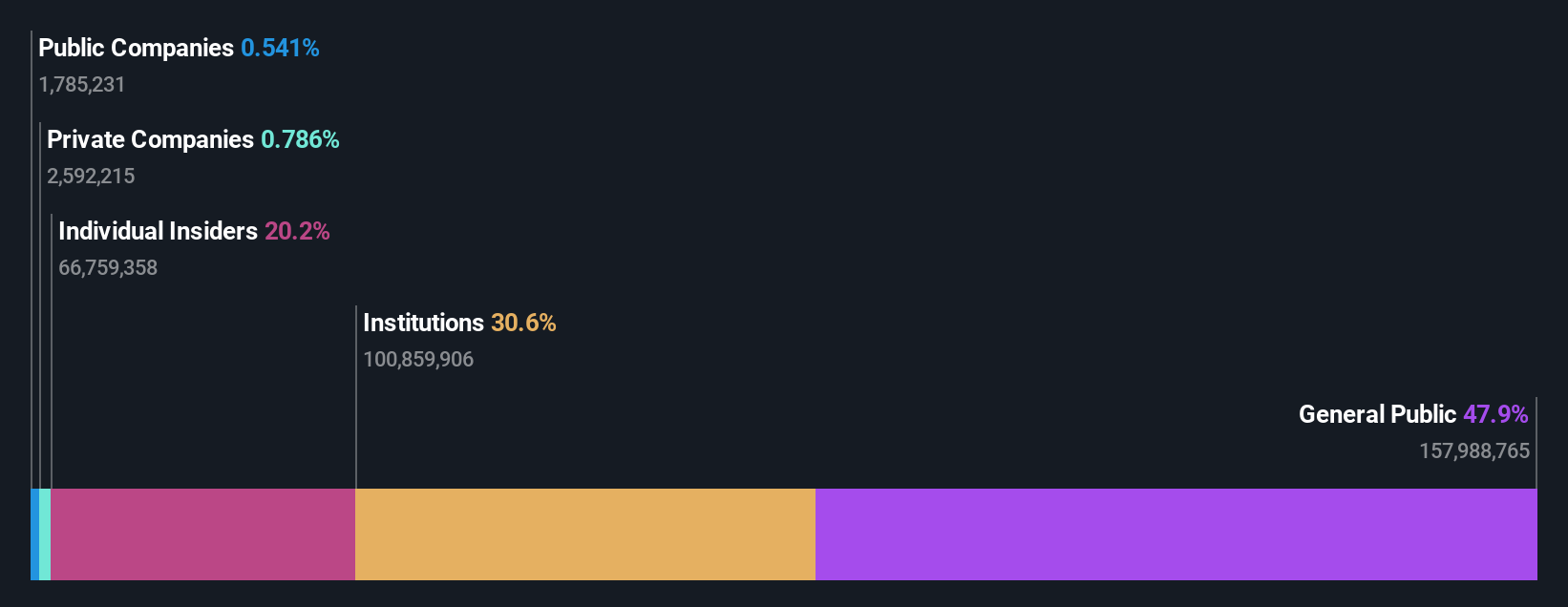

Insider Ownership: 22.6%

Develop Global (DVP) is expected to see significant revenue growth, with forecasts indicating a 57.5% annual increase, outpacing the Australian market's average. The company is projected to become profitable within three years, showcasing above-average market growth in earnings at 122.66% per year. Despite this strong outlook, DVP has less than one year of cash runway and a forecasted low return on equity of 13.5%. Recent events include presentations at the Bell Potter Emerging Leaders Conference in May 2024.

- Click to explore a detailed breakdown of our findings in Develop Global's earnings growth report.

- Insights from our recent valuation report point to the potential undervaluation of Develop Global shares in the market.

IPD Group (ASX:IPG)

Simply Wall St Growth Rating: ★★★★★☆

Overview: IPD Group Limited, with a market cap of A$480.72 million, distributes electrical equipment in Australia.

Operations: The company's revenue segments include the Products Division, generating A$215.98 million, and the Services Division, contributing A$20.79 million.

Insider Ownership: 28.1%

IPD Group is forecast to achieve annual earnings growth of 25.9% and revenue growth of 23.6%, both surpassing the Australian market averages. Despite trading at a discount to its estimated fair value, there has been significant insider selling recently with no substantial insider buying over the past three months. Earnings grew by 22.4% last year, but shareholders experienced dilution during this period. IPD presented at the Bell Potter Emerging Leaders Conference in May 2024.

- Click here and access our complete growth analysis report to understand the dynamics of IPD Group.

- The valuation report we've compiled suggests that IPD Group's current price could be quite moderate.

Nanosonics (ASX:NAN)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Nanosonics Limited, with a market cap of A$975.65 million, operates as a global infection prevention company.

Operations: Nanosonics generates revenue primarily from its Healthcare Equipment segment, amounting to A$170.01 million.

Insider Ownership: 15.1%

Nanosonics is forecast to achieve annual earnings growth of 22.3% and revenue growth of 8.7%, both outpacing the Australian market averages. Despite trading at a 37% discount to its estimated fair value, recent earnings results showed a decline in net income from A$19.88 million to A$12.97 million year-over-year, with profit margins also decreasing from 12% to 7.6%. There has been significant insider selling over the past three months, but more shares were bought than sold overall during this period.

- Delve into the full analysis future growth report here for a deeper understanding of Nanosonics.

- Our expertly prepared valuation report Nanosonics implies its share price may be too high.

Make It Happen

- Click here to access our complete index of 91 Fast Growing ASX Companies With High Insider Ownership.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:DVP

Develop Global

Engages in the exploration and development of mineral resource properties in Australia.

Exceptional growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives