Despite a cautious outlook from major U.S. retailers impacting Wall Street, the ASX200 is set to open slightly higher, reflecting a resilient Australian market. Penny stocks, while often considered relics of past market eras, continue to offer intriguing opportunities for investors seeking affordability and potential growth in smaller or newer companies. In this article, we explore three such penny stocks on the ASX that stand out due to their financial strength and resilience amidst current economic conditions.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| Embark Early Education (ASX:EVO) | A$0.80 | A$146.79M | ★★★★☆☆ |

| LaserBond (ASX:LBL) | A$0.595 | A$69.81M | ★★★★★★ |

| EZZ Life Science Holdings (ASX:EZZ) | A$1.93 | A$91.04M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.455 | A$282.17M | ★★★★★☆ |

| IVE Group (ASX:IGL) | A$2.20 | A$340.76M | ★★★★☆☆ |

| Helloworld Travel (ASX:HLO) | A$2.06 | A$335.4M | ★★★★★★ |

| Dusk Group (ASX:DSK) | A$1.03 | A$64.14M | ★★★★★★ |

| GTN (ASX:GTN) | A$0.525 | A$103.1M | ★★★★★★ |

| MaxiPARTS (ASX:MXI) | A$1.78 | A$98.46M | ★★★★★★ |

| SKS Technologies Group (ASX:SKS) | A$2.13 | A$238.71M | ★★★★★★ |

Click here to see the full list of 1,035 stocks from our ASX Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Dreadnought Resources (ASX:DRE)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Dreadnought Resources Limited is an Australian mineral exploration company with a market capitalization of A$49.02 million.

Operations: Dreadnought Resources Limited has not reported any revenue segments.

Market Cap: A$49.02M

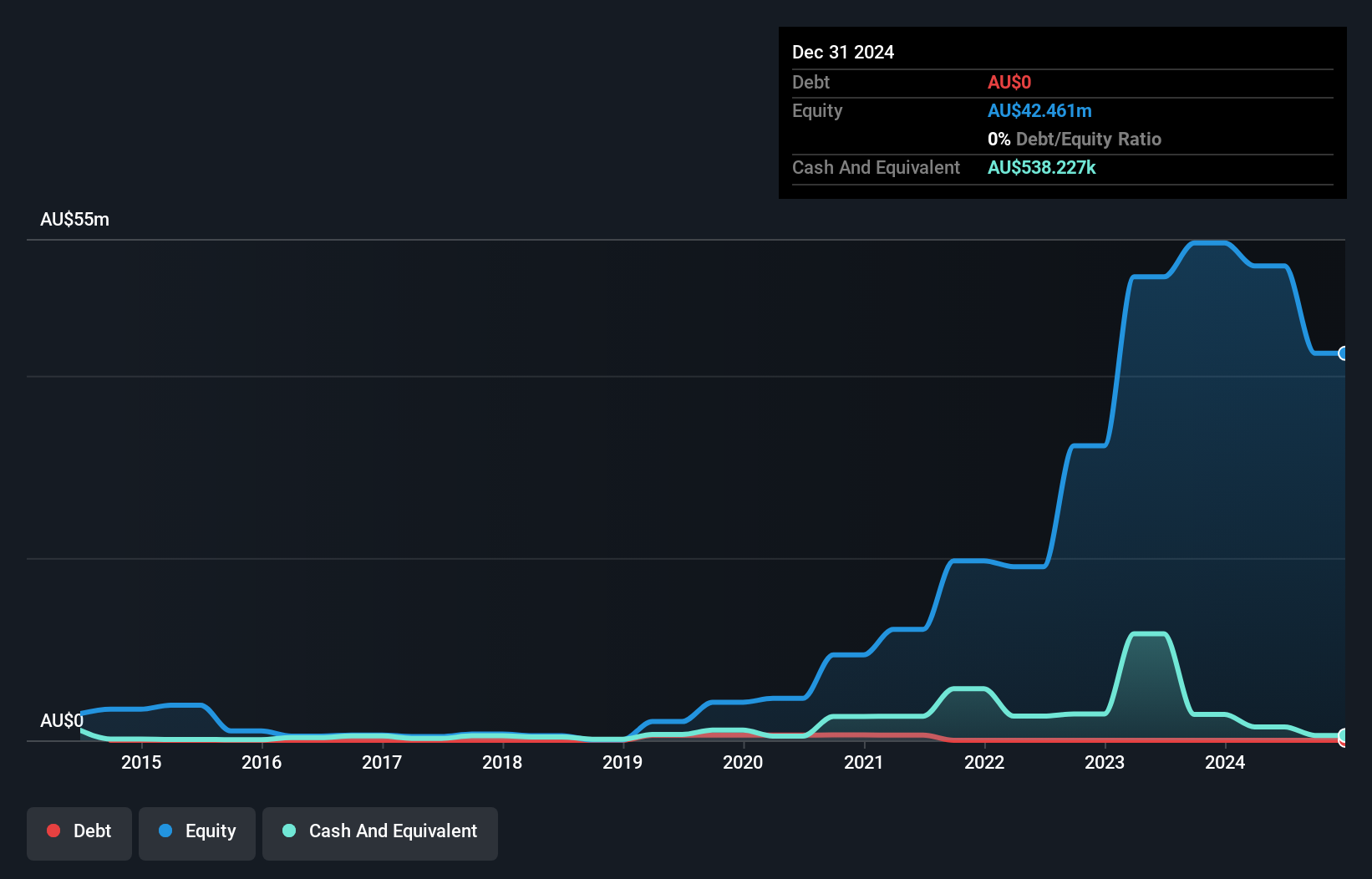

Dreadnought Resources, with a market cap of A$49.02 million, remains pre-revenue and unprofitable, yet it shows potential through its self-funded explorer strategy focused on the high-grade Star of Mangaroon gold mine. The management and board are experienced with average tenures of 3.1 and 5.8 years respectively. Recent capital raises amounting to A$4.1 million bolster its cash runway, though volatility persists in share price movements over recent months. The company is debt-free but has limited short-term financial stability with assets covering liabilities only marginally beyond the immediate term despite additional capital influxes from equity offerings.

- Get an in-depth perspective on Dreadnought Resources' performance by reading our balance sheet health report here.

- Learn about Dreadnought Resources' future growth trajectory here.

ReadyTech Holdings (ASX:RDY)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: ReadyTech Holdings Limited offers technology-based solutions in Australia and has a market cap of A$395.27 million.

Operations: The company's revenue is derived from three primary segments: Workforce Solutions (A$30.74 million), Government and Justice (A$42.51 million), and Education and Work Pathways (A$40.55 million).

Market Cap: A$395.27M

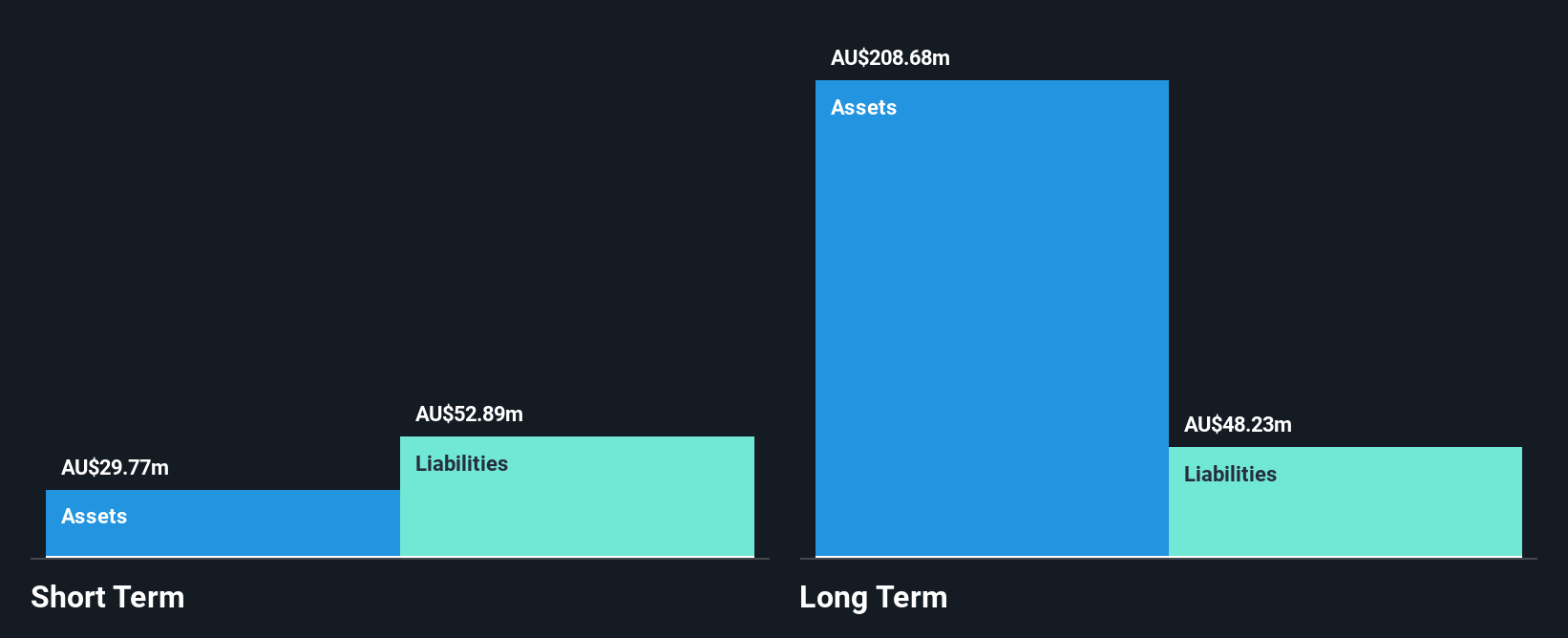

ReadyTech Holdings, with a market cap of A$395.27 million, has demonstrated robust earnings growth, outperforming the software industry over the past year. Despite its stable weekly volatility and satisfactory net debt to equity ratio of 13.2%, the company faces challenges with short-term and long-term liabilities exceeding its assets. The company's earnings quality is high, supported by an experienced management team and board. Trading significantly below estimated fair value presents a potential opportunity for investors; however, low return on equity at 3.6% suggests room for improvement in profitability metrics despite forecasts indicating continued earnings growth of 25.55% annually.

- Click here to discover the nuances of ReadyTech Holdings with our detailed analytical financial health report.

- Understand ReadyTech Holdings' earnings outlook by examining our growth report.

Southern Cross Electrical Engineering (ASX:SXE)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Southern Cross Electrical Engineering Limited offers electrical, instrumentation, communications, security, and maintenance services to the resources, commercial, and infrastructure sectors in Australia with a market cap of A$490.22 million.

Operations: Southern Cross Electrical Engineering Limited has not reported any specific revenue segments.

Market Cap: A$490.22M

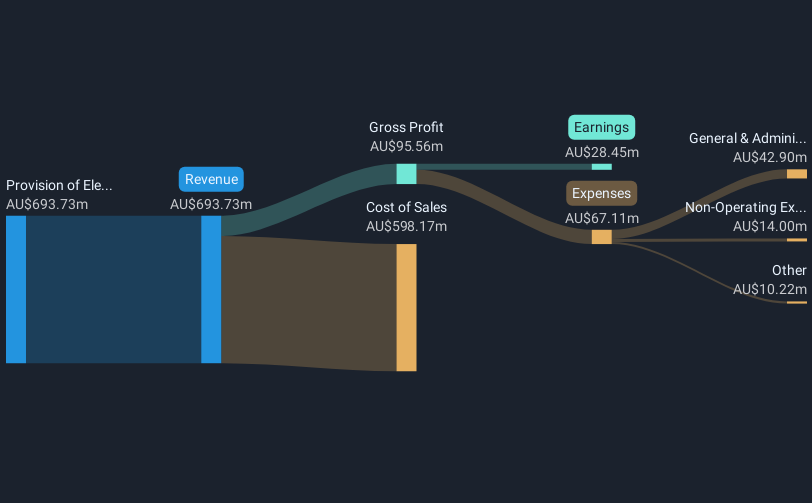

Southern Cross Electrical Engineering, with a market cap of A$490.22 million, has shown strong financial performance with earnings growing 42.3% over the past year and outperforming the construction industry average. The company is debt-free, eliminating concerns about interest coverage and enhancing its financial stability. Despite trading 30.3% below estimated fair value, its return on equity at 14.6% remains low compared to benchmarks. While short-term and long-term liabilities are well-covered by assets, dividend sustainability is unstable due to an inconsistent track record. The experienced management team further supports the company's operational resilience amidst stable weekly volatility.

- Click here and access our complete financial health analysis report to understand the dynamics of Southern Cross Electrical Engineering.

- Assess Southern Cross Electrical Engineering's future earnings estimates with our detailed growth reports.

Next Steps

- Gain an insight into the universe of 1,035 ASX Penny Stocks by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:RDY

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives