A Look at Dyno Nobel (ASX:DNL) Valuation After Full-Year Earnings Beat and New Dividend Announcement

Reviewed by Simply Wall St

Dyno Nobel (ASX:DNL) just released its full-year earnings report, revealing a jump in sales and a much smaller net loss than last year. The company also announced a fully paid dividend for the September period.

See our latest analysis for Dyno Nobel.

Following its improved earnings and freshly announced dividend, Dyno Nobel’s share price has climbed 12.5% over the last three months. This has fueled an upbeat momentum that is reflected in its 11.73% total shareholder return for the year. The stock is showing signs of renewed investor confidence after last year’s challenges.

If this kind of turnaround has you looking for fresh ideas, broaden your investing horizons and discover fast growing stocks with high insider ownership

With the stock rebounding on better earnings and a new dividend, some investors may wonder: Is Dyno Nobel still trading at a discount, or has the market already factored in all its future gains?

Most Popular Narrative: 3.5% Overvalued

Dyno Nobel's latest closing price of A$3.42 stands above the most widely followed fair value estimate of A$3.30. This small discrepancy reflects cautious optimism; however, the underlying story introduces dramatic shifts that could move the dial.

The transformation program at IPL has already realized $64 million in EBIT improvements for fiscal year '24, with a goal to achieve a run rate equivalent to 40%-50% of the earnings uplift by the end of fiscal year '25. This indicates potential for improved net margins and profitability. Strategies to expand margins through productivity enhancements, innovations, and reducing working capital are in place, aiming to improve net margins and overall earnings.

Curious about what’s powering this ambitious valuation? The narrative is built on bolder margin targets, operational upgrades, and anticipated profitability leaps, not the usual earnings story. Want to unravel which projections justify the price and hint at a major valuation shift? The full narrative packs the numbers and context you won’t want to miss.

Result: Fair Value of $3.30 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing uncertainty in Australian gas prices and operational disruptions at key plants could quickly upend these bullish forecasts for Dyno Nobel.

Find out about the key risks to this Dyno Nobel narrative.

Another View: Discounted Cash Flow Model Suggests Opportunity

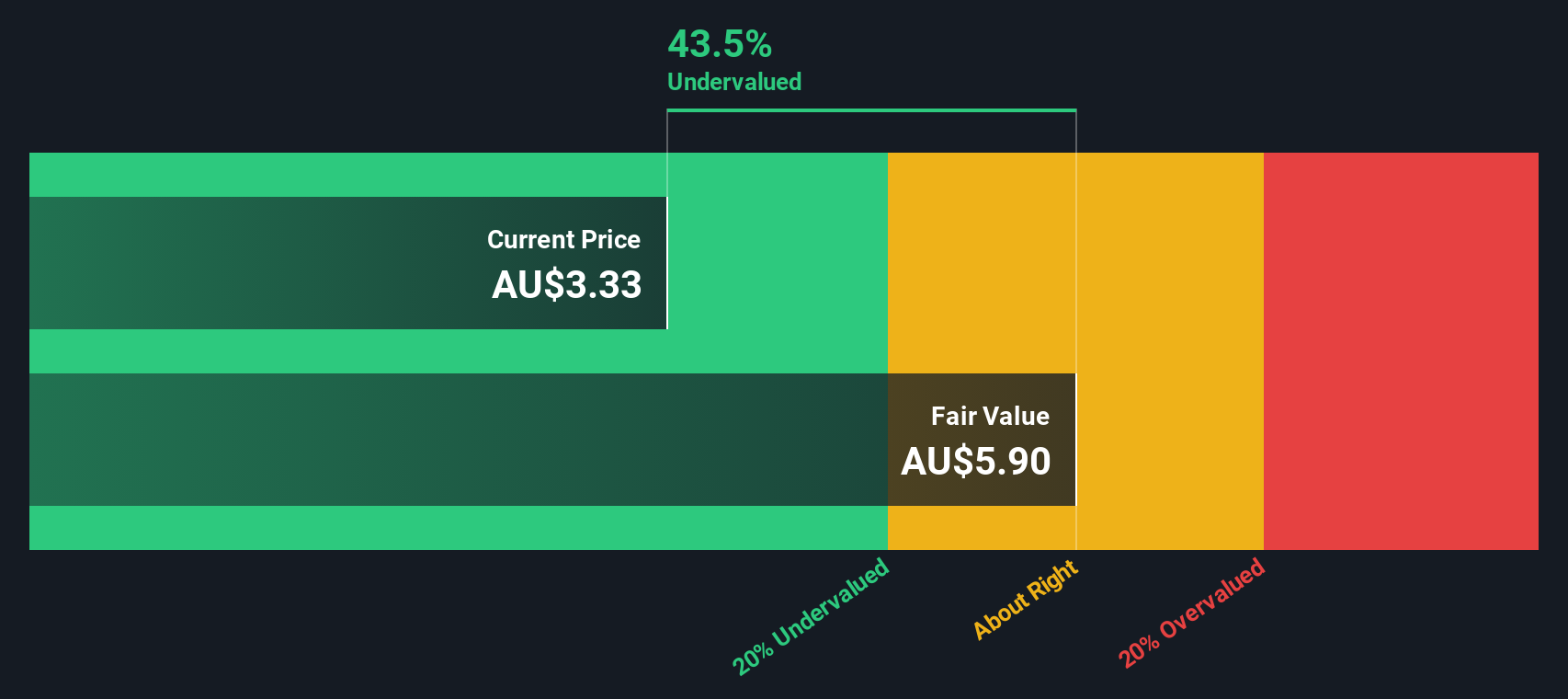

While the consensus valuation sees Dyno Nobel as overvalued by current market multiples, our DCF model presents a different perspective. The SWS DCF model estimates Dyno Nobel's fair value at A$5.89, suggesting the stock may be trading below its true worth. Could the market be overlooking something fundamental?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Dyno Nobel for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 906 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Dyno Nobel Narrative

If you’d like to put a different spin on the numbers or dig into your own research, you can craft your own outlook in just a few minutes. Do it your way

A great starting point for your Dyno Nobel research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Expand your portfolio by targeting stocks with proven advantages. Don’t let these opportunities pass you by and set yourself up for smarter gains today.

- Tap into the momentum of innovative healthcare by starting with these 31 healthcare AI stocks showing strong advances in medical AI and next-gen diagnostics.

- Catch undervalued opportunities early by reviewing these 906 undervalued stocks based on cash flows based on robust cash flow fundamentals not yet priced by the market.

- Ride the wave of digital transformation and financial disruption by browsing these 82 cryptocurrency and blockchain stocks at the forefront of blockchain and cryptocurrency innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:DNL

Dyno Nobel

Manufactures and distributes industrial explosives, chemicals, and fertilizers in the United States and Australia.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives