- Australia

- /

- Metals and Mining

- /

- ASX:DDH

Independent Non-Executive Chairperson Diane Smith-Gander Just Bought 73% More Shares In DDH1 Limited (ASX:DDH)

Whilst it may not be a huge deal, we thought it was good to see that the DDH1 Limited (ASX:DDH) Independent Non-Executive Chairperson, Diane Smith-Gander, recently bought AU$55k worth of stock, for AU$0.88 per share. While that isn't the hugest buy, it actually boosted their shareholding by 73%, which is good to see.

See our latest analysis for DDH1

DDH1 Insider Transactions Over The Last Year

Notably, that recent purchase by Diane Smith-Gander is the biggest insider purchase of DDH1 shares that we've seen in the last year. That means that an insider was happy to buy shares at above the current price of AU$0.86. Their view may have changed since then, but at least it shows they felt optimistic at the time. In our view, the price an insider pays for shares is very important. It is generally more encouraging if they paid above the current price, as it suggests they saw value, even at higher levels.

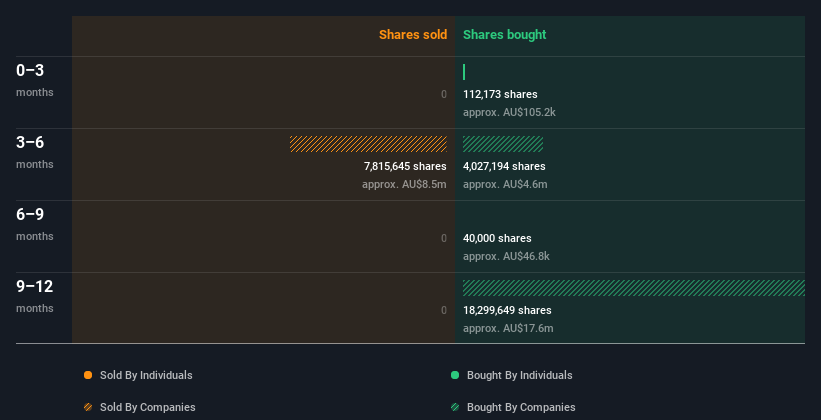

In the last twelve months DDH1 insiders were buying shares, but not selling. Their average price was about AU$0.99. These transactions suggest that insiders have considered the current price of AU$0.86 attractive. You can see a visual depiction of insider transactions (by companies and individuals) over the last 12 months, below. If you click on the chart, you can see all the individual transactions, including the share price, individual, and the date!

DDH1 is not the only stock insiders are buying. So take a peek at this free list of growing companies with insider buying.

Insider Ownership

Many investors like to check how much of a company is owned by insiders. I reckon it's a good sign if insiders own a significant number of shares in the company. DDH1 insiders own about AU$68m worth of shares. That equates to 24% of the company. While this is a strong but not outstanding level of insider ownership, it's enough to indicate some alignment between management and smaller shareholders.

So What Does This Data Suggest About DDH1 Insiders?

The recent insider purchases are heartening. We also take confidence from the longer term picture of insider transactions. Given that insiders also own a fair bit of DDH1 we think they are probably pretty confident of a bright future. While we like knowing what's going on with the insider's ownership and transactions, we make sure to also consider what risks are facing a stock before making any investment decision. Case in point: We've spotted 3 warning signs for DDH1 you should be aware of, and 1 of these shouldn't be ignored.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions, but not derivative transactions.

If you're looking to trade DDH1, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:DDH

DDH1

DDH1 Limited provides specialized surface and underground drilling services to mining and exploration operations in Australia, North America, and Western Europe.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives