- Australia

- /

- Metals and Mining

- /

- ASX:CZN

Should You Worry About Corazon Mining Limited's (ASX:CZN) CEO Salary Level?

Brett Smith has been the CEO of Corazon Mining Limited (ASX:CZN) since 2010. This analysis aims first to contrast CEO compensation with other companies that have similar market capitalization. After that, we will consider the growth in the business. And finally - as a second measure of performance - we will look at the returns shareholders have received over the last few years. The aim of all this is to consider the appropriateness of CEO pay levels.

View our latest analysis for Corazon Mining

How Does Brett Smith's Compensation Compare With Similar Sized Companies?

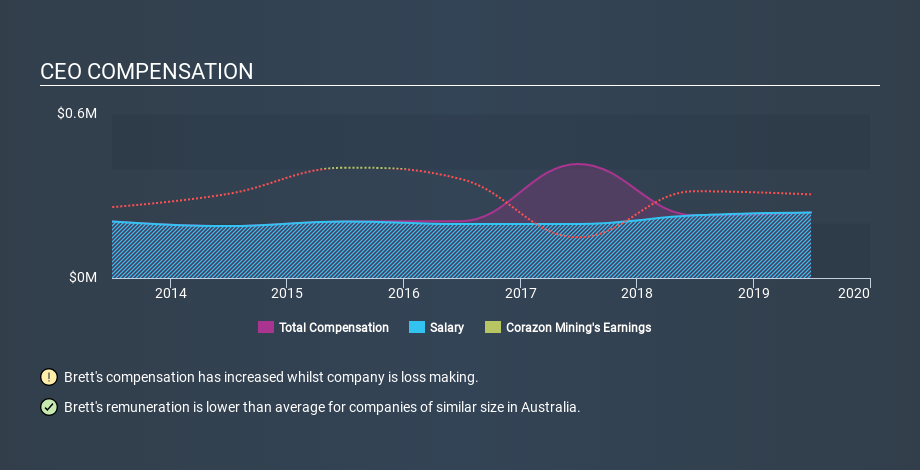

According to our data, Corazon Mining Limited has a market capitalization of AU$4.8m, and paid its CEO total annual compensation worth AU$240k over the year to June 2019. Notably, the salary of AU$240k is the vast majority of the CEO compensation. We looked at a group of companies with market capitalizations under AU$324m, and the median CEO total compensation was AU$390k.

A first glance this seems like a real positive for shareholders, since Brett Smith is paid less than the average total compensation paid by similar sized companies. However, before we heap on the praise, we should delve deeper to understand business performance.

You can see, below, how CEO compensation at Corazon Mining has changed over time.

Is Corazon Mining Limited Growing?

On average over the last three years, Corazon Mining Limited has grown earnings per share (EPS) by 53% each year (using a line of best fit). In the last year, its revenue is up 185%.

This demonstrates that the company has been improving recently. A good result. The combination of strong revenue growth with medium-term earnings per share improvement certainly points to the kind of growth I like to see. Although we don't have analyst forecasts you could get a better understanding of its growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Has Corazon Mining Limited Been A Good Investment?

Given the total loss of 94% over three years, many shareholders in Corazon Mining Limited are probably rather dissatisfied, to say the least. It therefore might be upsetting for shareholders if the CEO were paid generously.

In Summary...

It looks like Corazon Mining Limited pays its CEO less than similar sized companies.

Considering the underlying business is growing earnings, this would suggest the pay is modest. Few would deny that the total shareholder return over the last three years could have been a lot better. We're not critical of the remuneration Brett Smith receives, but it would be good to see improved returns to shareholders before the remuneration grows too much. In this case we may want to look deeper into the company. There are some real positives and we could see improved returns in the longer term. Shifting gears from CEO pay for a second, we've spotted 7 warning signs for Corazon Mining you should be aware of, and 4 of them are significant.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About ASX:CZN

Corazon Mining

Engages in the exploration of mineral resources and development of mining activities in Australia and Canada.

Flawless balance sheet with moderate risk.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Insiders Sell, Investors Watch: What’s Going On at PG?

Waiting for the Inevitable

Near zero debt, Japan centric focus provides future growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026