- Australia

- /

- Metals and Mining

- /

- ASX:CYL

CFO Elena O'Connor’s Exit Might Change The Case For Investing In Catalyst Metals (ASX:CYL)

Reviewed by Sasha Jovanovic

- Catalyst Metals has confirmed that Chief Financial Officer Elena O'Connor has left the company, creating a vacancy in a key leadership role.

- This change removes a central figure in the group’s financial oversight, raising fresh questions about continuity in budgeting, reporting and capital allocation.

- We’ll now consider how the unexpected CFO departure shapes Catalyst Metals’ investment narrative, particularly around financial stewardship and governance confidence.

AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

What Is Catalyst Metals' Investment Narrative?

To own Catalyst Metals, you need to believe that its growing gold production base and improving profitability can be sustained while the company beds down a relatively new leadership team. The numbers so far point to strong momentum, with A$361.4 million of revenue, improving margins and earnings growth that has outpaced both the broader market and the mining sector, alongside index inclusion that has lifted the company’s profile. Against that, the biggest near term drivers remain execution at Plutonic and Trident, capital discipline and how much value is retained for shareholders after recent dilution and insider selling. The sudden exit of CFO Elena O’Connor adds another layer of uncertainty around financial stewardship, but the share price reaction so far suggests investors are still weighing whether this is a fundamental setback or just a manageable bump in a bigger growth story.

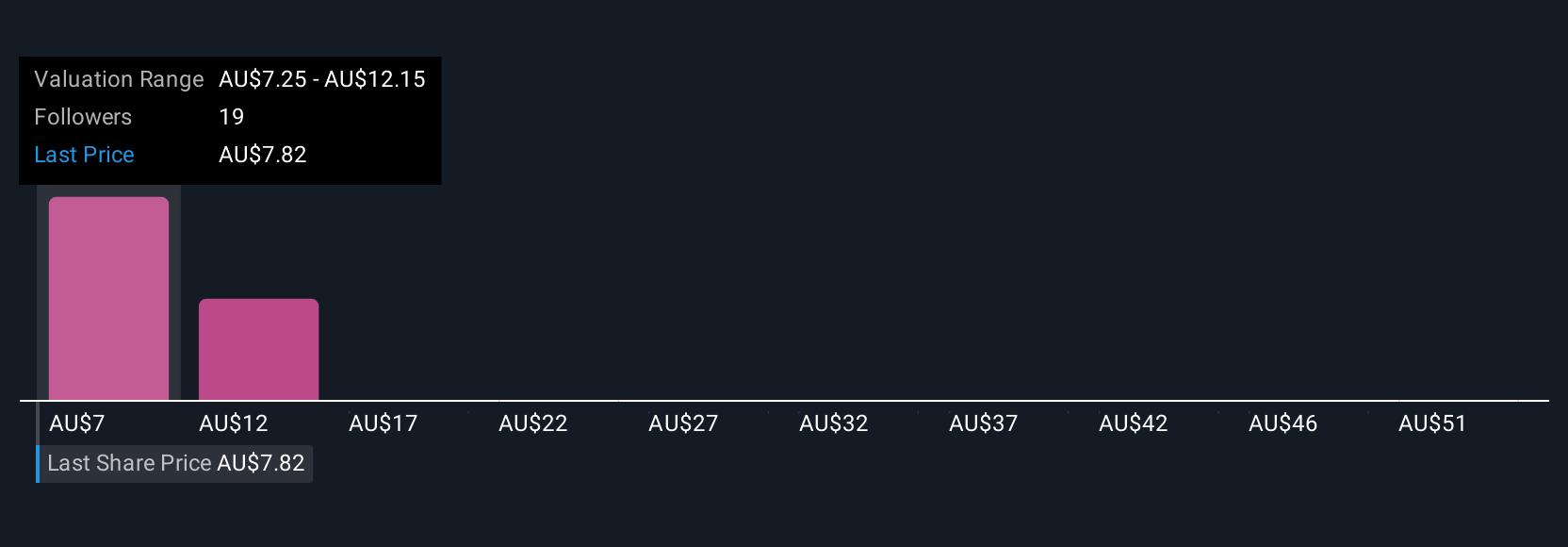

But there is one governance risk here that investors should not gloss over. Despite retreating, Catalyst Metals' shares might still be trading above their fair value and there could be some more downside. Discover how much.Exploring Other Perspectives

Explore 12 other fair value estimates on Catalyst Metals - why the stock might be worth over 7x more than the current price!

Build Your Own Catalyst Metals Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Catalyst Metals research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Catalyst Metals research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Catalyst Metals' overall financial health at a glance.

Searching For A Fresh Perspective?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:CYL

Catalyst Metals

Engages in the mineral exploration and evaluation in Australia.

Exceptional growth potential and undervalued.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026