- Australia

- /

- Metals and Mining

- /

- ASX:CYL

Catalyst Metals (ASX:CYL): Evaluating Valuation After Exploration Tunnel Approval at Four Eagles Gold Project

Reviewed by Kshitija Bhandaru

Catalyst Metals (ASX:CYL) received approval to move forward with an exploration tunnel at its Four Eagles gold project in Victoria. This milestone sent the stock higher as investors responded positively to the opportunity for resource growth.

See our latest analysis for Catalyst Metals.

This approval comes shortly after a period of standout momentum for Catalyst Metals. While the share price dipped 4.38% in the past day following a series of sharp gains, it is still up a remarkable 219% year-to-date. This reflects the market’s optimism for resource expansion and ongoing project development. Over both the short and long term, total shareholder returns have been impressive, highlighting sustained investor confidence as the company advances its gold exploration projects.

If strong upside stories like this have you curious, now’s the perfect moment to discover fast growing stocks with high insider ownership.

After such a remarkable rally, investors may wonder if Catalyst Metals shares are still trading below their true value, or if the current price already reflects all anticipated growth. Could there still be an opportunity to buy in ahead of the crowd?

Price-to-Earnings of 23x: Is it justified?

At a price-to-earnings (PE) ratio of 23x, Catalyst Metals appears undervalued compared to its fair PE ratio estimate of 35.3x and the peer group average of 28.6x. This is despite trading slightly above the industry average PE of 22.6x. The shares recently closed at A$8.30, which may signal the market does not fully appreciate future growth prospects.

The PE ratio reflects what investors are willing to pay today for a dollar of current earnings. For a resource company like Catalyst Metals, this multiple captures both gold price exposure and expectations for earnings momentum based on exploration success and increased output. A below-average PE can indicate the market is cautious about sustainability or is underpricing the company’s forecast profit expansion.

While Catalyst Metals does trade marginally higher than the sector’s 22.6x average, its earnings profile and growth trajectory may support a higher valuation, especially when considering the estimated fair PE of 35.3x. This level indicates where the market could reasonably move if forecast earnings growth materializes as expected.

Explore the SWS fair ratio for Catalyst Metals

Result: Price-to-Earnings of 23x (UNDERVALUED)

However, resource delays or a downturn in gold prices could challenge the upbeat outlook and could result in heightened volatility for Catalyst Metals shares.

Find out about the key risks to this Catalyst Metals narrative.

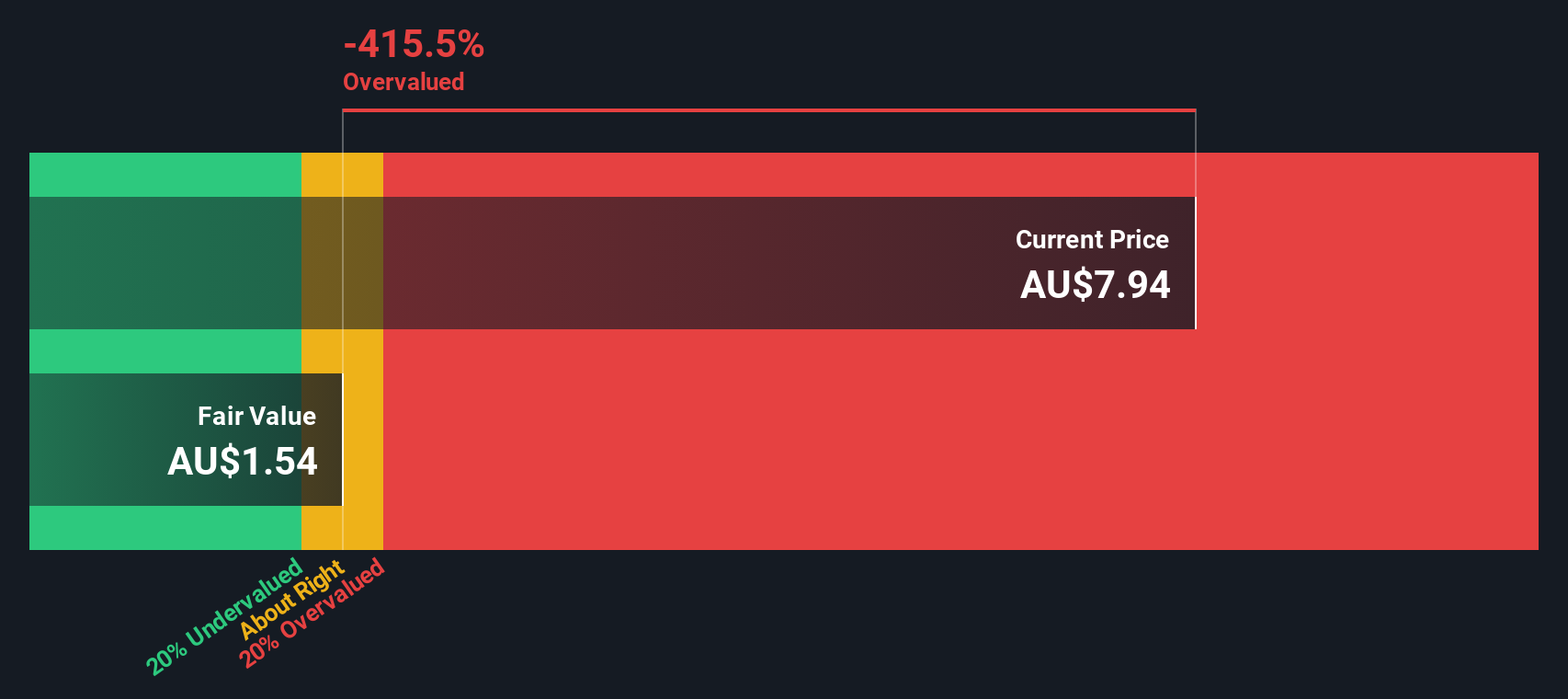

Another View: Discounted Cash Flow Perspective

While the price-to-earnings ratio points to an undervalued story, our SWS DCF model suggests Catalyst Metals could be trading at a major discount. The fair value estimate is nearly four times higher than its current price. Does this deeper value signal a hidden opportunity, or do market risks explain the gap?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Catalyst Metals for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Catalyst Metals Narrative

Keep in mind, if you have a different perspective or want to see the numbers your own way, you can craft your own narrative in just a few minutes. Do it your way.

A great starting point for your Catalyst Metals research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors never stop at just one opportunity. Sharpen your edge by tapping into handpicked screens designed for those who want to see real results this year.

- Find steady income and potential market-beaters by checking out these 20 dividend stocks with yields > 3%, which is packed with high-yield opportunities above 3%.

- Get ahead of technology trends and spot tomorrow’s leaders through these 24 AI penny stocks, where artificial intelligence transforms your investing playbook.

- Capitalize on misunderstood gems with strong financials using these 876 undervalued stocks based on cash flows, highlighting companies undervalued by their cash flows right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:CYL

Catalyst Metals

Engages in the mineral exploration and evaluation in Australia.

Exceptional growth potential and undervalued.

Similar Companies

Market Insights

Community Narratives