- Australia

- /

- Metals and Mining

- /

- ASX:SFX

3 ASX Penny Stocks With Market Caps Under A$200M To Consider

Reviewed by Simply Wall St

As the Australian stock market wraps up a year marked by an 8.8% gain, traders are witnessing a dip on the final trading day of 2024, likely due to profit-taking. In such fluctuating conditions, investors often seek opportunities that balance affordability with growth potential. Penny stocks, though an older term, continue to represent smaller or emerging companies that could offer value when backed by strong financials and clear growth paths.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| Embark Early Education (ASX:EVO) | A$0.765 | A$140.36M | ★★★★☆☆ |

| LaserBond (ASX:LBL) | A$0.565 | A$66.23M | ★★★★★★ |

| SHAPE Australia (ASX:SHA) | A$2.86 | A$237.13M | ★★★★★★ |

| Helloworld Travel (ASX:HLO) | A$1.955 | A$318.31M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.515 | A$319.37M | ★★★★★☆ |

| Navigator Global Investments (ASX:NGI) | A$1.745 | A$855.19M | ★★★★★☆ |

| MaxiPARTS (ASX:MXI) | A$1.88 | A$103.99M | ★★★★★★ |

| SKS Technologies Group (ASX:SKS) | A$1.59 | A$217.98M | ★★★★★★ |

| Vita Life Sciences (ASX:VLS) | A$1.8975 | A$106.44M | ★★★★★★ |

| Servcorp (ASX:SRV) | A$4.90 | A$483.46M | ★★★★☆☆ |

Click here to see the full list of 1,053 stocks from our ASX Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Anson Resources (ASX:ASN)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Anson Resources Limited is a critical minerals company focused on the exploration and development of natural resources in the United States and Australia, with a market cap of A$87.23 million.

Operations: No specific revenue segments are reported for Anson Resources Limited.

Market Cap: A$87.23M

Anson Resources Limited, with a market cap of A$87.23 million, is pre-revenue and has experienced shareholder dilution over the past year. Despite being unprofitable and not forecast to achieve profitability in the next three years, it maintains more cash than its total debt and covers both short-term and long-term liabilities with its assets. The company recently raised A$2.25 million through a follow-on equity offering, which may help extend its cash runway beyond the current two-month estimate based on free cash flow projections. Anson's board is experienced with an average tenure of 9.7 years, although management is relatively new at 1.9 years average tenure.

- Take a closer look at Anson Resources' potential here in our financial health report.

- Understand Anson Resources' earnings outlook by examining our growth report.

Core Lithium (ASX:CXO)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Core Lithium Ltd focuses on developing lithium and various metal deposits in Northern Territory and South Australia, with a market cap of A$184.30 million.

Operations: The company's revenue comes entirely from the Finniss Lithium Project, generating A$189.49 million.

Market Cap: A$184.3M

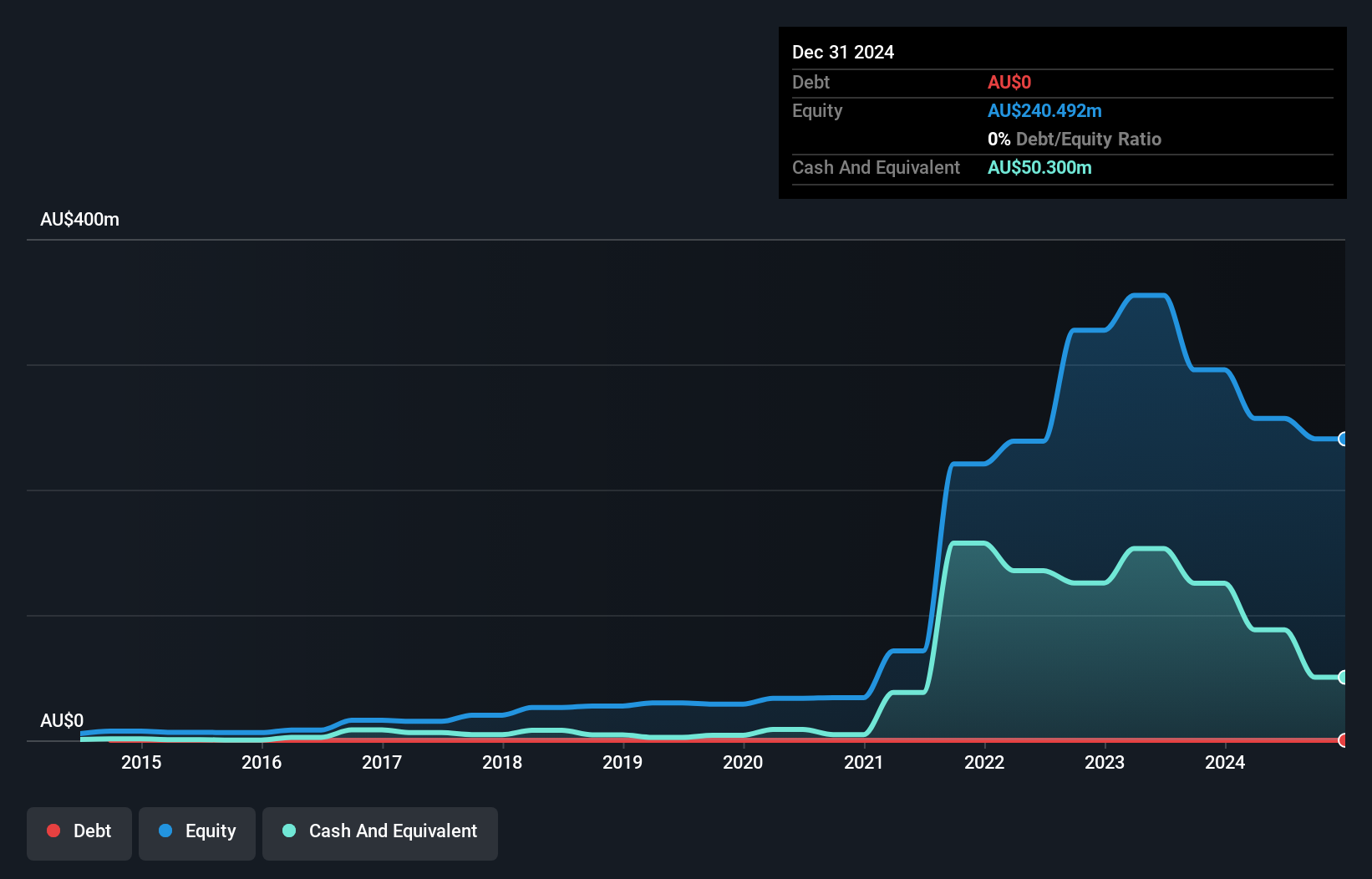

Core Lithium Ltd, with a market cap of A$184.30 million, is currently unprofitable and not expected to achieve profitability in the next three years. Despite this, it has no debt and its short-term assets of A$99.5 million cover both short-term (A$37.8M) and long-term liabilities (A$29.3M). The company relies heavily on its Finniss Lithium Project for revenue generation but faces a cash runway challenge with less than a year based on current free cash flow trends. Recent board changes include the appointment of Alicia Sherwood as Non-Executive Director, enhancing strategic value through her extensive ESG credentials and stakeholder relations expertise in Northern Territory operations.

- Unlock comprehensive insights into our analysis of Core Lithium stock in this financial health report.

- Evaluate Core Lithium's prospects by accessing our earnings growth report.

Sheffield Resources (ASX:SFX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Sheffield Resources Limited is involved in the evaluation and development of mineral sands in Australia, with a market capitalization of A$67.12 million.

Operations: There are no reported revenue segments for the company.

Market Cap: A$67.12M

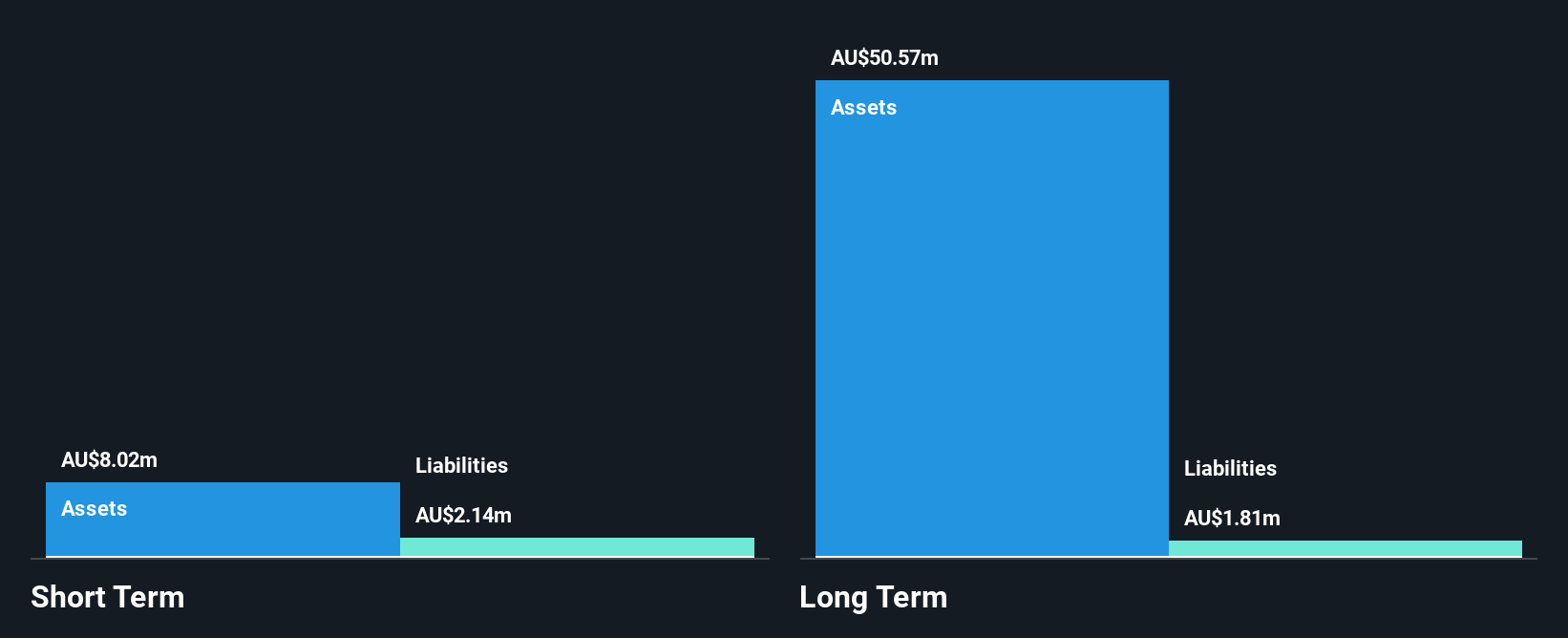

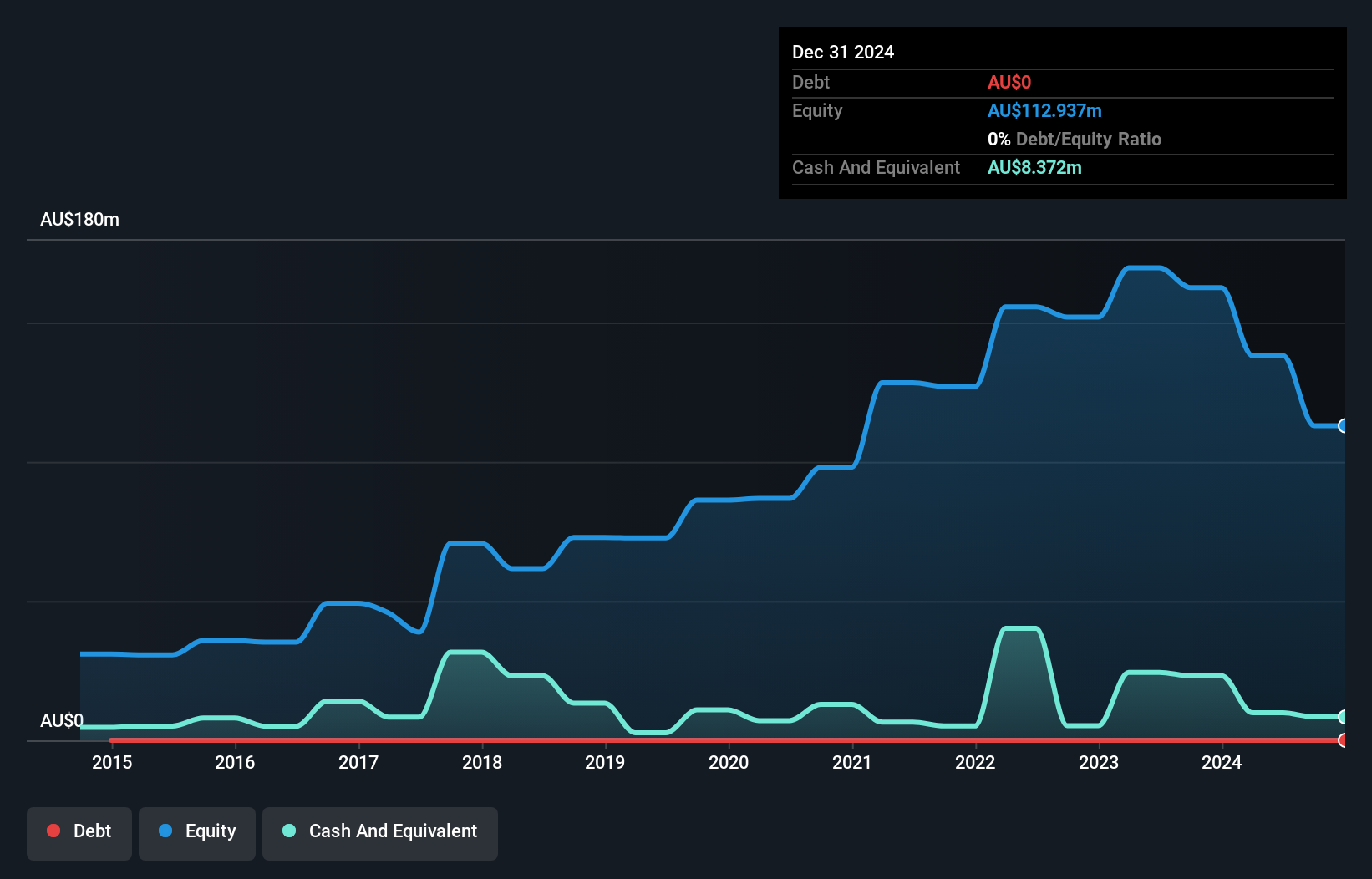

Sheffield Resources Limited, with a market cap of A$67.12 million, is pre-revenue and unprofitable, facing a negative return on equity of -23.3%. Despite this, the company benefits from having no debt and sufficient cash runway for over three years if free cash flow continues to grow at historical rates. Its short-term assets significantly exceed its short-term liabilities by A$9.45 million, providing financial stability in the near term. The board's average tenure of 4.5 years indicates experienced governance; however, profitability remains elusive with no forecasted turnaround in the next three years. Recent corporate governance updates include proposed changes to its constitution regarding takeover provisions.

- Jump into the full analysis health report here for a deeper understanding of Sheffield Resources.

- Gain insights into Sheffield Resources' future direction by reviewing our growth report.

Taking Advantage

- Reveal the 1,053 hidden gems among our ASX Penny Stocks screener with a single click here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:SFX

Sheffield Resources

Engages in the evaluation and development of mineral sands in Australia.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives