- Australia

- /

- Entertainment

- /

- ASX:ICI

Agency Group Australia And 2 More Promising ASX Penny Stocks

Reviewed by Simply Wall St

The ASX200 is set to open 0.46% higher today, reflecting a mixed night on the US stock market after inflation figures matched expectations, suggesting stability in global economic conditions. For investors looking beyond established giants, penny stocks—often representing smaller or newer companies—can still offer intriguing opportunities despite being an outdated term. By focusing on those with strong financials and growth potential, investors may find promising options among these lesser-known stocks.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| Embark Early Education (ASX:EVO) | A$0.765 | A$140.36M | ★★★★☆☆ |

| LaserBond (ASX:LBL) | A$0.6075 | A$71.21M | ★★★★★★ |

| Helloworld Travel (ASX:HLO) | A$1.93 | A$314.24M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.55 | A$341.08M | ★★★★★☆ |

| MaxiPARTS (ASX:MXI) | A$1.87 | A$103.44M | ★★★★★★ |

| SHAPE Australia (ASX:SHA) | A$2.75 | A$228.01M | ★★★★★★ |

| Navigator Global Investments (ASX:NGI) | A$1.645 | A$806.18M | ★★★★★☆ |

| Perenti (ASX:PRN) | A$1.17 | A$1.08B | ★★★★★★ |

| West African Resources (ASX:WAF) | A$1.49 | A$1.7B | ★★★★★★ |

| EZZ Life Science Holdings (ASX:EZZ) | A$3.00 | A$133.27M | ★★★★★★ |

Click here to see the full list of 1,036 stocks from our ASX Penny Stocks screener.

Let's explore several standout options from the results in the screener.

Agency Group Australia (ASX:AU1)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: The Agency Group Australia Limited operates in the real estate sector within Australia and has a market capitalization of A$10.71 million.

Operations: The company's revenue is primarily derived from Real Estate Property Services, generating A$87.06 million, and Mortgage Origination Services, contributing A$0.88 million.

Market Cap: A$10.71M

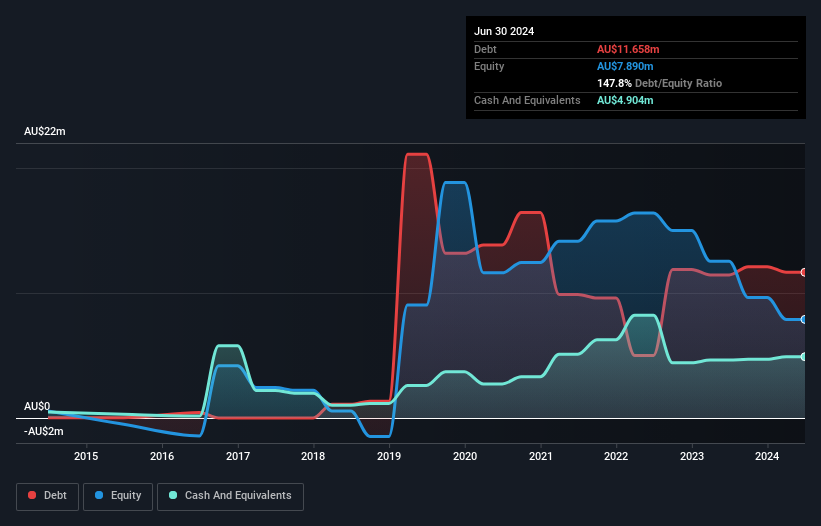

Agency Group Australia Limited, with a market cap of A$10.71 million, operates in the real estate sector and reported A$87.97 million in sales for the year ended June 2024. Despite this revenue growth from A$76.93 million the previous year, it remains unprofitable with a net loss of A$4.89 million. The company has managed to reduce its debt-to-equity ratio significantly over five years and maintains a cash runway exceeding three years due to positive free cash flow growth. However, short-term liabilities exceed short-term assets, indicating potential liquidity concerns amidst share price volatility.

- Unlock comprehensive insights into our analysis of Agency Group Australia stock in this financial health report.

- Explore historical data to track Agency Group Australia's performance over time in our past results report.

Castile Resources (ASX:CST)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Castile Resources Limited is an Australian company focused on mineral exploration and project development, with a market cap of A$21.05 million.

Operations: The company's revenue is primarily derived from its mineral exploration activities, amounting to A$0.27 million.

Market Cap: A$21.05M

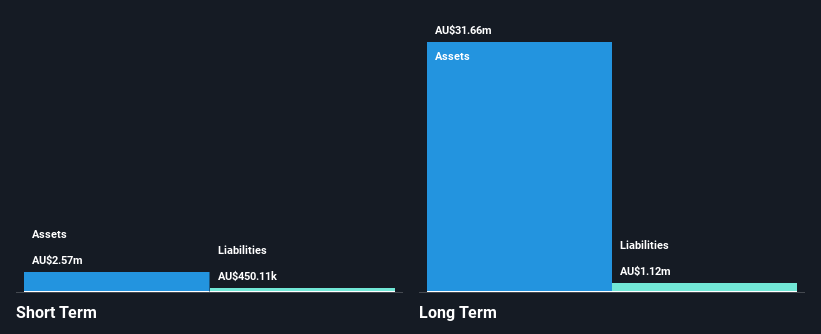

Castile Resources Limited, with a market cap of A$21.05 million, is pre-revenue, generating only A$0.27 million from mineral exploration activities in the last fiscal year. The company remains unprofitable but has reduced its net loss to A$0.68 million from the previous year's A$1.39 million, reflecting some progress in managing costs or improving efficiency. With no debt and short-term assets of A$2.6 million exceeding both short and long-term liabilities, Castile maintains a solid liquidity position despite earnings volatility and ongoing losses over the past five years at an annual rate of 14.5%.

- Take a closer look at Castile Resources' potential here in our financial health report.

- Understand Castile Resources' track record by examining our performance history report.

iCandy Interactive (ASX:ICI)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: iCandy Interactive Limited, with a market cap of A$29.45 million, designs, develops, and publishes mobile games and digital entertainment across Australia, Singapore, Malaysia, Indonesia, and Europe.

Operations: The company's revenue primarily comes from the Provision of Creative Arts segment, generating A$25.48 million, followed by Game Development/publishing with A$2.10 million.

Market Cap: A$29.45M

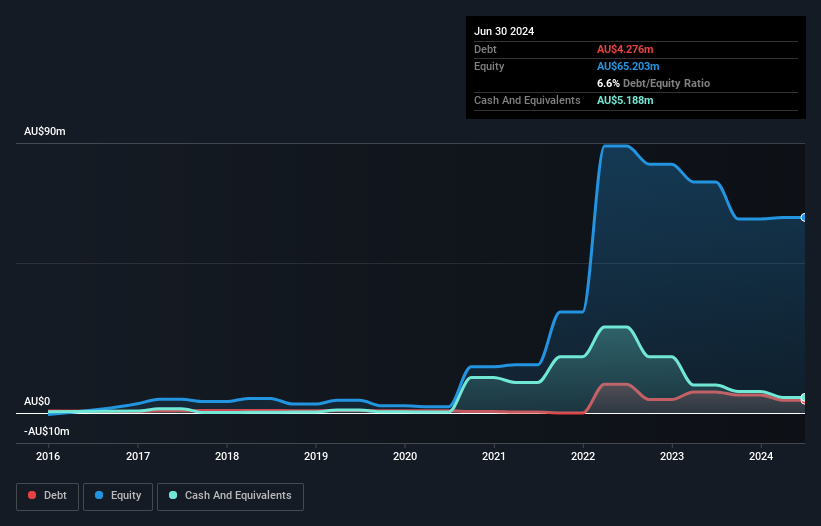

iCandy Interactive Limited, with a market cap of A$29.45 million, has shown some revenue growth in its creative arts segment, reporting sales of A$13.18 million for the half year ending June 2024. Despite this, the company remains unprofitable with a net loss of A$0.073 million but has significantly narrowed its losses from the previous year. The company benefits from a strong liquidity position as short-term assets exceed liabilities and maintains more cash than total debt, although it faces challenges with earnings volatility and high share price fluctuations over recent months.

- Navigate through the intricacies of iCandy Interactive with our comprehensive balance sheet health report here.

- Learn about iCandy Interactive's historical performance here.

Make It Happen

- Take a closer look at our ASX Penny Stocks list of 1,036 companies by clicking here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade iCandy Interactive, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if iCandy Interactive might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:ICI

iCandy Interactive

Designs, develops, and publishes mobile games and digital entertainment in Australia, Singapore, Malaysia, Indonesia, and Europe.

Flawless balance sheet with questionable track record.

Market Insights

Community Narratives