- Australia

- /

- Aerospace & Defense

- /

- ASX:ASB

ASX Value Picks Austal And 2 More Stocks That May Be Trading Below Intrinsic Estimates

Reviewed by Simply Wall St

As the Australian market flirts with its all-time high, buoyed by strong performances in sectors like energy, investors are keenly watching for opportunities amidst mixed economic signals such as a low GDP growth rate. In this environment, identifying undervalued stocks that may be trading below their intrinsic value can offer potential rewards for those looking to capitalize on market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows In Australia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Praemium (ASX:PPS) | A$0.695 | A$1.15 | 39.8% |

| Catalyst Metals (ASX:CYL) | A$7.09 | A$13.20 | 46.3% |

| Lynas Rare Earths (ASX:LYC) | A$8.23 | A$13.78 | 40.3% |

| Fenix Resources (ASX:FEX) | A$0.285 | A$0.47 | 39.5% |

| Polymetals Resources (ASX:POL) | A$0.85 | A$1.55 | 45.3% |

| Charter Hall Group (ASX:CHC) | A$18.86 | A$33.88 | 44.3% |

| Nuix (ASX:NXL) | A$2.40 | A$4.02 | 40.4% |

| ReadyTech Holdings (ASX:RDY) | A$2.35 | A$4.69 | 49.9% |

| PointsBet Holdings (ASX:PBH) | A$1.20 | A$2.05 | 41.6% |

| Superloop (ASX:SLC) | A$2.81 | A$4.92 | 42.9% |

Let's explore several standout options from the results in the screener.

Austal (ASX:ASB)

Overview: Austal Limited designs, manufactures, and supports vessels for commercial and defense customers globally, with a market cap of A$2.49 billion.

Operations: The company's revenue is derived from several segments: USA - Support (A$310.21 million), USA - Shipbuilding (A$916.49 million), Australasia - Support (A$156.69 million), and Australasia - Shipbuilding (A$197.62 million).

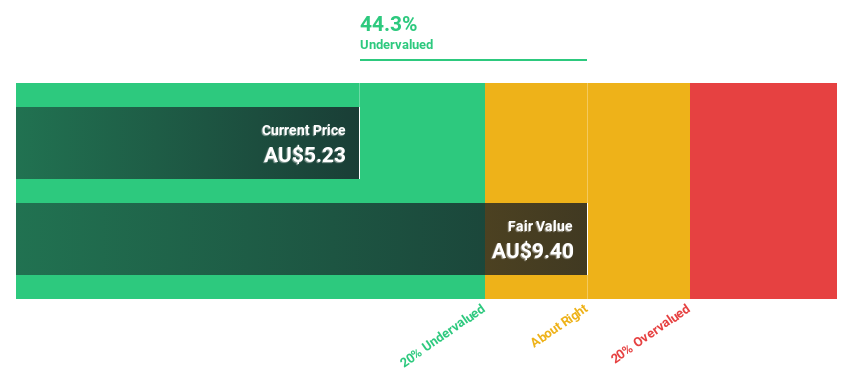

Estimated Discount To Fair Value: 33.3%

Austal Limited is trading at A$5.94, significantly below its estimated fair value of A$8.91, suggesting it may be undervalued based on cash flows. Its earnings are forecast to grow significantly at 20.08% annually over the next three years, outpacing the Australian market's growth rate of 11.7%. However, recent equity offerings totaling A$220 million could indicate potential shareholder dilution concerns despite robust profit growth and favorable valuation metrics.

- Our expertly prepared growth report on Austal implies its future financial outlook may be stronger than recent results.

- Dive into the specifics of Austal here with our thorough financial health report.

Capricorn Metals (ASX:CMM)

Overview: Capricorn Metals Ltd is involved in the evaluation, exploration, development, and production of gold properties in Australia with a market cap of A$4.33 billion.

Operations: The company generates revenue primarily from its Karlawinda gold operations, amounting to A$379.47 million.

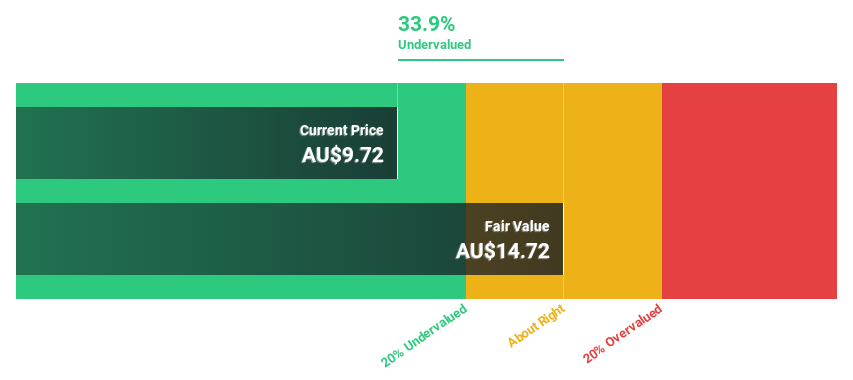

Estimated Discount To Fair Value: 32.1%

Capricorn Metals, trading at A$10.05, is priced below its estimated fair value of A$14.81, indicating potential undervaluation based on cash flows. Earnings are expected to grow significantly at 32.8% annually over the next three years, surpassing the Australian market's growth rate. Despite recent executive changes and legal issues involving its CEO, Capricorn's leadership remains stable with Executive Chairman Mark Clark at the helm, ensuring continuity in management and strategic direction.

- Our growth report here indicates Capricorn Metals may be poised for an improving outlook.

- Unlock comprehensive insights into our analysis of Capricorn Metals stock in this financial health report.

James Hardie Industries (ASX:JHX)

Overview: James Hardie Industries plc manufactures and sells fiber cement, fiber gypsum, and cement bonded building products for both interior and exterior construction applications across the United States, Australia, Europe, and New Zealand with a market cap of A$16.52 billion.

Operations: The company's revenue is primarily derived from North America Fiber Cement ($2.86 billion), Asia Pacific Fiber Cement ($519.90 million), and Europe Building Products ($494.30 million).

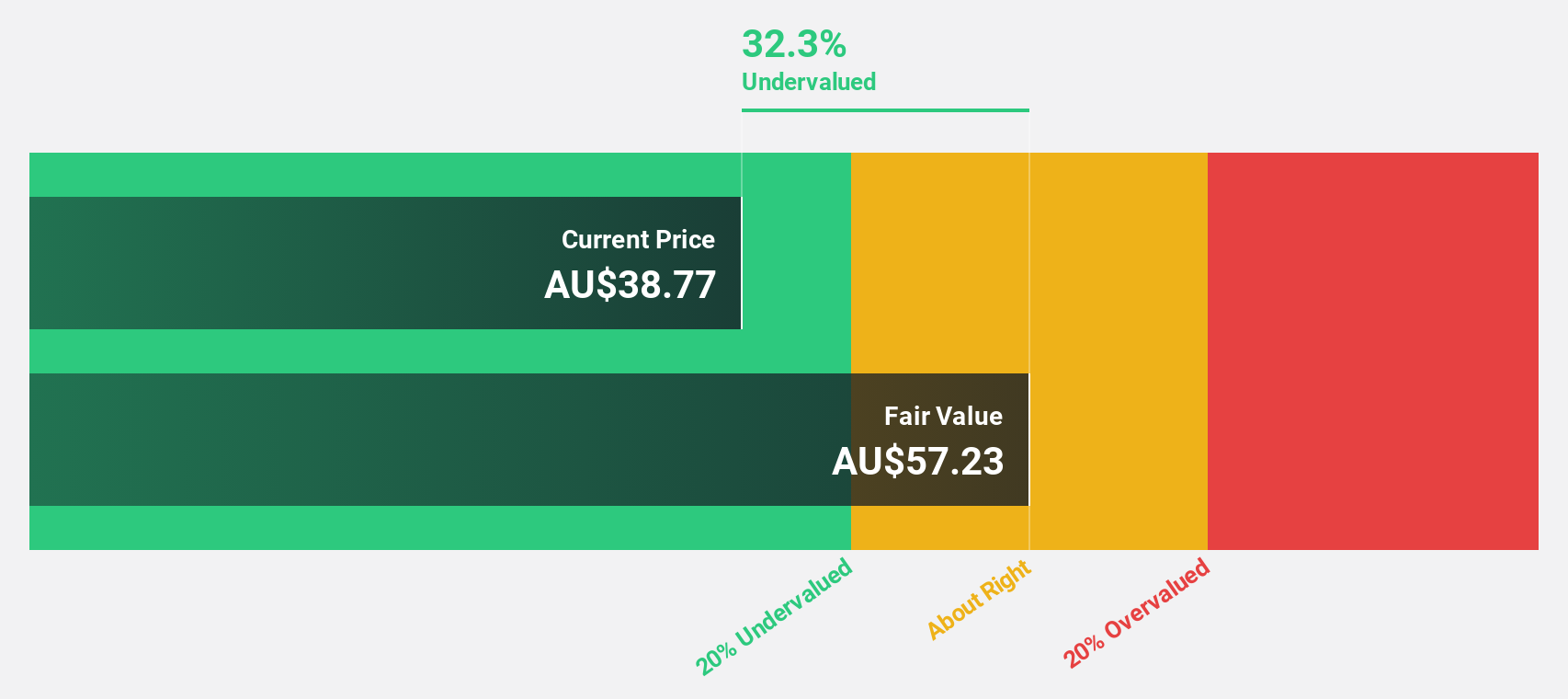

Estimated Discount To Fair Value: 33.3%

James Hardie Industries, currently trading at A$38.42, is valued below its estimated fair value of A$57.61, suggesting it may be undervalued based on cash flows. The company forecasts annual revenue growth of 11.7% and earnings growth of 19.1%, both outpacing the Australian market averages. Recently, James Hardie secured a US$3.5 billion credit facility to support its merger with The AZEK Company Inc., potentially enhancing future cash flow generation through strategic expansion and synergy realization.

- Insights from our recent growth report point to a promising forecast for James Hardie Industries' business outlook.

- Click here and access our complete balance sheet health report to understand the dynamics of James Hardie Industries.

Summing It All Up

- Click through to start exploring the rest of the 30 Undervalued ASX Stocks Based On Cash Flows now.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:ASB

Austal

Engages in the design, manufacture, and support of vessels for commercial and defense customers in the United States, Australia, Europe, Asia, and South America.

Flawless balance sheet and good value.

Market Insights

Community Narratives