Analysts Just Shaved Their Clover Corporation Limited (ASX:CLV) Forecasts Dramatically

One thing we could say about the analysts on Clover Corporation Limited (ASX:CLV) - they aren't optimistic, having just made a major negative revision to their near-term (statutory) forecasts for the organization. Both revenue and earnings per share (EPS) estimates were cut sharply as analysts factored in the latest outlook for the business, concluding that they were too optimistic previously. Bidders are definitely seeing a different story, with the stock price of AU$1.75 reflecting a 31% rise in the past week. With such a sharp increase, it seems brokers may have seen something that is not yet being priced in by the wider market.

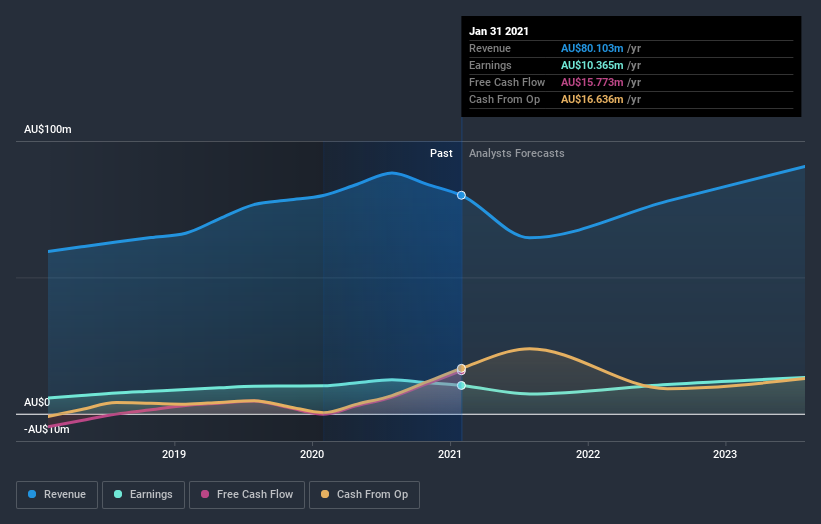

Following the downgrade, the consensus from dual analysts covering Clover is for revenues of AU$64m in 2021, implying a chunky 19% decline in sales compared to the last 12 months. Statutory earnings per share are supposed to nosedive 30% to AU$0.043 in the same period. Before this latest update, the analysts had been forecasting revenues of AU$78m and earnings per share (EPS) of AU$0.054 in 2021. Indeed, we can see that the analysts are a lot more bearish about Clover's prospects, administering a substantial drop in revenue estimates and slashing their EPS estimates to boot.

See our latest analysis for Clover

Analysts made no major changes to their price target of AU$2.19, suggesting the downgrades are not expected to have a long-term impact on Clover's valuation. There's another way to think about price targets though, and that's to look at the range of price targets put forward by analysts, because a wide range of estimates could suggest a diverse view on possible outcomes for the business. Currently, the most bullish analyst values Clover at AU$2.37 per share, while the most bearish prices it at AU$2.00. The narrow spread of estimates could suggest that the business' future is relatively easy to value, or that the analysts have a clear view on its prospects.

Looking at the bigger picture now, one of the ways we can make sense of these forecasts is to see how they measure up against both past performance and industry growth estimates. These estimates imply that sales are expected to slow, with a forecast annualised revenue decline of 35% by the end of 2021. This indicates a significant reduction from annual growth of 18% over the last five years. Compare this with our data, which suggests that other companies in the same industry are, in aggregate, expected to see their revenue grow 5.1% per year. It's pretty clear that Clover's revenues are expected to perform substantially worse than the wider industry.

The Bottom Line

The biggest issue in the new estimates is that analysts have reduced their earnings per share estimates, suggesting business headwinds lay ahead for Clover. Unfortunately analysts also downgraded their revenue estimates, and industry data suggests that Clover's revenues are expected to grow slower than the wider market. The lack of change in the price target is puzzling in light of the downgrade but, with a serious decline expected this year, we wouldn't be surprised if investors were a bit wary of Clover.

With that said, the long-term trajectory of the company's earnings is a lot more important than next year. At least one analyst has provided forecasts out to 2023, which can be seen for free on our platform here.

Of course, seeing company management invest large sums of money in a stock can be just as useful as knowing whether analysts are downgrading their estimates. So you may also wish to search this free list of stocks that insiders are buying.

If you decide to trade Clover, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ASX:CLV

Clover

Engages in the production, refining, and sale of natural oils and encapsulated powders in Australia, New Zealand, Asia, Europe, the Middle East, and the Americas.

Flawless balance sheet and good value.

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success