- Canada

- /

- Trade Distributors

- /

- TSX:DBM

3 Undervalued Small Caps In Global With Insider Action To Consider

Reviewed by Simply Wall St

In recent weeks, global markets have shown a positive shift as trade tensions between the U.S. and China appear to be easing, leading to gains in small- and mid-cap equities for the third consecutive week. Despite this optimism, economic indicators such as the slowdown in U.S. business activity growth highlight ongoing uncertainties that can impact smaller companies more acutely than their larger counterparts. In this environment, identifying small-cap stocks with strong fundamentals and potential insider action can offer intriguing opportunities for investors looking to navigate these complex market conditions.

Top 10 Undervalued Small Caps With Insider Buying Globally

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Morgan Advanced Materials | 10.8x | 0.5x | 41.94% | ★★★★★★ |

| Tristel | 28.0x | 3.9x | 25.84% | ★★★★★★ |

| Chorus Aviation | NA | 0.4x | 17.15% | ★★★★★☆ |

| Savills | 23.5x | 0.5x | 43.67% | ★★★★☆☆ |

| Sing Investments & Finance | 7.0x | 3.5x | 44.58% | ★★★★☆☆ |

| Norcros | 24.5x | 0.6x | 27.32% | ★★★☆☆☆ |

| FRP Advisory Group | 12.8x | 2.3x | 13.49% | ★★★☆☆☆ |

| Speedy Hire | NA | 0.2x | -9.12% | ★★★☆☆☆ |

| Westshore Terminals Investment | 13.7x | 3.9x | 36.77% | ★★★☆☆☆ |

| European Residential Real Estate Investment Trust | NA | 1.6x | -140.71% | ★★★☆☆☆ |

Let's review some notable picks from our screened stocks.

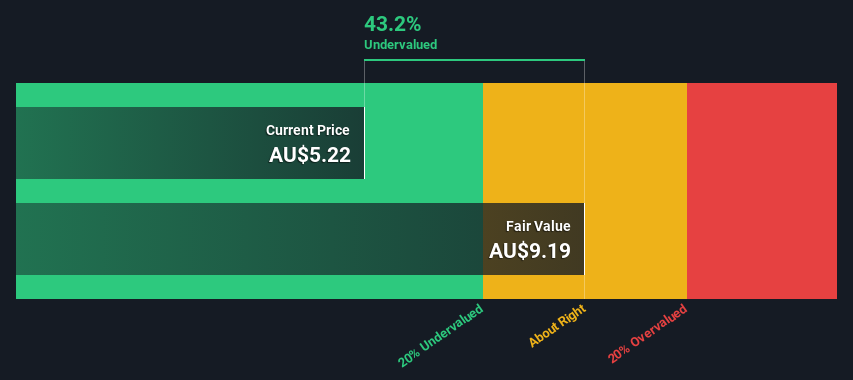

Champion Iron (ASX:CIA)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Champion Iron is a mining company focused on the production and development of iron ore concentrate, with a market cap of CA$3.25 billion.

Operations: Champion Iron generates revenue primarily from iron ore concentrate sales, with a recent figure of CA$1.51 billion. The company's cost of goods sold (COGS) is significant, amounting to CA$1.02 billion, impacting its gross profit margin at 32.94%. Operating expenses and non-operating expenses further affect profitability, with net income recorded at CA$128.70 million and a net income margin of 8.50%.

PE: 16.5x

Champion Iron, a small company in the mining industry, recently reported production results for Q4 ending March 31, 2025. Waste mined increased significantly to 10.9 million wmt from last year's 6.5 million wmt, while ore milled slightly decreased to 9.2 million wmt from 9.3 million wmt previously. Despite lower profit margins dropping to 8.5% from last year’s 17.9%, insider confidence is evident with share purchases over the past year, hinting at potential future growth as earnings are projected to rise by approximately 18% annually.

- Unlock comprehensive insights into our analysis of Champion Iron stock in this valuation report.

Review our historical performance report to gain insights into Champion Iron's's past performance.

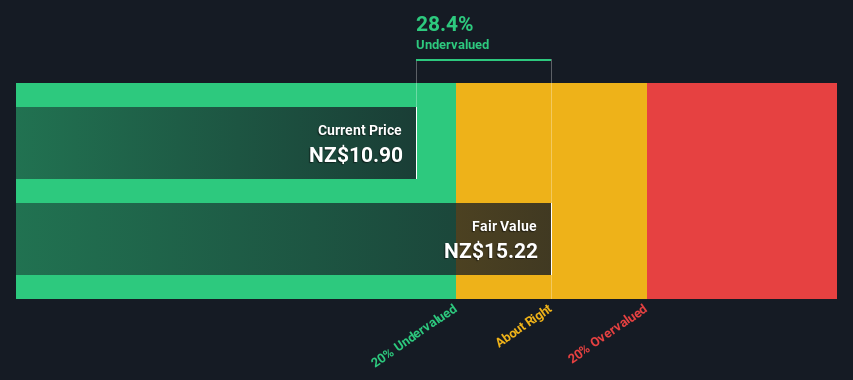

Freightways Group (NZSE:FRW)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Freightways Group operates in the logistics sector, focusing on express package and business mail services as well as information management, with a market capitalization of NZ$1.65 billion.

Operations: Freightways Group generates revenue primarily from its Express Package & Business Mail segment, contributing NZ$1.03 billion, and the Information Management segment with NZ$226.23 million. The company's gross profit margin has shown a decline from 33.92% in March 2015 to 29.52% in December 2024, indicating changes in cost management or pricing strategies over time. Operating expenses have consistently increased alongside revenue growth, impacting overall profitability metrics such as net income margin which was last recorded at 5.96%.

PE: 24.2x

Freightways Group, a smaller company with potential for growth, reported half-year sales of NZ$662 million and net income of NZ$44.64 million, showing year-on-year improvement. Despite its high debt level and reliance on external borrowing, earnings are projected to grow annually by 11.63%. Recent dividend announcements reflect steady cash flow management. Insider confidence is evident from share purchases over the past six months, suggesting belief in future prospects despite financial risks tied to funding structure.

- Get an in-depth perspective on Freightways Group's performance by reading our valuation report here.

Examine Freightways Group's past performance report to understand how it has performed in the past.

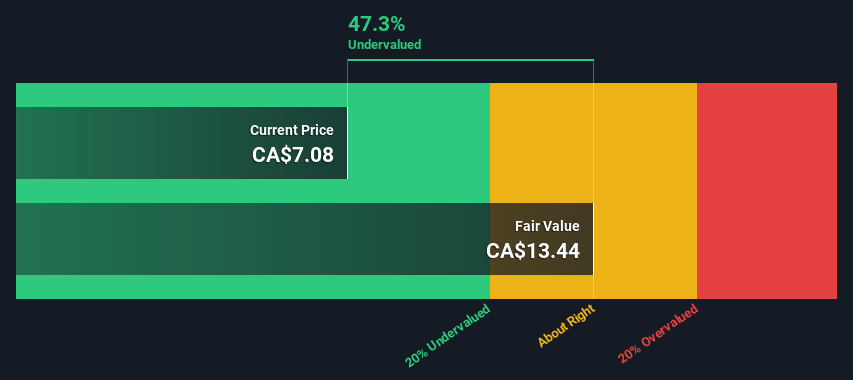

Doman Building Materials Group (TSX:DBM)

Simply Wall St Value Rating: ★★★★★☆

Overview: Doman Building Materials Group is a company that specializes in the distribution and manufacturing of building materials, with a significant focus on this segment, contributing CA$2.63 billion to its operations.

Operations: The company primarily generates revenue from its Building Materials segment, amounting to CA$2.63 billion. Over the observed periods, the gross profit margin showed a notable trend, peaking at 17.44% in June 2021 and fluctuating around this level before reaching 16.31% in March 2024. Operating expenses consistently impact net income margins, which saw a significant increase to 6.20% in June 2021 but experienced fluctuations thereafter, ending at approximately 2.03% by December 2024.

PE: 11.3x

Doman Building Materials Group, a company with external borrowing as its sole funding source, has shown insider confidence through recent share purchases. Despite a decline in net profit margin from 3% to 2%, the company continues to affirm dividends, marking its 60th consecutive quarter at C$0.14 per share. Sales rose to C$2.66 billion for the year ending December 2024, though net income slipped to C$54 million. Earnings are forecasted to grow annually by nearly 26%, indicating potential for future value realization amidst current financial challenges.

Summing It All Up

- Click this link to deep-dive into the 155 companies within our Undervalued Global Small Caps With Insider Buying screener.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Doman Building Materials Group, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:DBM

Doman Building Materials Group

Through its subsidiaries, engages in the wholesale distribution of building materials and home renovation products in the United States and Canada.

Undervalued with reasonable growth potential.

Market Insights

Community Narratives