- Australia

- /

- Metals and Mining

- /

- ASX:CHN

It May Be Possible That Chalice Mining Limited's (ASX:CHN) CEO Compensation Could Get Bumped Up

Shareholders will probably not be disappointed by the robust results at Chalice Mining Limited (ASX:CHN) recently and they will be keeping this in mind as they go into the AGM on 23 November 2022. The focus will probably be on the future strategic initiatives that the board and management will put in place to improve the business rather than executive remuneration when they cast their votes on company resolutions. Here is our take on why we think CEO compensation is fair and may even warrant a raise.

Check out the opportunities and risks within the AU Metals and Mining industry.

Comparing Chalice Mining Limited's CEO Compensation With The Industry

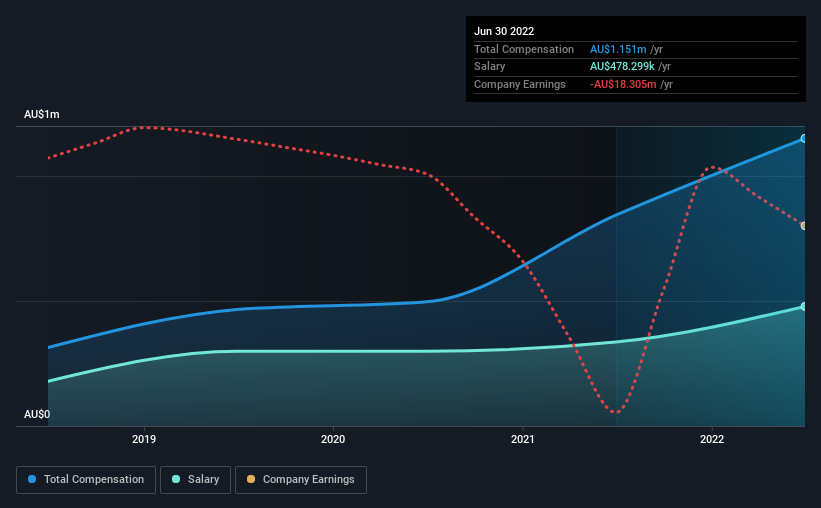

Our data indicates that Chalice Mining Limited has a market capitalization of AU$1.8b, and total annual CEO compensation was reported as AU$1.2m for the year to June 2022. That's a notable increase of 36% on last year. We think total compensation is more important but our data shows that the CEO salary is lower, at AU$478k.

On comparing similar companies from the same industry with market caps ranging from AU$1.5b to AU$4.7b, we found that the median CEO total compensation was AU$1.7m. Accordingly, Chalice Mining pays its CEO under the industry median. What's more, Alex Dorsch holds AU$33m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

| Component | 2022 | 2021 | Proportion (2022) |

| Salary | AU$478k | AU$336k | 42% |

| Other | AU$672k | AU$508k | 58% |

| Total Compensation | AU$1.2m | AU$844k | 100% |

On an industry level, roughly 60% of total compensation represents salary and 40% is other remuneration. It's interesting to note that Chalice Mining allocates a smaller portion of compensation to salary in comparison to the broader industry. If non-salary compensation dominates total pay, it's an indicator that the executive's salary is tied to company performance.

Chalice Mining Limited's Growth

Over the last three years, Chalice Mining Limited has shrunk its earnings per share by 21% per year. It achieved revenue growth of 22% over the last year.

The reduction in EPS, over three years, is arguably concerning. But in contrast the revenue growth is strong, suggesting future potential for EPS growth. It's hard to reach a conclusion about business performance right now. This may be one to watch. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has Chalice Mining Limited Been A Good Investment?

Boasting a total shareholder return of 2,852% over three years, Chalice Mining Limited has done well by shareholders. So they may not be at all concerned if the CEO were to be paid more than is normal for companies around the same size.

To Conclude...

The company's overall performance, while not bad, could be better. Assuming the business continues to grow at a good clip, few shareholders would raise any objections to the CEO's remuneration. Rather, investors would more likely want to engage on discussions related to key strategic initiatives and future growth opportunities for the company and set their longer-term expectations.

CEO compensation is an important area to keep your eyes on, but we've also need to pay attention to other attributes of the company. That's why we did our research, and identified 4 warning signs for Chalice Mining (of which 2 are a bit concerning!) that you should know about in order to have a holistic understanding of the stock.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:CHN

Flawless balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives