ASX Penny Stocks: Catapult Group International And 2 More Promising Investments

Reviewed by Simply Wall St

The Australian market has shown resilience, with the ASX 200 closing up 0.52% at 8,386 points, driven by strong performances in the Energy and Health Care sectors. While penny stocks might seem like a dated concept, they still offer intriguing opportunities for investors willing to explore smaller or newer companies with solid financial foundations. In this article, we highlight three such penny stocks that combine financial strength with growth potential, providing a chance to uncover hidden value in the market.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| Lindsay Australia (ASX:LAU) | A$0.705 | A$223.61M | ✅ 4 ⚠️ 2 View Analysis > |

| CTI Logistics (ASX:CLX) | A$1.80 | A$144.98M | ✅ 4 ⚠️ 2 View Analysis > |

| Accent Group (ASX:AX1) | A$1.91 | A$1.15B | ✅ 4 ⚠️ 2 View Analysis > |

| EZZ Life Science Holdings (ASX:EZZ) | A$1.615 | A$76.18M | ✅ 4 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.59 | A$399.33M | ✅ 4 ⚠️ 2 View Analysis > |

| GTN (ASX:GTN) | A$0.60 | A$114.64M | ✅ 3 ⚠️ 2 View Analysis > |

| Bisalloy Steel Group (ASX:BIS) | A$3.50 | A$166.08M | ✅ 3 ⚠️ 1 View Analysis > |

| Regal Partners (ASX:RPL) | A$2.15 | A$722.75M | ✅ 4 ⚠️ 4 View Analysis > |

| Navigator Global Investments (ASX:NGI) | A$1.70 | A$833.14M | ✅ 5 ⚠️ 3 View Analysis > |

| Tasmea (ASX:TEA) | A$2.88 | A$669.09M | ✅ 4 ⚠️ 2 View Analysis > |

Click here to see the full list of 999 stocks from our ASX Penny Stocks screener.

Let's explore several standout options from the results in the screener.

Catapult Group International (ASX:CAT)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Catapult Group International Ltd is a sports science and analytics company that offers technologies to enhance athlete performance, prevent injuries, and aid in recovery across various regions worldwide, with a market cap of A$1.29 billion.

Operations: Catapult Group International Ltd has not reported any specific revenue segments.

Market Cap: A$1.29B

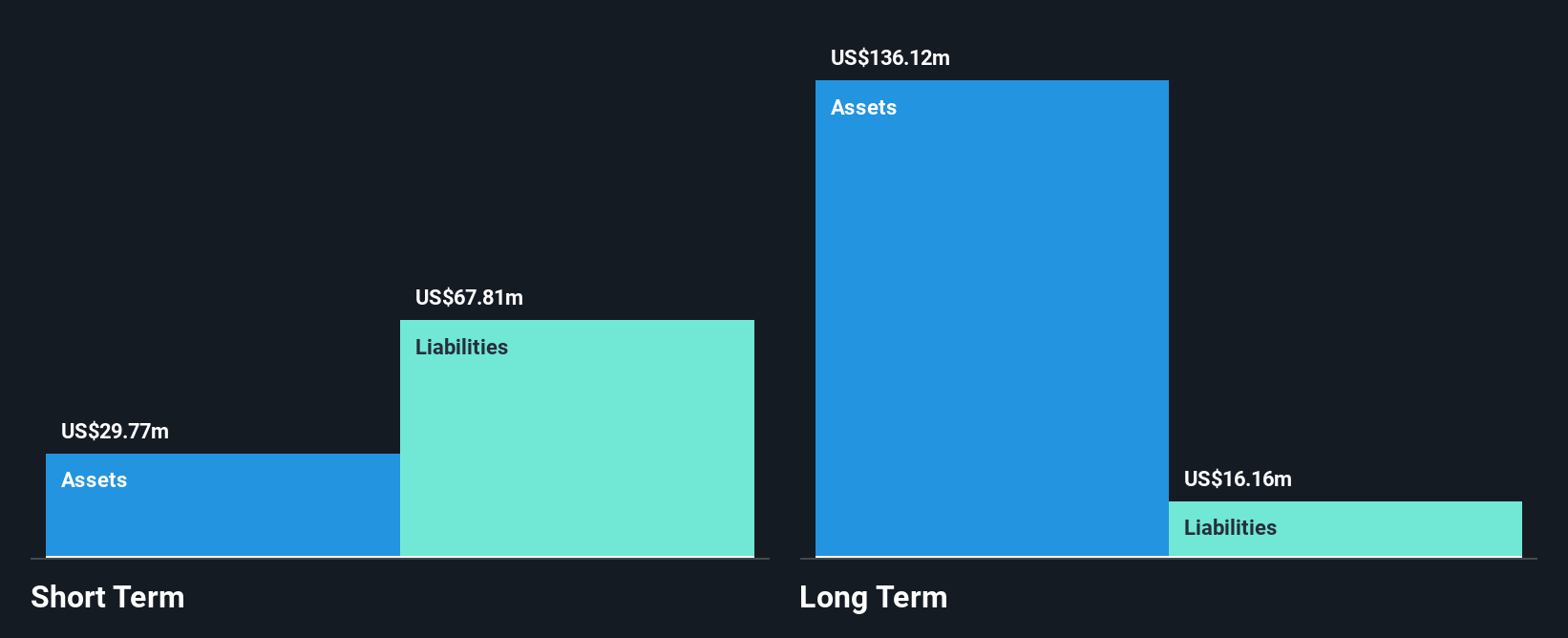

Catapult Group International Ltd recently reported a significant increase in sales to US$116.53 million, up from US$100 million the previous year, while reducing its net loss to US$8.81 million. Despite being unprofitable, Catapult maintains a positive free cash flow and has sufficient cash runway for over three years. The launch of Vector 8 marks a major advancement in athlete performance monitoring, potentially enhancing revenue streams as it rolls out across major sports in 2025. Although short-term liabilities exceed assets, long-term liabilities are covered, and the company holds more cash than debt.

- Click to explore a detailed breakdown of our findings in Catapult Group International's financial health report.

- Learn about Catapult Group International's future growth trajectory here.

Chalice Mining (ASX:CHN)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Chalice Mining Limited is a mineral exploration and evaluation company with a market cap of A$435.71 million.

Operations: Chalice Mining Limited does not report any revenue segments.

Market Cap: A$435.71M

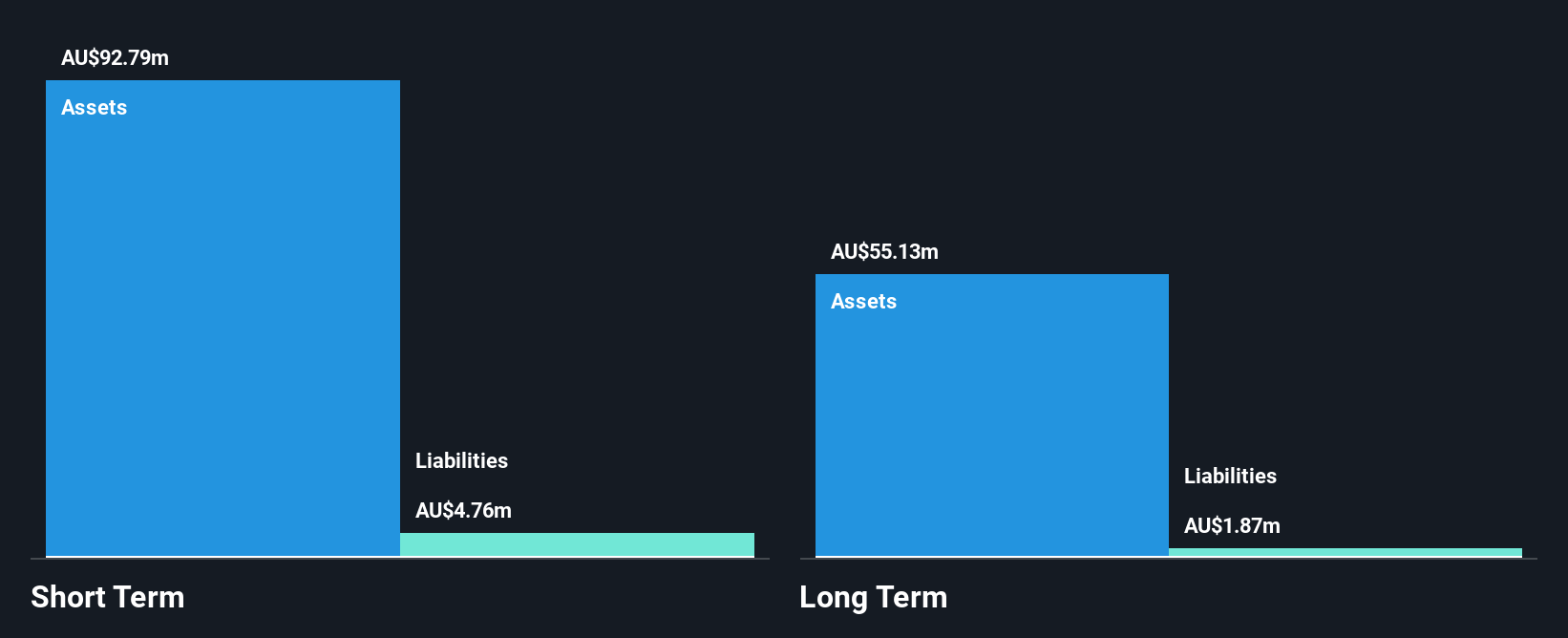

Chalice Mining's status as a pre-revenue company with A$0.496 million in sales highlights its early-stage nature in the mining sector. Despite being unprofitable and not expected to achieve profitability soon, it benefits from a strong financial position with A$92.8 million in short-term assets surpassing both short and long-term liabilities, and no debt burden. The company's experienced board and management team provide stability, while its cash runway exceeds three years even if free cash flow continues to decline. However, significant insider selling could be a concern for potential investors considering this penny stock opportunity.

- Take a closer look at Chalice Mining's potential here in our financial health report.

- Explore Chalice Mining's analyst forecasts in our growth report.

Tasmea (ASX:TEA)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Tasmea Limited (ASX:TEA) offers shutdown, maintenance, emergency breakdown, and capital upgrade services in Australia with a market cap of A$669.09 million.

Operations: There are no reported revenue segments available for Tasmea Limited (ASX:TEA).

Market Cap: A$669.09M

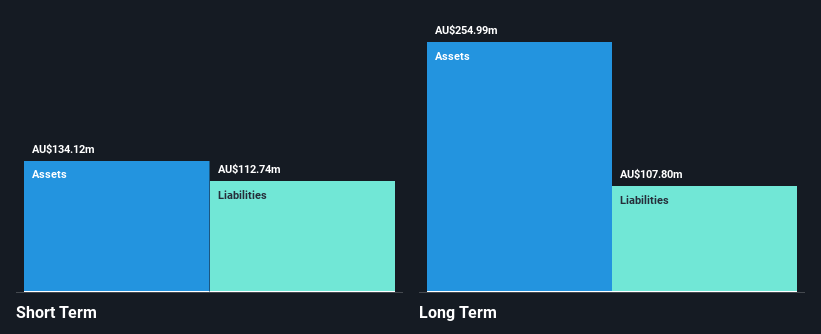

Tasmea Limited has demonstrated strong financial performance with recent half-year sales of A$246.65 million, up from A$193.32 million the previous year, and net income of A$27.81 million. The company's earnings growth of 75.3% over the past year outpaces both its five-year average and industry benchmarks, highlighting its robust profit trajectory. While Tasmea trades significantly below estimated fair value and offers high-quality earnings, it carries a high net debt to equity ratio of 49.7%. Despite this leverage, interest payments are well-covered by EBIT, and short-term assets exceed liabilities, suggesting sound financial health overall for this penny stock opportunity in Australia.

- Dive into the specifics of Tasmea here with our thorough balance sheet health report.

- Assess Tasmea's future earnings estimates with our detailed growth reports.

Next Steps

- Click this link to deep-dive into the 999 companies within our ASX Penny Stocks screener.

- Ready To Venture Into Other Investment Styles? The end of cancer? These 23 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:CAT

Catapult Sports

A sports science and analytics company, development and supply of technologies that improve the performance of athletes and sports teams in Australia, Europe, the Middle East, Africa, the Asia Pacific, and the Americas.

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives