- Australia

- /

- Metals and Mining

- /

- ASX:CTM

Canyon Resources And 2 Other Promising ASX Penny Stocks To Watch

Reviewed by Simply Wall St

The Australian stock market recently experienced a slight downturn, with the ASX closing down 0.04% as profit-taking and slow trade affected most sectors, except for Energy and Healthcare. Despite these broader market challenges, certain investment opportunities remain attractive, particularly in niche areas like penny stocks. Although the term "penny stock" might seem outdated, these smaller or newer companies can still offer significant potential when supported by strong financials; this article will explore three such promising stocks on the ASX that could present hidden value to investors.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| Embark Early Education (ASX:EVO) | A$0.765 | A$138.53M | ★★★★☆☆ |

| LaserBond (ASX:LBL) | A$0.565 | A$65.06M | ★★★★★★ |

| SHAPE Australia (ASX:SHA) | A$2.86 | A$234.64M | ★★★★★★ |

| Helloworld Travel (ASX:HLO) | A$1.955 | A$320.75M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.515 | A$316.27M | ★★★★★☆ |

| Navigator Global Investments (ASX:NGI) | A$1.745 | A$833.14M | ★★★★★☆ |

| EZZ Life Science Holdings (ASX:EZZ) | A$2.95 | A$143.09M | ★★★★★★ |

| SKS Technologies Group (ASX:SKS) | A$1.59 | A$216.86M | ★★★★★★ |

| Vita Life Sciences (ASX:VLS) | A$1.8975 | A$106.58M | ★★★★★★ |

| Servcorp (ASX:SRV) | A$4.90 | A$478.53M | ★★★★☆☆ |

Click here to see the full list of 1,053 stocks from our ASX Penny Stocks screener.

Let's uncover some gems from our specialized screener.

Canyon Resources (ASX:CAY)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Canyon Resources Limited, with a market cap of A$262.12 million, focuses on the exploration and development of mineral properties in West Africa.

Operations: Canyon Resources Limited does not have any reported revenue segments.

Market Cap: A$262.12M

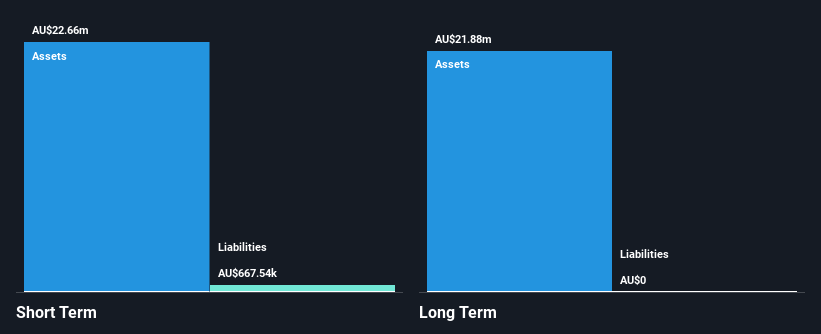

Canyon Resources Limited, with a market cap of A$262.12 million, is pre-revenue and currently unprofitable, reporting a net loss of A$9.54 million for the year ending June 30, 2024. Although the company has no debt and sufficient cash runway exceeding one year based on current free cash flow, shareholders have experienced dilution with shares outstanding increasing by 3.5% over the past year. The management team and board are relatively inexperienced with average tenures under two years. Despite these challenges, Canyon Resources maintains short-term asset coverage over its liabilities and has no long-term liabilities.

- Take a closer look at Canyon Resources' potential here in our financial health report.

- Explore historical data to track Canyon Resources' performance over time in our past results report.

Centaurus Metals (ASX:CTM)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Centaurus Metals Limited focuses on the exploration and evaluation of mineral resource properties in Brazil, with a market capitalization of A$176.33 million.

Operations: Centaurus Metals Limited does not report distinct revenue segments.

Market Cap: A$176.33M

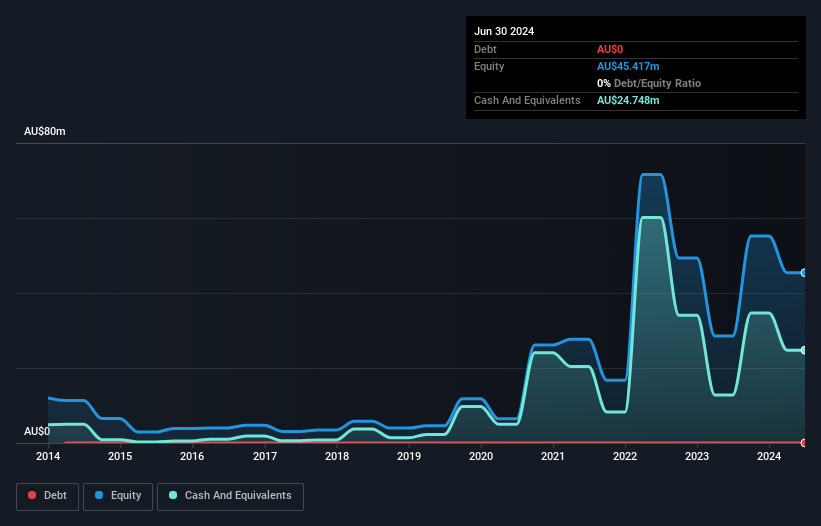

Centaurus Metals Limited, with a market cap of A$176.33 million, is pre-revenue and currently unprofitable. The company has been debt-free for the past five years, though it faces challenges with less than a year of cash runway based on current free cash flow trends. Despite increasing losses at 39% annually over the past five years, its short-term assets (A$27.8M) comfortably cover both short-term (A$3.5M) and long-term liabilities (A$670.8K). Management and board members are seasoned, averaging tenures of 5.1 and 11.3 years respectively, providing stability amid financial uncertainties.

- Get an in-depth perspective on Centaurus Metals' performance by reading our balance sheet health report here.

- Understand Centaurus Metals' earnings outlook by examining our growth report.

XRF Scientific (ASX:XRF)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: XRF Scientific Limited manufactures and markets precious metal products, specialized chemicals, and instruments for the scientific, analytical, construction material, and mining industries across Australia, Canada, and Europe with a market cap of A$265.53 million.

Operations: The company's revenue segments include Consumables generating A$18.82 million, Precious Metals contributing A$21.50 million, and Capital Equipment with A$21.75 million in revenue.

Market Cap: A$265.53M

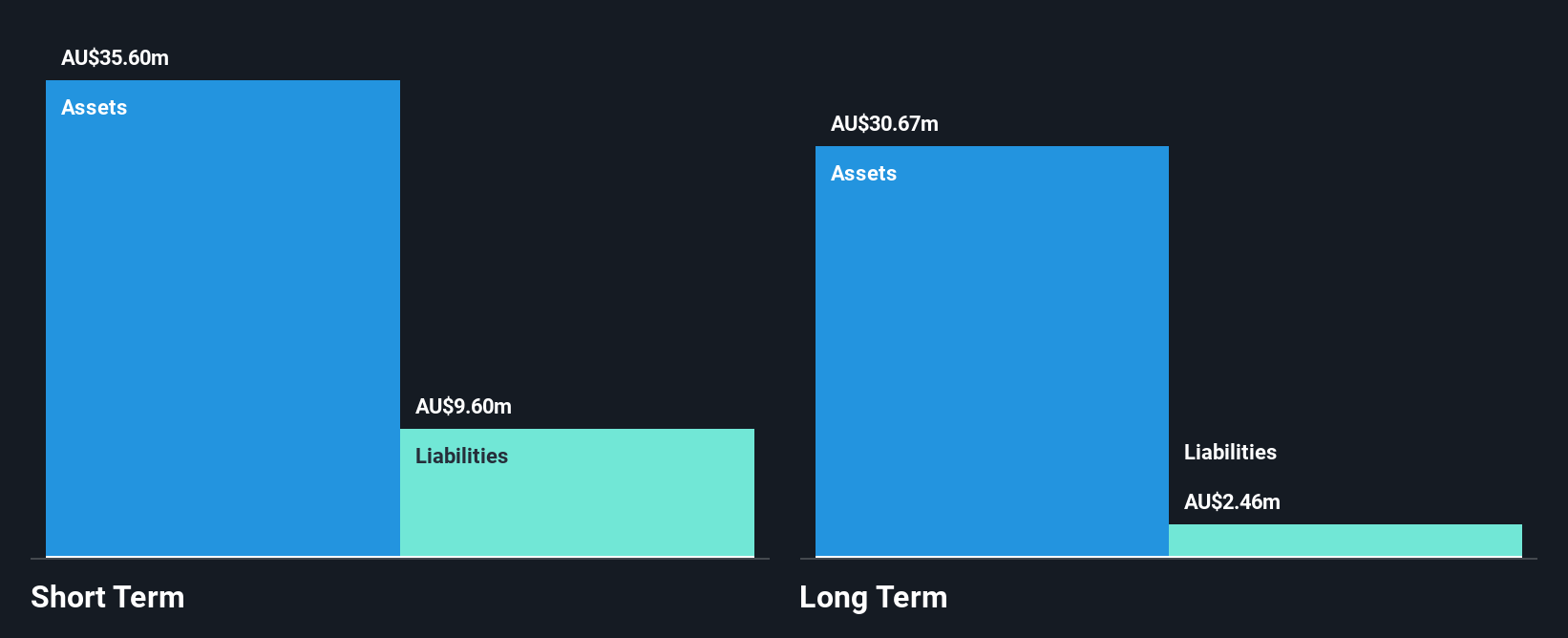

XRF Scientific, with a market cap of A$265.53 million, demonstrates robust financial health in the penny stock segment. Its short-term assets (A$39.2M) comfortably cover both short-term (A$10.4M) and long-term liabilities (A$2.2M), indicating strong liquidity management. The company has reduced its debt to equity ratio significantly over five years and maintains more cash than total debt, reflecting prudent fiscal policies. Despite a lower return on equity at 17.1%, XRF's earnings have grown by 15.6% over the past year, outpacing industry averages and showcasing high-quality earnings supported by experienced management and board teams with long tenures.

- Click here and access our complete financial health analysis report to understand the dynamics of XRF Scientific.

- Learn about XRF Scientific's future growth trajectory here.

Taking Advantage

- Jump into our full catalog of 1,053 ASX Penny Stocks here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:CTM

Centaurus Metals

Engages in the exploration and evaluation of mineral resource properties Brazil.

Excellent balance sheet low.

Similar Companies

Market Insights

Community Narratives