Cannindah Resources Leads 3 ASX Penny Stocks Worth Considering

Reviewed by Simply Wall St

The Australian market has seen a slight downturn, with the ASX200 down 1.1% at 8,162 points in afternoon trade, influenced by sectoral declines in Financials and Health Care. Amid these broader market movements, investors may find opportunities in penny stocks—an investment area that continues to intrigue despite its old-fashioned name. These stocks often represent smaller or newer companies that can offer significant value when they possess strong financial foundations and growth potential.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| Embark Early Education (ASX:EVO) | A$0.79 | A$144.95M | ★★★★☆☆ |

| Helloworld Travel (ASX:HLO) | A$1.92 | A$312.61M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.55 | A$341.08M | ★★★★★☆ |

| MaxiPARTS (ASX:MXI) | A$1.87 | A$103.44M | ★★★★★★ |

| LaserBond (ASX:LBL) | A$0.62 | A$72.68M | ★★★★★★ |

| SHAPE Australia (ASX:SHA) | A$2.77 | A$229.66M | ★★★★★★ |

| Navigator Global Investments (ASX:NGI) | A$1.665 | A$815.98M | ★★★★★☆ |

| Perenti (ASX:PRN) | A$1.185 | A$1.09B | ★★★★★★ |

| West African Resources (ASX:WAF) | A$1.535 | A$1.75B | ★★★★★★ |

| EZZ Life Science Holdings (ASX:EZZ) | A$3.05 | A$135.49M | ★★★★★★ |

Click here to see the full list of 1,035 stocks from our ASX Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Cannindah Resources (ASX:CAE)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Cannindah Resources Limited, along with its subsidiaries, is involved in the exploration, evaluation, and development of mineral projects in Australia and has a market cap of A$24.28 million.

Operations: No specific revenue segments are reported for the company.

Market Cap: A$24.28M

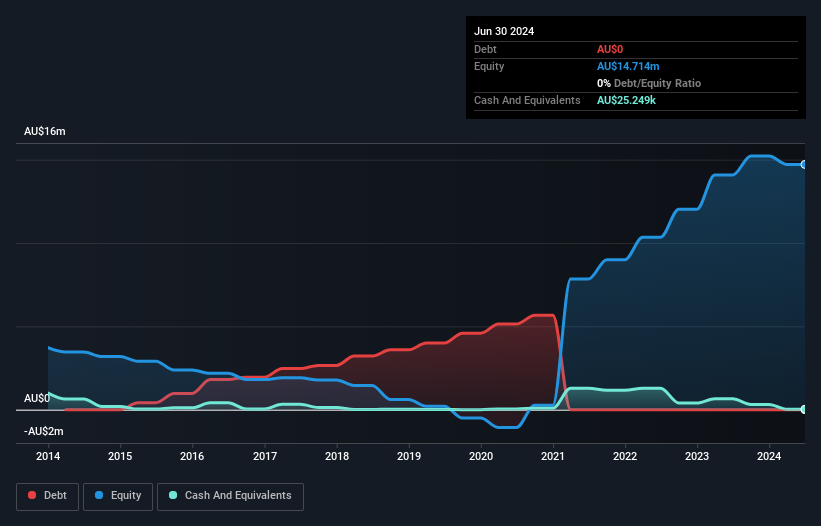

Cannindah Resources is a pre-revenue company with a market cap of A$24.28 million, operating in the mineral exploration sector. Despite being debt-free and having an experienced board, it faces financial challenges with short-term liabilities exceeding its assets and no significant revenue streams. The company recently completed a A$5 million equity offering to bolster its cash position after reporting a net loss of A$1.51 million for the year ending June 2024, slightly improved from the previous year’s loss. Its shares have not been meaningfully diluted over the past year, maintaining stability for existing shareholders.

- Take a closer look at Cannindah Resources' potential here in our financial health report.

- Review our historical performance report to gain insights into Cannindah Resources' track record.

Cynata Therapeutics (ASX:CYP)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Cynata Therapeutics Limited, with a market cap of A$42.46 million, develops and commercializes proprietary stem cell technologies under the Cymerus brand for therapeutic use in Australia.

Operations: The company's revenue is derived entirely from the development and commercialization of therapeutic products, totaling A$2.32 million.

Market Cap: A$42.46M

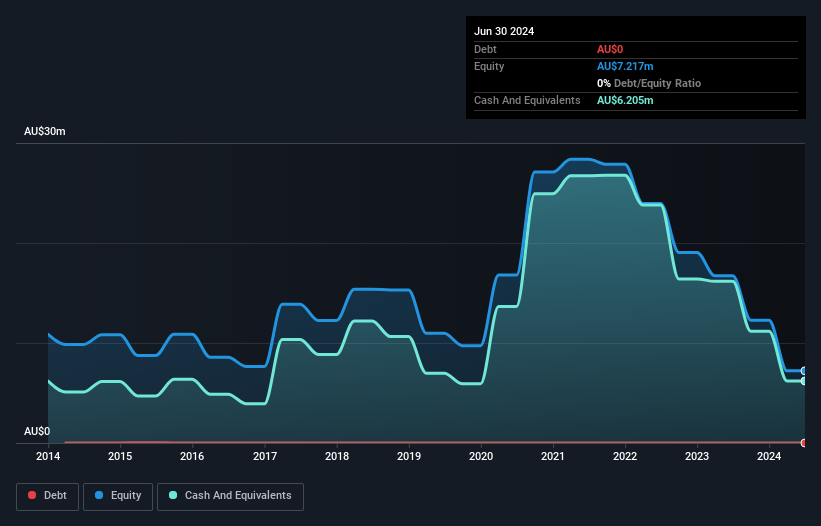

Cynata Therapeutics, with a market cap of A$42.46 million, is pre-revenue and unprofitable, reporting a net loss of A$9.74 million for the year ending June 2024 despite revenue growth to A$2.73 million from the previous year. The company remains debt-free and has an experienced management team and board but faces financial constraints with less than a year of cash runway based on current free cash flow trends. Shareholders have not been meaningfully diluted recently, providing some stability in ownership structure amidst ongoing challenges in achieving profitability within the next three years.

- Dive into the specifics of Cynata Therapeutics here with our thorough balance sheet health report.

- Review our growth performance report to gain insights into Cynata Therapeutics' future.

Salter Brothers Emerging Companies (ASX:SB2)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Salter Brothers Emerging Companies Limited is an investment company that concentrates on a portfolio of investment opportunities in Australian listed and unlisted securities, with a market cap of A$63.60 million.

Operations: The company generates revenue from its securities segment, amounting to A$7.99 million.

Market Cap: A$63.6M

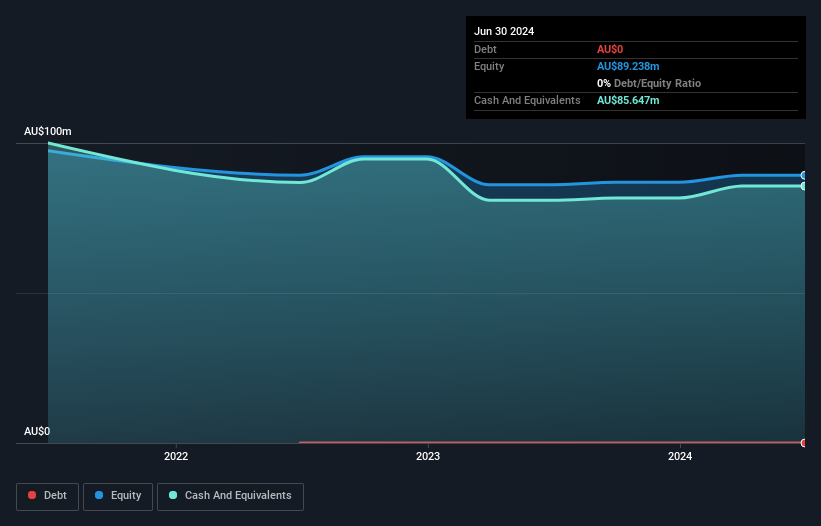

Salter Brothers Emerging Companies Limited, with a market cap of A$63.60 million, has recently become profitable, reporting a net income of A$4.22 million for the year ending June 2024. The company is debt-free and maintains a stable weekly volatility of 4%. Its short-term assets significantly exceed its liabilities, indicating strong financial health. The board is experienced with an average tenure of 3.9 years, while the Price-To-Earnings ratio stands at 15.1x, below the Australian market average. Recent strategic moves include adjustments to its equity buyback plan and potential ASX listing plans for its hotel portfolio valued up to $2 billion.

- Get an in-depth perspective on Salter Brothers Emerging Companies' performance by reading our balance sheet health report here.

- Gain insights into Salter Brothers Emerging Companies' past trends and performance with our report on the company's historical track record.

Turning Ideas Into Actions

- Reveal the 1,035 hidden gems among our ASX Penny Stocks screener with a single click here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:CYP

Cynata Therapeutics

Engages in the development and commercialization of proprietary induced pluripotent stem cell and mesenchymal stem cell technology under the Cymerus brand for human therapeutic use in Australia.

Flawless balance sheet with moderate growth potential.

Market Insights

Community Narratives