- Australia

- /

- Professional Services

- /

- ASX:SIQ

3 ASX Dividend Stocks To Enhance Your Portfolio

Reviewed by Simply Wall St

As the ASX200 experiences modest gains, with materials and financials sectors leading the charge, investors are keeping a close eye on inflation figures that remain above the Reserve Bank of Australia's target range. In this fluctuating economic landscape, dividend stocks can offer a reliable income stream and potential stability for portfolios; here are three ASX-listed options to consider.

Top 10 Dividend Stocks In Australia

| Name | Dividend Yield | Dividend Rating |

| Nick Scali (ASX:NCK) | 4.37% | ★★★★★☆ |

| Fiducian Group (ASX:FID) | 4.44% | ★★★★★☆ |

| Collins Foods (ASX:CKF) | 3.66% | ★★★★★☆ |

| Super Retail Group (ASX:SUL) | 7.86% | ★★★★★☆ |

| MFF Capital Investments (ASX:MFF) | 3.01% | ★★★★★☆ |

| National Storage REIT (ASX:NSR) | 4.62% | ★★★★★☆ |

| Premier Investments (ASX:PMV) | 4.21% | ★★★★★☆ |

| New Hope (ASX:NHC) | 7.99% | ★★★★☆☆ |

| Ricegrowers (ASX:SGLLV) | 5.61% | ★★★★☆☆ |

| Australian United Investment (ASX:AUI) | 3.59% | ★★★★☆☆ |

Click here to see the full list of 32 stocks from our Top ASX Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

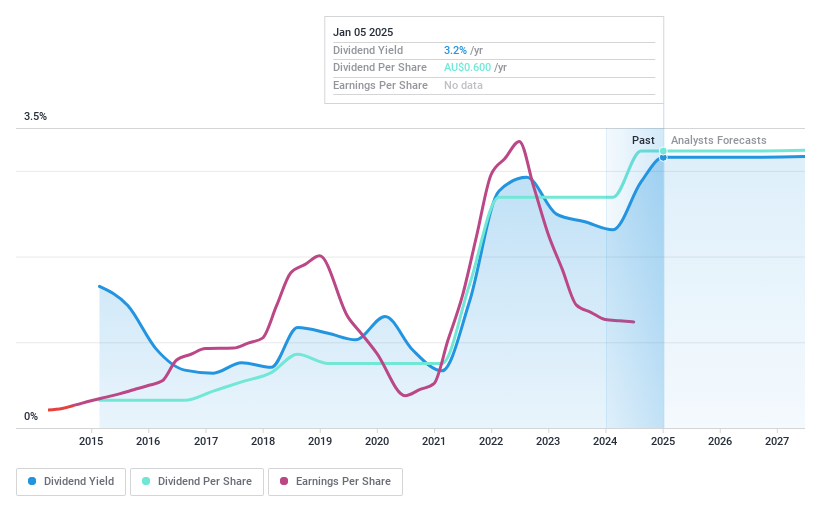

BlueScope Steel (ASX:BSL)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: BlueScope Steel Limited is involved in the production and marketing of metal coated and painted steel building products across Australia, New Zealand, Asia, North America, and internationally with a market cap of A$8.37 billion.

Operations: BlueScope Steel Limited's revenue is primarily derived from Australian Steel Products (A$6.98 billion), North Star BlueScope Steel (A$3.84 billion), Buildings and Coated Products North America (A$3.70 billion), Coated Products Asia (A$2.08 billion), and New Zealand & Pacific Islands (A$914.70 million).

Dividend Yield: 3.1%

BlueScope Steel's dividend payments have been historically volatile and unreliable, with fluctuations exceeding 20% annually. Despite this, the company's dividends are well-covered by earnings and cash flows, with a payout ratio of 30.6% and a cash payout ratio of 60.5%. Trading at A$57.4% below its estimated fair value suggests potential for capital appreciation. However, its current dividend yield of 3.14% is relatively low compared to top-tier Australian dividend payers at 6.11%.

- Navigate through the intricacies of BlueScope Steel with our comprehensive dividend report here.

- The analysis detailed in our BlueScope Steel valuation report hints at an deflated share price compared to its estimated value.

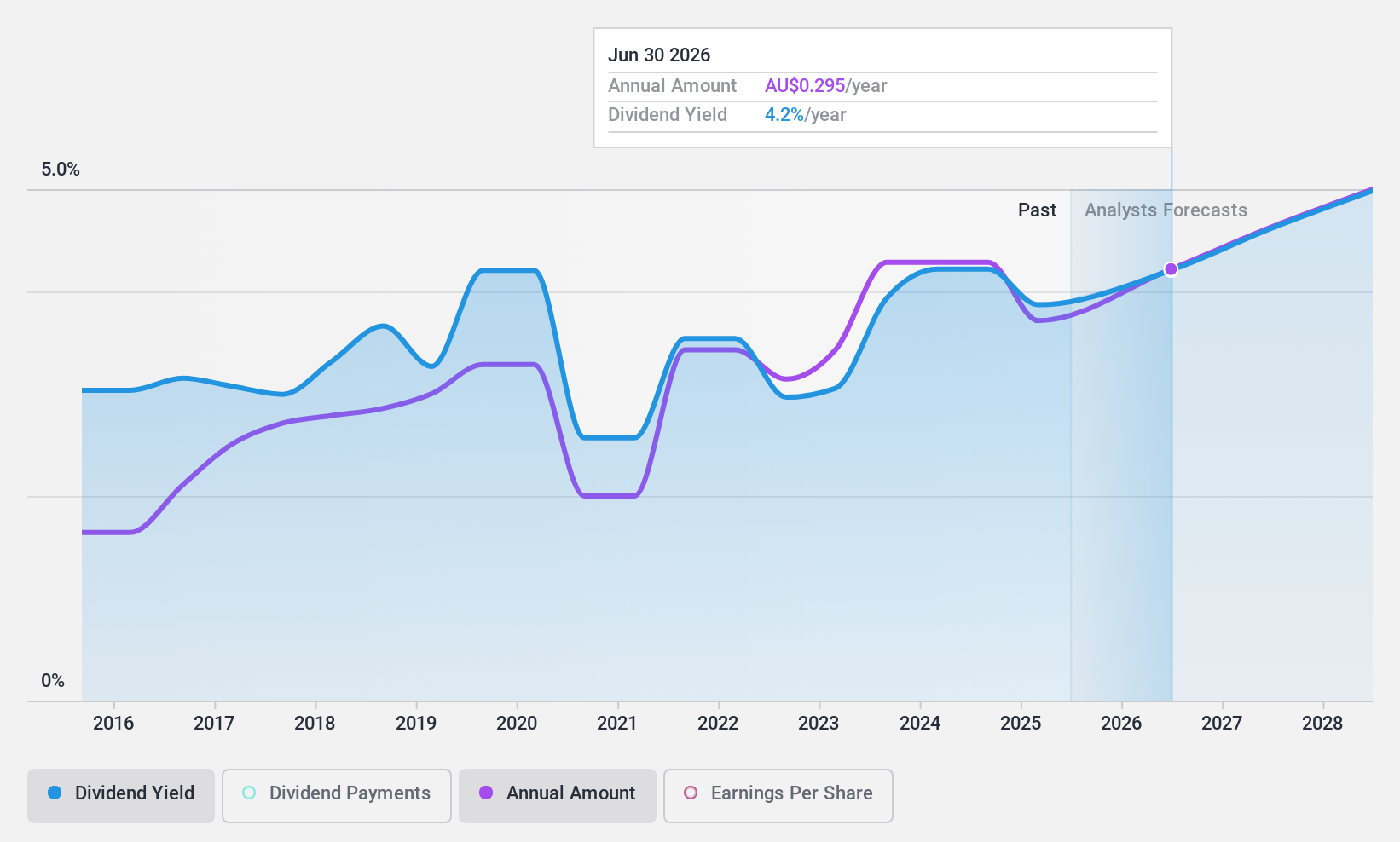

nib holdings (ASX:NHF)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: nib holdings limited operates in the underwriting and distribution of private health, life, and living insurance for residents, international students, and visitors in Australia and New Zealand with a market cap of A$2.71 billion.

Operations: nib holdings limited generates revenue through several segments, including Australian Residents Health Insurance (A$2.65 billion), New Zealand Insurance (A$373.10 million), International (Inbound) Health Insurance (A$203.50 million), NIB Travel (A$96.80 million), and Nib Thrive (A$51.30 million).

Dividend Yield: 5.2%

nib holdings' dividends have been inconsistent over the past decade, with significant volatility including annual drops exceeding 20%. Despite this, current payments are supported by earnings and cash flows, with payout ratios of 75.3% and 67.5%, respectively. The dividend yield of 5.2% is below the top quartile in Australia (6.11%). Recent board changes include Edward Close's appointment as director on December 1, 2024, potentially impacting future strategic decisions.

- Delve into the full analysis dividend report here for a deeper understanding of nib holdings.

- In light of our recent valuation report, it seems possible that nib holdings is trading behind its estimated value.

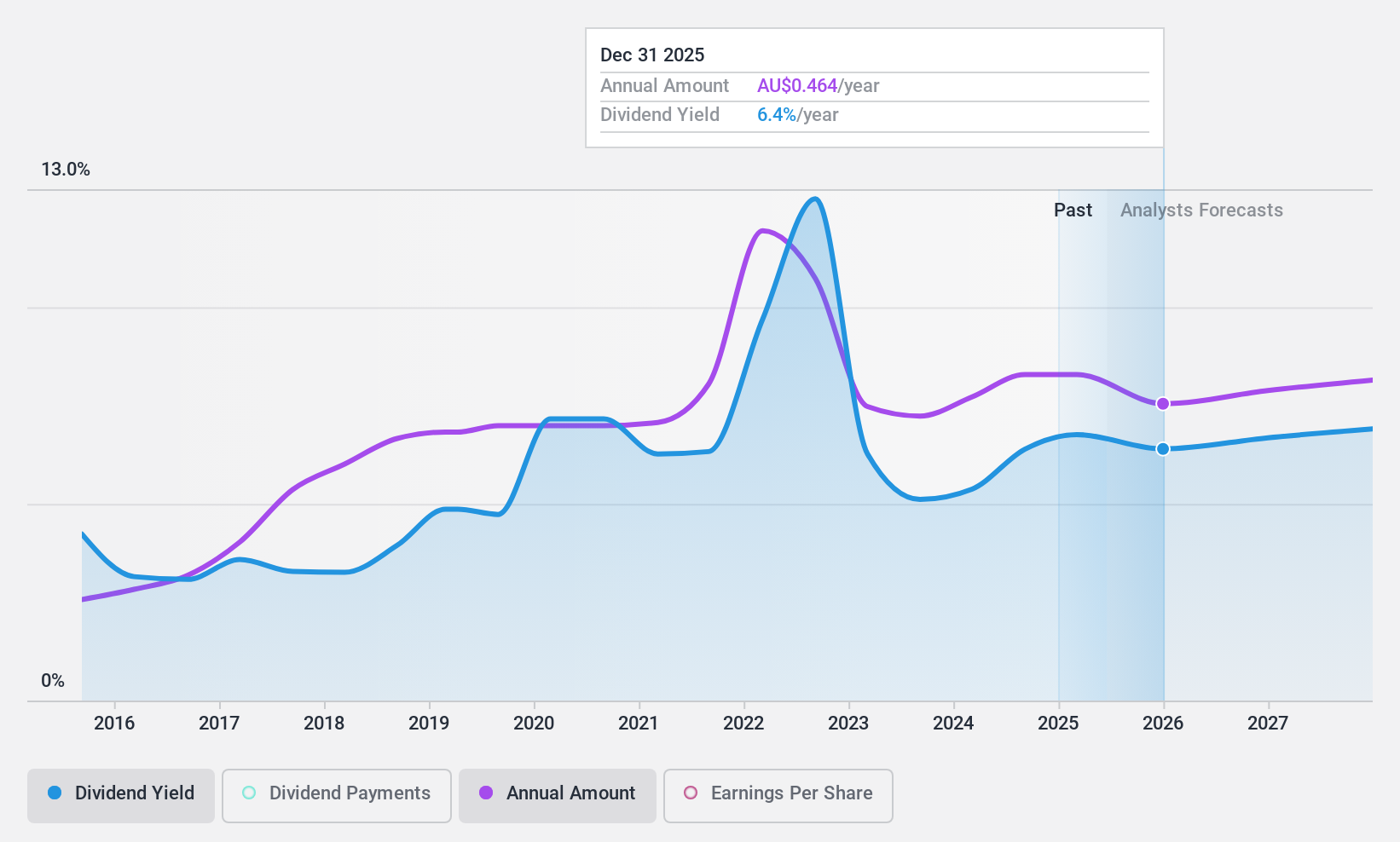

Smartgroup (ASX:SIQ)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Smartgroup Corporation Ltd, with a market cap of A$1.02 billion, provides employee management services in Australia.

Operations: Smartgroup Corporation Ltd generates revenue from Vehicle Services (A$19.53 million), Outsourced Administration (A$263.07 million), and Software, Distribution and Group Services (A$41.02 million).

Dividend Yield: 6.5%

Smartgroup's dividend yield of 6.46% ranks in the top 25% among Australian payers, yet sustainability is a concern with a high cash payout ratio of 131%, indicating dividends are not well covered by free cash flows. While earnings support the current payout ratio of 64.6%, historical volatility and unreliability in payments pose risks. The stock trades at a significant discount to its estimated fair value, suggesting potential value despite these challenges.

- Get an in-depth perspective on Smartgroup's performance by reading our dividend report here.

- Our expertly prepared valuation report Smartgroup implies its share price may be lower than expected.

Seize The Opportunity

- Click here to access our complete index of 32 Top ASX Dividend Stocks.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:SIQ

Very undervalued with solid track record and pays a dividend.

Market Insights

Community Narratives