- Australia

- /

- Metals and Mining

- /

- ASX:BHP

Is BHP (ASX:BHP) Using Battery-Electric Trucks to Quietly Reshape Its Long-Term Cost Base?

Reviewed by Sasha Jovanovic

- BHP Group announced that Australia’s first Cat 793 XE Early Learner battery-electric haul trucks have arrived at its Jimblebar iron ore mine in the Pilbara, beginning on-site testing with Rio Tinto and Caterpillar of zero-exhaust mining haulage technology.

- This industry-first collaboration not only advances BHP’s long-term decarbonisation plans, but also serves as a real-world test of whether large-scale battery-electric fleets can maintain productivity in one of the world’s most important iron ore hubs.

- We’ll now explore how this early-stage battery-electric haul truck trial could influence BHP’s long-term cost profile, project risks and ESG positioning.

Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

BHP Group Investment Narrative Recap

To own BHP, you need to believe its low cost, scale iron ore and growing exposure to copper and potash can offset commodity volatility and project execution risk. The Pilbara battery-electric haul truck trial looks directionally positive for long term decarbonisation and operating costs, but it is unlikely to shift the main near term share price drivers, which remain iron ore pricing and progress on major projects like Jansen.

The renewed takeover approach to Anglo American sits in the background as a separate but important storyline, because any large transaction could reshape BHP’s exposure to copper and its overall risk profile. Set against that, the Jimblebar truck trial is a more incremental development that feeds into BHP’s broader ESG and cost ambitions, rather than a catalyst that rivals the potential portfolio impact of large scale M&A.

However, investors should also be aware that rising ESG expectations and the risk that decarbonisation technologies fail to deliver cost effective results could...

Read the full narrative on BHP Group (it's free!)

BHP Group’s narrative projects $49.6 billion revenue and $10.0 billion earnings by 2028. This implies revenue declining by 1.1% per year and an earnings increase of about $1.0 billion from $9.0 billion today.

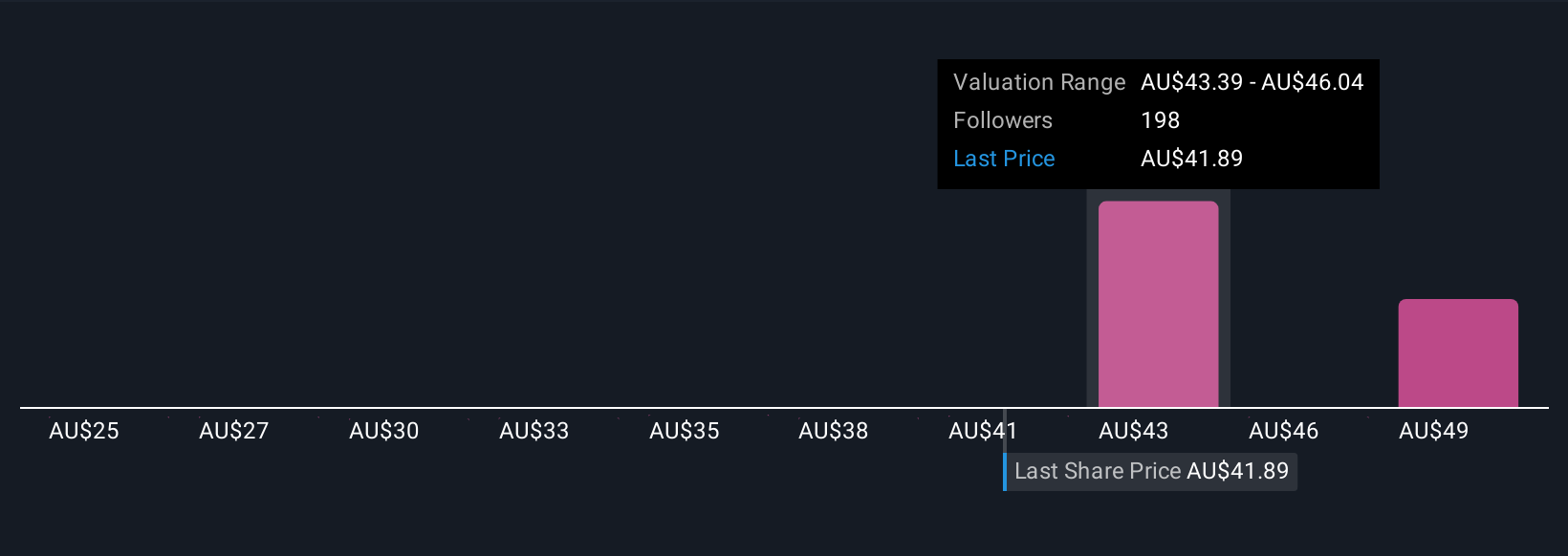

Uncover how BHP Group's forecasts yield a A$45.21 fair value, in line with its current price.

Exploring Other Perspectives

Twenty one members of the Simply Wall St Community currently value BHP between A$29.94 and A$55.50, highlighting very different expectations for the company. When you layer this against BHP’s reliance on large, long lived Western Australian iron ore operations, it underlines why examining several independent views on future risk and reward can be so important.

Explore 21 other fair value estimates on BHP Group - why the stock might be worth as much as 24% more than the current price!

Build Your Own BHP Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your BHP Group research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free BHP Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate BHP Group's overall financial health at a glance.

No Opportunity In BHP Group?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BHP Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:BHP

BHP Group

Operates as a resources company in Australia, Europe, China, Japan, India, South Korea, rest of Asia, North America, South America, and internationally.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026