- Australia

- /

- Metals and Mining

- /

- ASX:BHP

How Investors Are Reacting To BHP Group (ASX:BHP) Facing China’s Seaborne Iron Ore Purchase Halt

Reviewed by Sasha Jovanovic

- In recent days, China's state-backed China Mineral Resources Group instructed domestic steelmakers and traders to suspend purchases of all new dollar-denominated seaborne iron ore cargoes from BHP, following a breakdown in pricing negotiations and halting imports from Australia's largest listed miner.

- This escalation highlights China's growing influence over commodity pricing and introduces new challenges to BHP's historically strong exposure to Chinese steel demand.

- We'll examine how BHP's concentrated revenue exposure to China shapes its risk profile and future growth story in light of this event.

The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

BHP Group Investment Narrative Recap

BHP shareholders are generally betting on global demand for steelmaking materials, especially from China, and on the company's ability to use its scale and project pipeline to deliver stable earnings and dividends. The recent directive by China's state-backed importer to halt new seaborne iron ore purchases from BHP injects near-term uncertainty into this core thesis, directly impacting the group's most visible catalyst while underscoring its vulnerability to shifts in Chinese steel demand and negotiations; in the short term, the risk of material revenue disruption is now front and center.

Against this backdrop, BHP has announced more than A$840 million in new investment to grow its South Australian copper operations, targeting increased production from 1.7 million to around 2.5 million tons annually. While this expansion aligns with long-term opportunities in electrification and renewables, it also reflects management’s ongoing effort to reduce over-reliance on iron ore and diversify revenue streams, which is especially relevant as China flexes its bargaining power.

By contrast, there’s an additional layer of risk that investors should be aware of: the possibility that concentrated exposure to a single market could ...

Read the full narrative on BHP Group (it's free!)

BHP Group's outlook anticipates $49.6 billion in revenue and $10.0 billion in earnings by 2028. This projection assumes a 1.1% annual revenue decline and an earnings increase of $1.0 billion from current earnings of $9.0 billion.

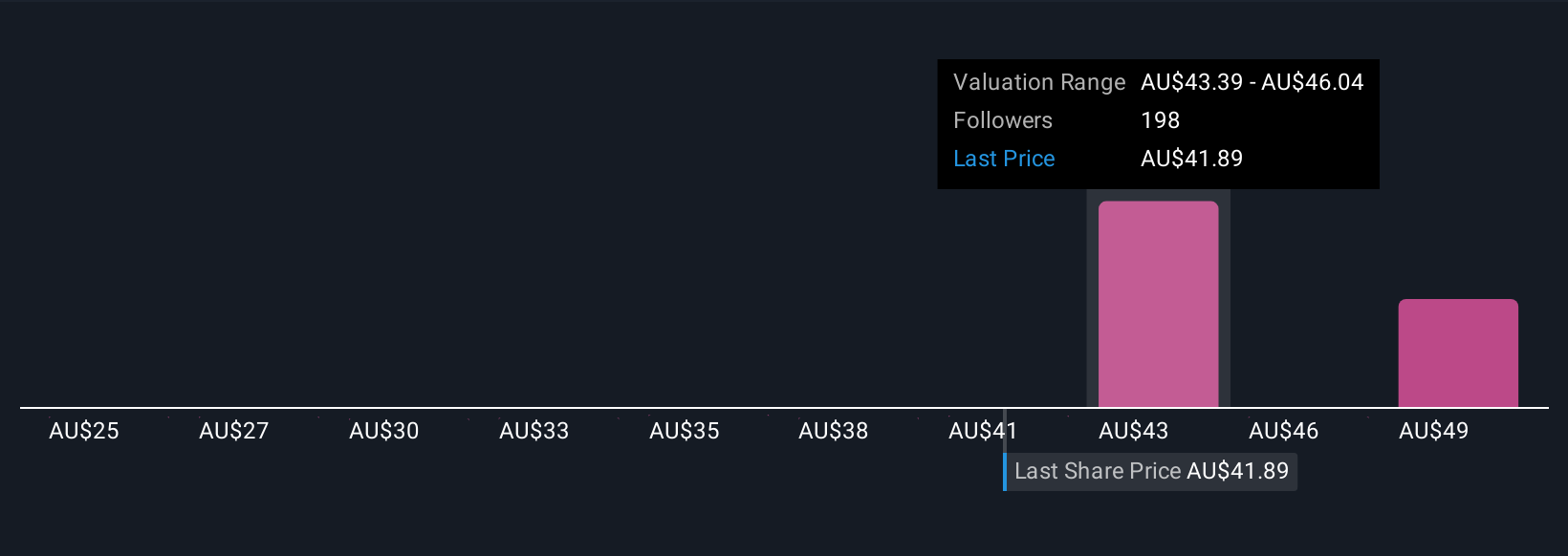

Uncover how BHP Group's forecasts yield a A$43.51 fair value, a 3% upside to its current price.

Exploring Other Perspectives

The Simply Wall St Community’s 24 fair value forecasts for BHP span from A$24.82 to A$52.36 per share. With China emerging as a more assertive price negotiator, your peers are clearly weighing diverse scenarios for future returns, explore several alternative viewpoints to inform your own.

Explore 24 other fair value estimates on BHP Group - why the stock might be worth 41% less than the current price!

Build Your Own BHP Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your BHP Group research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free BHP Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate BHP Group's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Find companies with promising cash flow potential yet trading below their fair value.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BHP Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:BHP

BHP Group

Operates as a resources company in Australia, Europe, China, Japan, India, South Korea, rest of Asia, North America, South America, and internationally.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives