- Australia

- /

- Metals and Mining

- /

- ASX:BGL

How Investors May Respond To Bellevue Gold (ASX:BGL) Posting Higher Sales but Unexpected Net Loss

Reviewed by Simply Wall St

- Bellevue Gold recently announced its earnings results for the full year ended June 30, 2025, reporting sales of A$505.84 million compared to A$298.41 million a year earlier, while shifting from a net income of A$75.42 million last year to a net loss of A$45.89 million.

- This swing to a net loss despite a substantial increase in revenue highlights material shifts in the company's operating costs or margins.

- We'll explore how Bellevue Gold's higher sales but unexpected net loss may shape its investment narrative going forward.

AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

What Is Bellevue Gold's Investment Narrative?

To get behind Bellevue Gold as a shareholder, you’d need to believe its rapid growth in sales will ultimately translate to sustainable profitability, despite the company’s swing from a strong net profit to a net loss this year. The recent earnings report is a significant development: record revenue didn’t stop mounting costs from pushing Bellevue into the red, which puts short-term profit guidance and future cash requirements directly in the spotlight. This sharp change may reshape market views about the company’s near-term execution, potentially making cost control, production targets, and capital needs the most pressing catalysts and risks now, instead of only focusing on output growth. Given declining share performance and completed equity raisings, funding and operational efficiency have moved to the front of the queue for investors tracking Bellevue’s next steps.

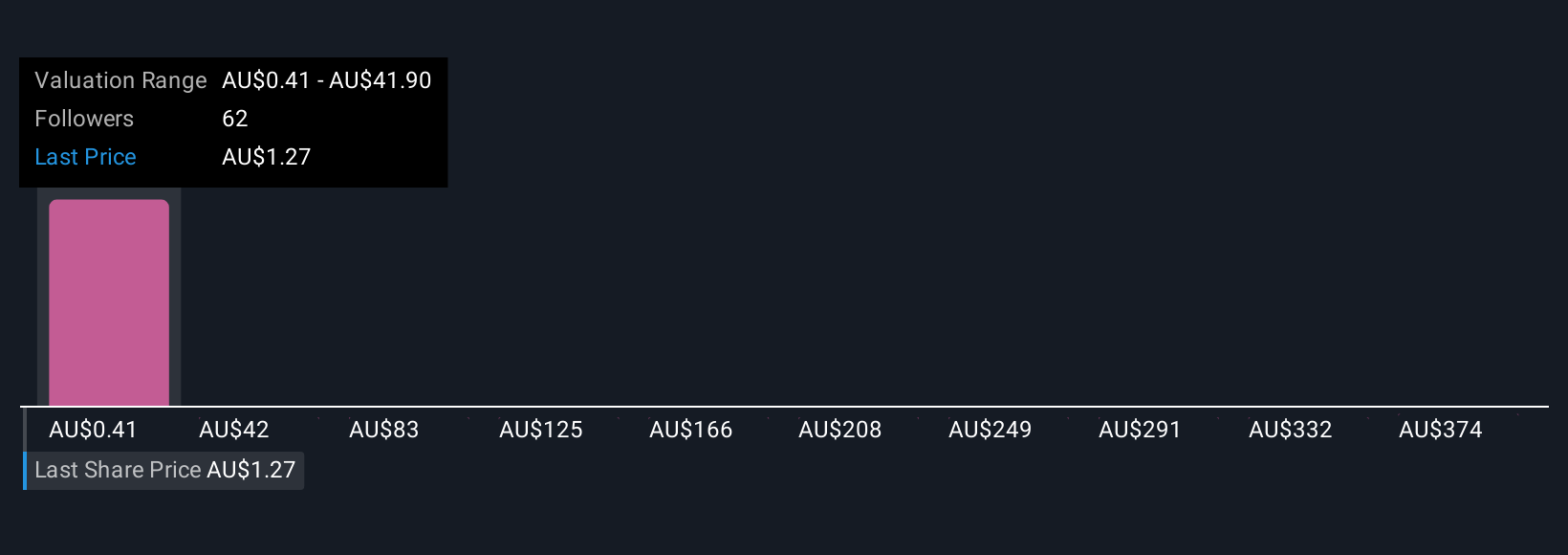

But if expenses continue to outpace revenue, investors should be watching for further dilution or funding moves. Bellevue Gold's shares have been on the rise but are still potentially undervalued. Find out how large the opportunity might be.Exploring Other Perspectives

Explore 11 other fair value estimates on Bellevue Gold - why the stock might be worth 14% less than the current price!

Build Your Own Bellevue Gold Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Bellevue Gold research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Bellevue Gold research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Bellevue Gold's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Explore 23 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 29 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bellevue Gold might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:BGL

Bellevue Gold

Engages in the exploration, development, mining, and processing of gold properties in Australia.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives