- Australia

- /

- Metals and Mining

- /

- ASX:AZL

ASX Penny Stocks To Watch In May 2025

Reviewed by Simply Wall St

The Australian sharemarket is poised to dip, mirroring Wall Street's overnight losses, as investors focus on upcoming trade talks between China and the US and await updates from the Macquarie Australia conference. In such a climate, identifying stocks with strong fundamentals becomes crucial for investors seeking opportunities amid market fluctuations. While the term "penny stocks" might seem outdated, these smaller or less-established companies can still offer significant value when backed by solid financials; we will explore three such promising penny stocks in Australia.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| CTI Logistics (ASX:CLX) | A$1.74 | A$140.15M | ✅ 4 ⚠️ 2 View Analysis > |

| Accent Group (ASX:AX1) | A$1.85 | A$1.05B | ✅ 4 ⚠️ 2 View Analysis > |

| EZZ Life Science Holdings (ASX:EZZ) | A$1.515 | A$71.47M | ✅ 4 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.63 | A$405.5M | ✅ 4 ⚠️ 2 View Analysis > |

| GTN (ASX:GTN) | A$0.61 | A$116.58M | ✅ 3 ⚠️ 2 View Analysis > |

| West African Resources (ASX:WAF) | A$2.43 | A$2.77B | ✅ 4 ⚠️ 1 View Analysis > |

| GR Engineering Services (ASX:GNG) | A$2.85 | A$476.96M | ✅ 2 ⚠️ 1 View Analysis > |

| Bisalloy Steel Group (ASX:BIS) | A$3.27 | A$155.16M | ✅ 3 ⚠️ 1 View Analysis > |

| Regal Partners (ASX:RPL) | A$2.17 | A$729.48M | ✅ 4 ⚠️ 3 View Analysis > |

| NRW Holdings (ASX:NWH) | A$2.74 | A$1.25B | ✅ 5 ⚠️ 1 View Analysis > |

Click here to see the full list of 992 stocks from our ASX Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Arizona Lithium (ASX:AZL)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Arizona Lithium Limited is a mineral exploration company focused on lithium resources in the United States and Canada, with a market cap of A$41.06 million.

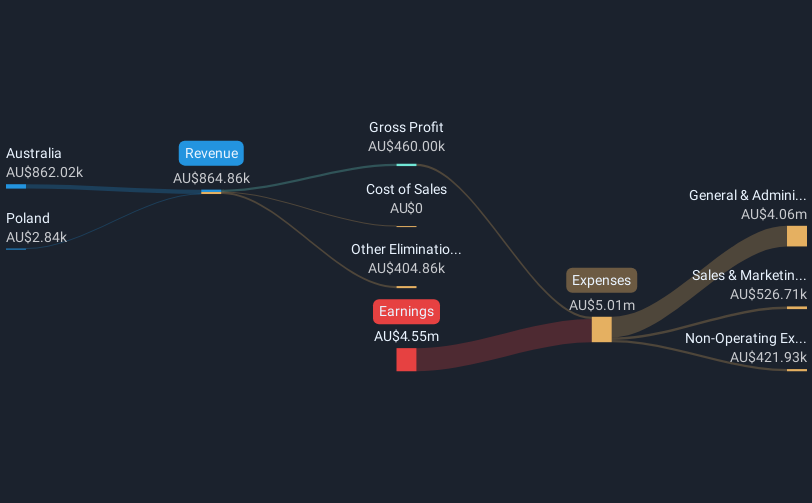

Operations: The company's revenue is derived from two geographical segments: Australia, contributing A$4.52 million, and North America, accounting for A$11.49 million.

Market Cap: A$41.06M

Arizona Lithium Limited, with a market cap of A$41.06 million, has recently reported a net income of A$9.08 million for the half year ended December 31, 2024, marking an improvement from a previous loss. Despite being pre-revenue and unprofitable over the past five years with increasing losses, it has managed to raise A$2 million through a follow-on equity offering to address its cash runway concerns. The company benefits from an experienced management team and board but faces challenges such as high share price volatility and recent exclusion from the S&P/ASX Emerging Companies Index.

- Click here and access our complete financial health analysis report to understand the dynamics of Arizona Lithium.

- Evaluate Arizona Lithium's historical performance by accessing our past performance report.

GreenX Metals (ASX:GRX)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: GreenX Metals Limited is involved in the exploration and evaluation of mineral properties across Greenland, Poland, and Germany, with a market cap of A$226.71 million.

Operations: There are no reported revenue segments for GreenX Metals Limited.

Market Cap: A$226.71M

GreenX Metals Limited, with a market cap of A$226.71 million, is pre-revenue and currently unprofitable. The company has no debt and its short-term assets cover both short- and long-term liabilities. Despite having less than a year of cash runway if free cash flow continues to decline, GreenX's recent expansion of the Tannenberg Copper Project in Germany is promising, increasing the exploration area seven-fold to 1,900 km². This project was selected for BHP's Xplor program, which provides funding for accelerated exploration efforts in collaboration with BHP. The management team is experienced but faces challenges due to ongoing losses.

- Unlock comprehensive insights into our analysis of GreenX Metals stock in this financial health report.

- Gain insights into GreenX Metals' past trends and performance with our report on the company's historical track record.

MotorCycle Holdings (ASX:MTO)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: MotorCycle Holdings Limited operates motorcycle dealerships across Australia with a market capitalization of A$183.04 million.

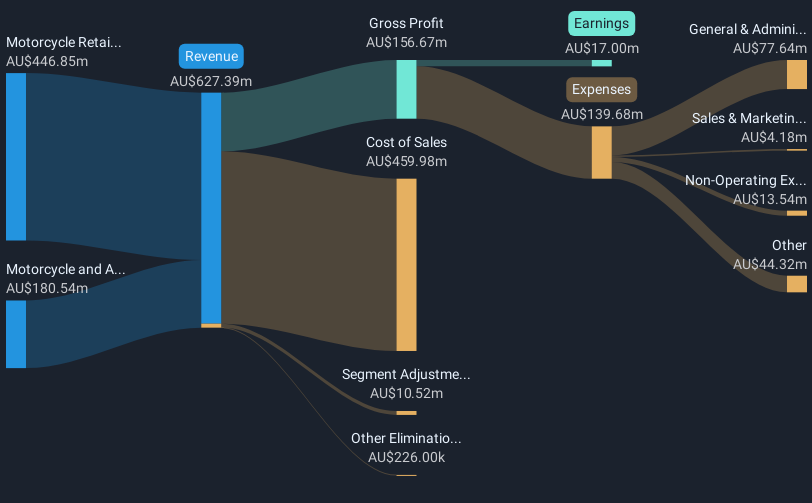

Operations: The company generates revenue from two primary segments: Motorcycle Retailing, which accounts for A$446.85 million, and Motorcycle and Accessories Wholesaling, contributing A$180.54 million.

Market Cap: A$183.04M

MotorCycle Holdings, with a market cap of A$183.04 million, shows financial stability with short-term assets exceeding both short- and long-term liabilities. Its debt is well-covered by operating cash flow, and interest payments are adequately managed by EBIT. Despite recent negative earnings growth, the company has achieved an average profit growth of 19.6% over five years. The stock trades below its estimated fair value and offers good relative value compared to peers. However, the dividend track record remains unstable while net profit margins have slightly decreased from last year. Recent board changes include appointing Nikki Thomas as an Independent Non-Executive Director.

- Take a closer look at MotorCycle Holdings' potential here in our financial health report.

- Understand MotorCycle Holdings' earnings outlook by examining our growth report.

Summing It All Up

- Investigate our full lineup of 992 ASX Penny Stocks right here.

- Interested In Other Possibilities? The latest GPUs need a type of rare earth metal called Dysprosium and there are only 24 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Arizona Lithium, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:AZL

Arizona Lithium

Operates as a mineral exploration company in the United States and Canada.

Flawless balance sheet slight.

Market Insights

Community Narratives