- Australia

- /

- Metals and Mining

- /

- ASX:ARL

ASX Penny Stocks With Promising Prospects In February 2025

Reviewed by Simply Wall St

As the Australian market experiences a modest uptick, with ASX 200 futures indicating a slight gain, all eyes are on the Reserve Bank of Australia's anticipated rate cut decision. Amidst these economic dynamics, investors are keenly observing opportunities that may arise from smaller or newer companies often categorized as penny stocks. While the term "penny stocks" might seem outdated, these investments can still offer significant growth potential when backed by strong financial health and solid fundamentals.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| Embark Early Education (ASX:EVO) | A$0.79 | A$144.95M | ★★★★☆☆ |

| EZZ Life Science Holdings (ASX:EZZ) | A$1.97 | A$92.93M | ★★★★★★ |

| LaserBond (ASX:LBL) | A$0.575 | A$67.47M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.485 | A$300.77M | ★★★★★☆ |

| IVE Group (ASX:IGL) | A$2.24 | A$346.95M | ★★★★☆☆ |

| SHAPE Australia (ASX:SHA) | A$3.02 | A$250.39M | ★★★★★★ |

| Dusk Group (ASX:DSK) | A$1.08 | A$67.25M | ★★★★★★ |

| GTN (ASX:GTN) | A$0.55 | A$108.01M | ★★★★★★ |

| Helloworld Travel (ASX:HLO) | A$2.09 | A$340.29M | ★★★★★★ |

| MaxiPARTS (ASX:MXI) | A$1.84 | A$101.78M | ★★★★★★ |

Click here to see the full list of 1,032 stocks from our ASX Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Ardea Resources (ASX:ARL)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Ardea Resources Limited is a battery mineral company in Australia with a market capitalization of A$87.86 million.

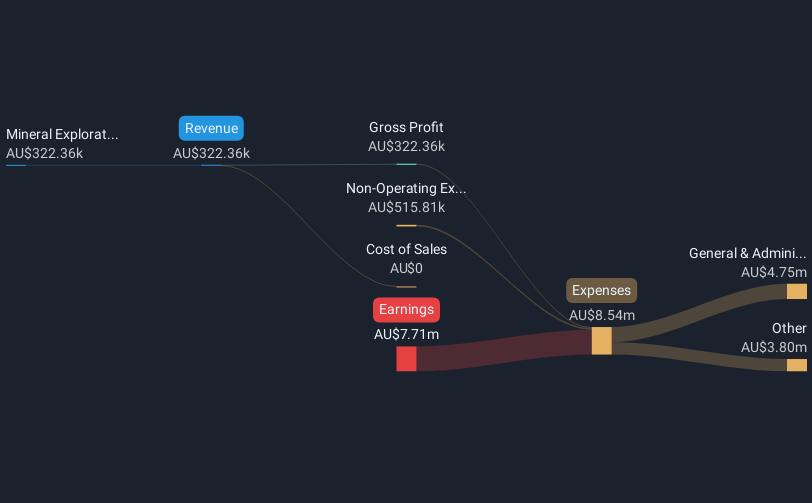

Operations: The company generates revenue of A$0.32 million from its mineral exploration and development activities.

Market Cap: A$87.86M

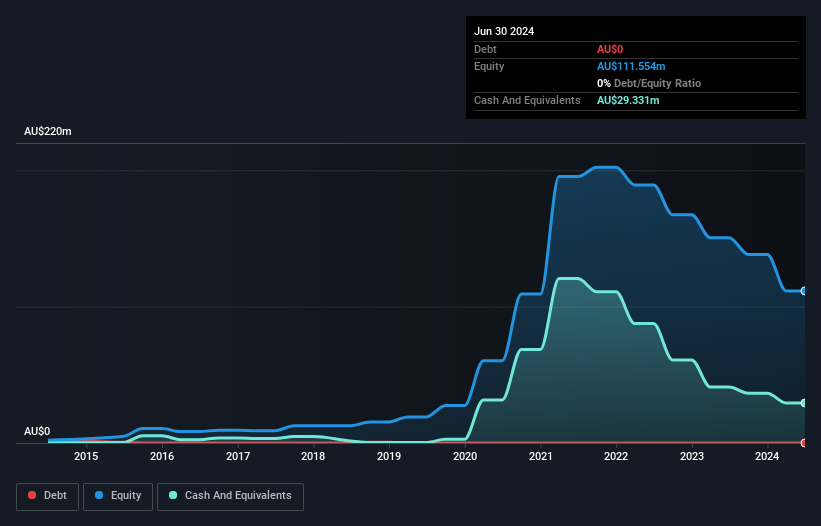

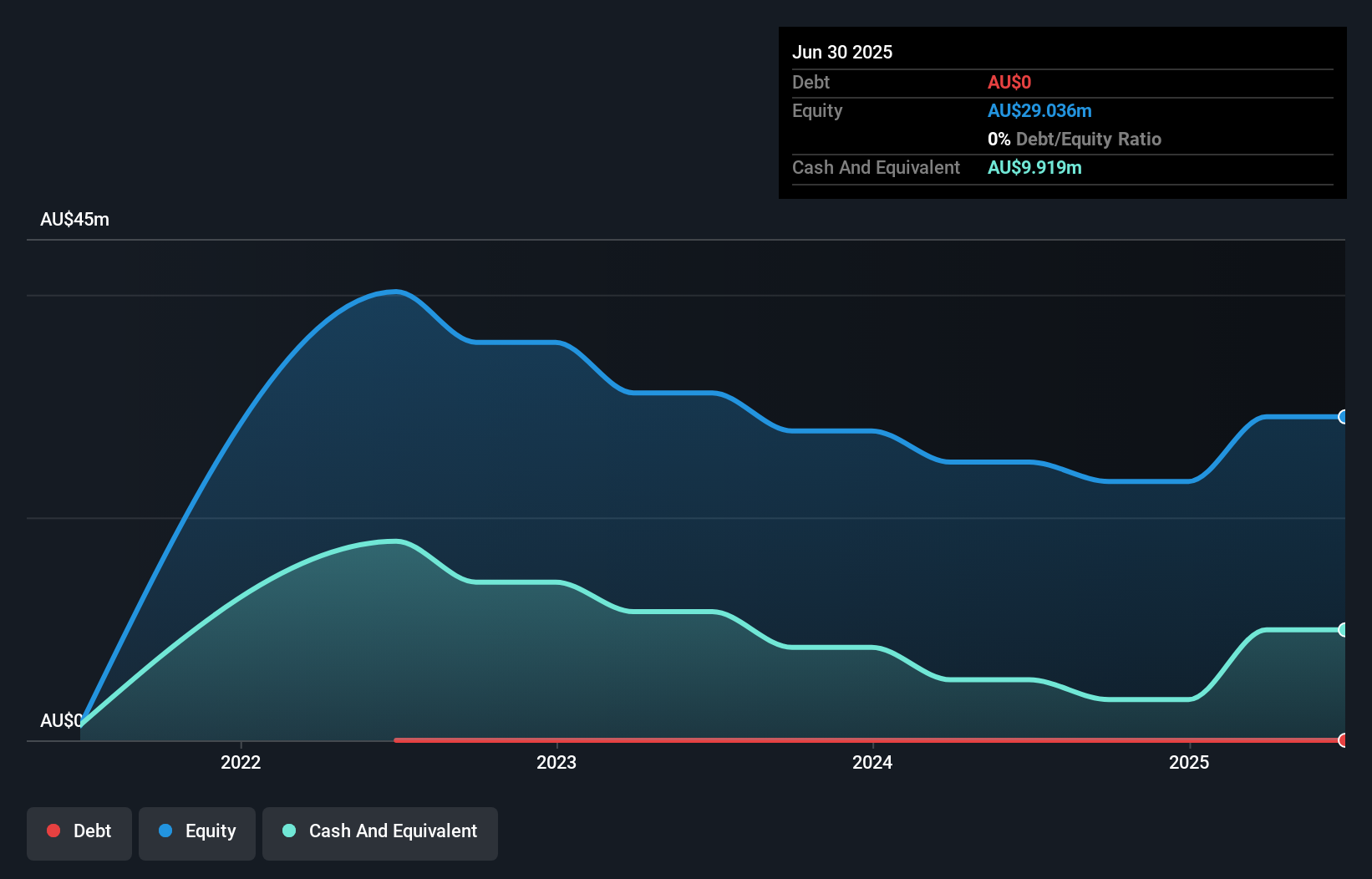

Ardea Resources, a pre-revenue battery mineral company with a market cap of A$87.86 million, is advancing its Kalgoorlie Nickel Project. Despite being unprofitable and experiencing significant losses over the past five years, the company maintains a stable financial position with short-term assets exceeding liabilities and more cash than debt. The recent appointment of experienced metallurgist Michael Rodriguez as an Executive Director is poised to enhance project development efforts for the Goongarrie Hub. With no meaningful shareholder dilution in the past year, Ardea's seasoned management and board are focused on optimizing their strategic initiatives in nickel-cobalt production.

- Click here and access our complete financial health analysis report to understand the dynamics of Ardea Resources.

- Assess Ardea Resources' previous results with our detailed historical performance reports.

Betmakers Technology Group (ASX:BET)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Betmakers Technology Group Ltd develops and provides software, data, and analytics products for the B2B wagering market across Australia, New Zealand, the United States, the United Kingdom, Europe, and internationally with a market cap of A$116.41 million.

Operations: The company's revenue is derived from two main segments: Global Tote, contributing A$54.77 million, and Global Betting Services, generating A$40.43 million.

Market Cap: A$116.41M

Betmakers Technology Group, with a market cap of A$116.41 million, is navigating the challenges of being unprofitable while maintaining a solid financial footing. The company forecasts higher revenue in the second half of FY25 compared to the first half, benefiting from reduced cloud costs and operating expenses. Despite its volatile share price and inexperienced management team, Betmakers has not significantly diluted shareholders recently and holds sufficient cash to cover liabilities for over three years without debt concerns. However, its negative return on equity and increasing losses highlight ongoing profitability struggles amidst expected revenue growth.

- Click to explore a detailed breakdown of our findings in Betmakers Technology Group's financial health report.

- Review our growth performance report to gain insights into Betmakers Technology Group's future.

Southern Palladium (ASX:SPD)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Southern Palladium Limited, with a market cap of A$41.84 million, is involved in the exploration and development of platinum group metals through its subsidiaries.

Operations: Southern Palladium Limited currently does not report any revenue segments.

Market Cap: A$41.84M

Southern Palladium Limited, with a market cap of A$41.84 million, is pre-revenue and debt-free, focusing on platinum group metals exploration. The company boasts an experienced management team and board, with average tenures of 2.8 and 3.8 years respectively. Despite its unprofitability and negative return on equity (-26.93%), Southern Palladium maintains a stable financial position with sufficient cash to cover operations for over three years without incurring debt or significant shareholder dilution recently. Recent conference presentations highlight ongoing activity updates but do not yet translate into revenue generation or profitability improvements for the company.

- Navigate through the intricacies of Southern Palladium with our comprehensive balance sheet health report here.

- Gain insights into Southern Palladium's historical outcomes by reviewing our past performance report.

Summing It All Up

- Take a closer look at our ASX Penny Stocks list of 1,032 companies by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:ARL

Adequate balance sheet low.

Similar Companies

Market Insights

Community Narratives