The ASX200 has reached a new all-time high of 8,566 points, bolstered by strong performances in the real estate and materials sectors. Despite the market's current strength, investors continue to explore diverse opportunities, including those offered by penny stocks. While the term "penny stock" might seem outdated, it still signifies smaller or newer companies that can offer potential value when backed by solid financials.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| Embark Early Education (ASX:EVO) | A$0.775 | A$142.2M | ★★★★☆☆ |

| LaserBond (ASX:LBL) | A$0.575 | A$67.4M | ★★★★★★ |

| EZZ Life Science Holdings (ASX:EZZ) | A$1.95 | A$91.99M | ★★★★★★ |

| SHAPE Australia (ASX:SHA) | A$2.99 | A$247.9M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.515 | A$319.37M | ★★★★★☆ |

| MaxiPARTS (ASX:MXI) | A$1.90 | A$105.1M | ★★★★★★ |

| GTN (ASX:GTN) | A$0.54 | A$106.04M | ★★★★★★ |

| Helloworld Travel (ASX:HLO) | A$2.01 | A$327.26M | ★★★★★★ |

| Servcorp (ASX:SRV) | A$4.92 | A$485.51M | ★★★★☆☆ |

| IVE Group (ASX:IGL) | A$2.18 | A$337.66M | ★★★★☆☆ |

Click here to see the full list of 1,029 stocks from our ASX Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Alkane Resources (ASX:ALK)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Alkane Resources Ltd is a gold exploration and production company in Australia with a market cap of A$345.16 million.

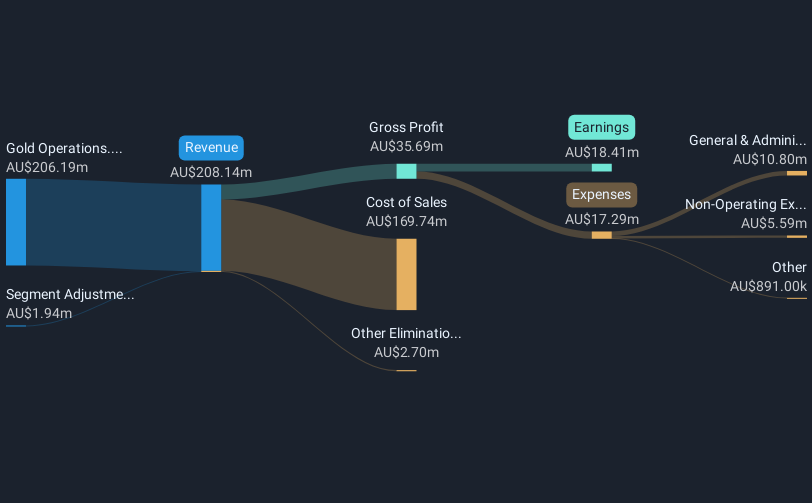

Operations: The company's revenue primarily comes from its Gold Operations segment, which generated A$173.58 million.

Market Cap: A$345.16M

Alkane Resources, with a market cap of A$345.16 million, primarily generates revenue from its Gold Operations segment, reporting A$173.58 million in revenue. Despite negative earnings growth over the past year and lower profit margins compared to last year, Alkane's earnings have grown by 9.7% annually over five years. The company is debt-free with seasoned management and board teams but faces challenges as short-term assets do not cover long-term liabilities. Trading significantly below estimated fair value, Alkane's earnings are forecasted to grow substantially at 37.2% per year according to analyst estimates.

- Unlock comprehensive insights into our analysis of Alkane Resources stock in this financial health report.

- Understand Alkane Resources' earnings outlook by examining our growth report.

Pancontinental Energy (ASX:PCL)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Pancontinental Energy NL is involved in the exploration of oil and gas properties in Namibia and Australia, with a market cap of A$138.24 million.

Operations: Currently, there are no reported revenue segments for the company.

Market Cap: A$138.24M

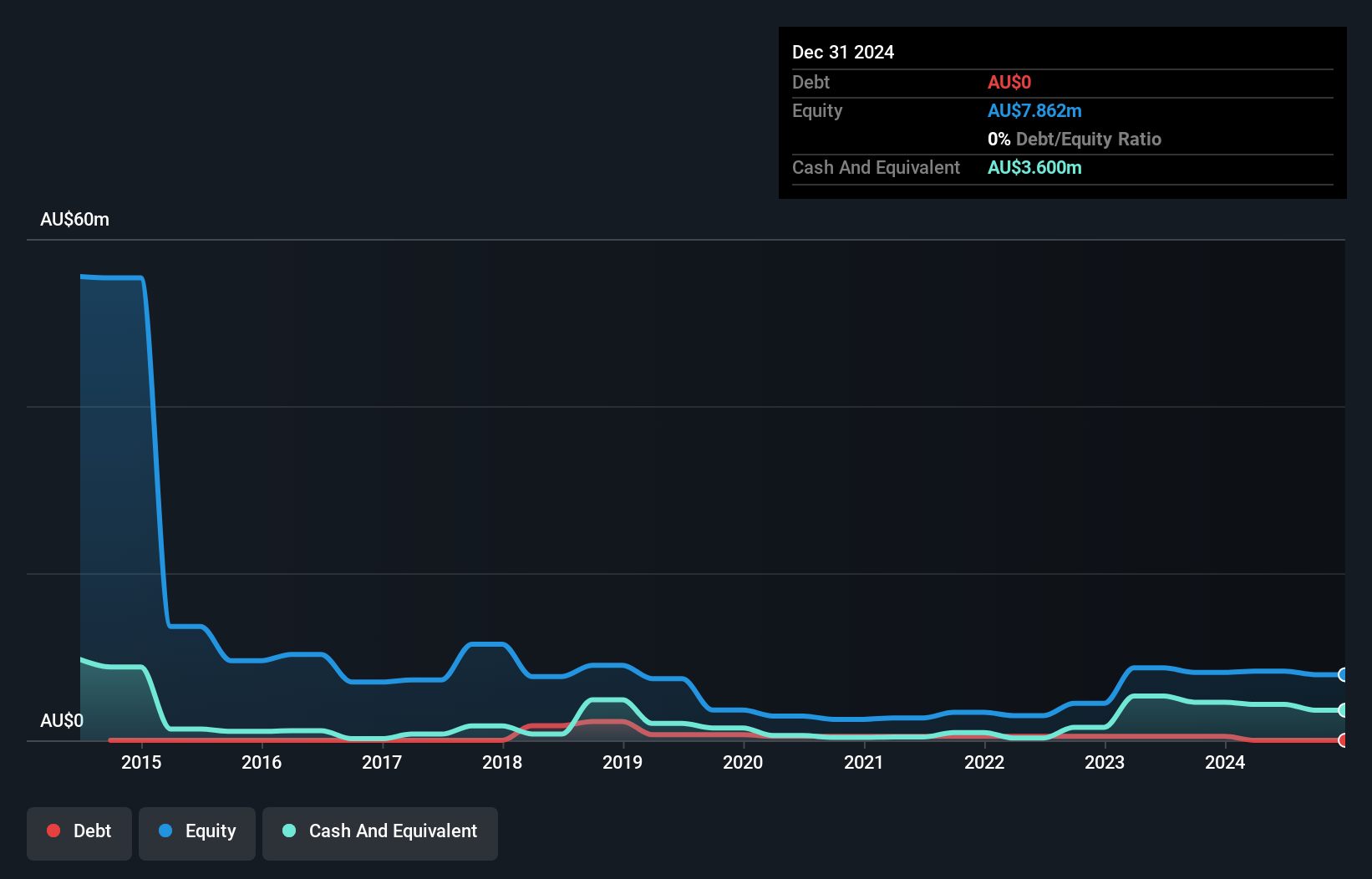

Pancontinental Energy, with a market cap of A$138.24 million, is pre-revenue and currently unprofitable. The company has managed to reduce losses over the past five years at a rate of 26.4% annually and maintains a stable cash runway for over two years if free cash flow continues its historical growth. Pancontinental is debt-free, with short-term assets covering both short- and long-term liabilities comfortably. Despite high volatility in share price recently, shareholders have not faced significant dilution in the past year. The board is seasoned with an average tenure of 16 years, though management experience data remains insufficient.

- Click here and access our complete financial health analysis report to understand the dynamics of Pancontinental Energy.

- Understand Pancontinental Energy's track record by examining our performance history report.

TPG Telecom (ASX:TPG)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: TPG Telecom Limited offers telecommunications services to a diverse range of customers including consumer, business, enterprise, government, and wholesale sectors in Australia with a market cap of A$8.10 billion.

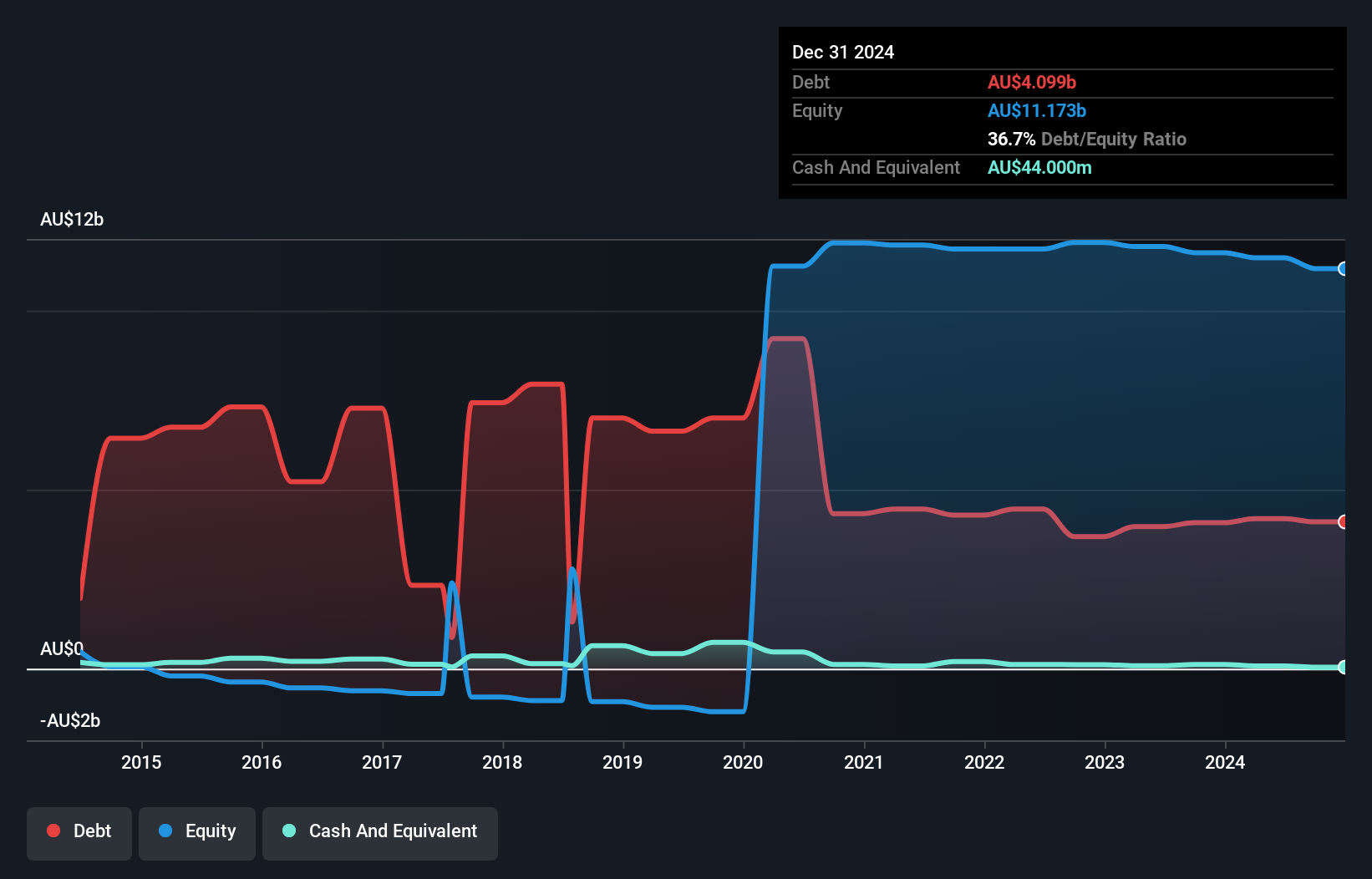

Operations: The company generates revenue from two main segments: Consumer, contributing A$4.53 billion, and Enterprise, Government and Wholesale, contributing A$1.09 billion.

Market Cap: A$8.1B

TPG Telecom, with a market cap of A$8.10 billion, shows mixed financial health. While it has grown profitable over the past five years, recent negative earnings growth and a significant one-off loss have impacted its performance. The company's interest payments are well covered by EBIT, and its debt level is satisfactory with operating cash flow covering 42.2% of its debt. However, short-term assets fall short of covering both short- and long-term liabilities. Despite trading below estimated fair value and having an experienced board, low return on equity and unsustainable dividends remain concerns for investors considering penny stocks in Australia.

- Click to explore a detailed breakdown of our findings in TPG Telecom's financial health report.

- Evaluate TPG Telecom's prospects by accessing our earnings growth report.

Key Takeaways

- Jump into our full catalog of 1,029 ASX Penny Stocks here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if TPG Telecom might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:TPG

TPG Telecom

Provides telecommunications services to consumer, business, enterprise, and government and wholesale customers in Australia.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Visa Stock: The Toll Booth at the Center of Global Commerce

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion