- Australia

- /

- Metals and Mining

- /

- ASX:KCN

ASX Penny Stocks To Consider In April 2025

Reviewed by Simply Wall St

Amid a turbulent week marked by significant market fluctuations and escalating trade tensions between China and the U.S., Australian shares have experienced notable declines, reflecting broader global uncertainties. Despite these challenges, investors continue to seek opportunities in various segments of the market. Penny stocks, often representing smaller or newer companies, remain an intriguing area for potential growth when backed by solid financials. In this article, we explore three such stocks that may offer hidden value and long-term prospects for discerning investors.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| CTI Logistics (ASX:CLX) | A$1.57 | A$121.31M | ✅ 4 ⚠️ 2 View Analysis > |

| MotorCycle Holdings (ASX:MTO) | A$2.00 | A$150.57M | ✅ 4 ⚠️ 2 View Analysis > |

| Accent Group (ASX:AX1) | A$1.785 | A$1.01B | ✅ 4 ⚠️ 1 View Analysis > |

| EZZ Life Science Holdings (ASX:EZZ) | A$1.32 | A$68.87M | ✅ 4 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.38 | A$370.04M | ✅ 4 ⚠️ 2 View Analysis > |

| GTN (ASX:GTN) | A$0.62 | A$115.45M | ✅ 3 ⚠️ 2 View Analysis > |

| Bisalloy Steel Group (ASX:BIS) | A$3.13 | A$148.52M | ✅ 3 ⚠️ 2 View Analysis > |

| Navigator Global Investments (ASX:NGI) | A$1.68 | A$813.53M | ✅ 5 ⚠️ 3 View Analysis > |

| Southern Cross Electrical Engineering (ASX:SXE) | A$1.66 | A$432.08M | ✅ 4 ⚠️ 1 View Analysis > |

| NRW Holdings (ASX:NWH) | A$2.41 | A$1.1B | ✅ 5 ⚠️ 1 View Analysis > |

Click here to see the full list of 981 stocks from our ASX Penny Stocks screener.

Let's explore several standout options from the results in the screener.

Alkane Resources (ASX:ALK)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Alkane Resources Ltd is an Australian company focused on gold exploration and production, with a market cap of A$423.88 million.

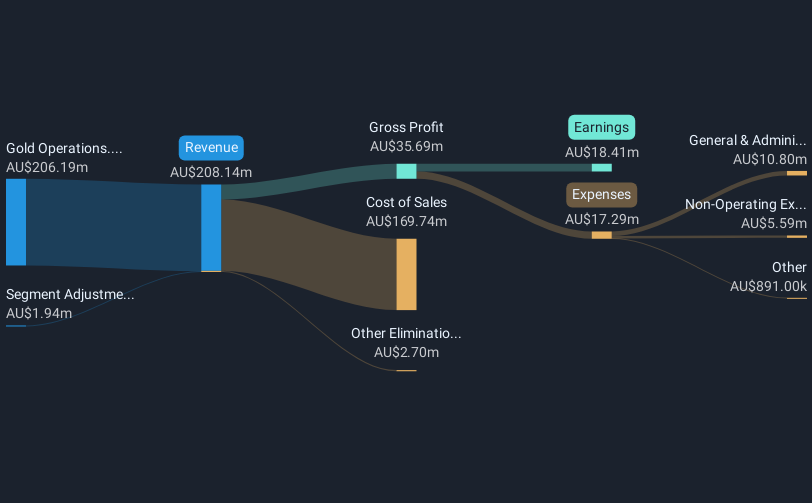

Operations: The company generated revenue of A$206.19 million from its gold operations.

Market Cap: A$423.88M

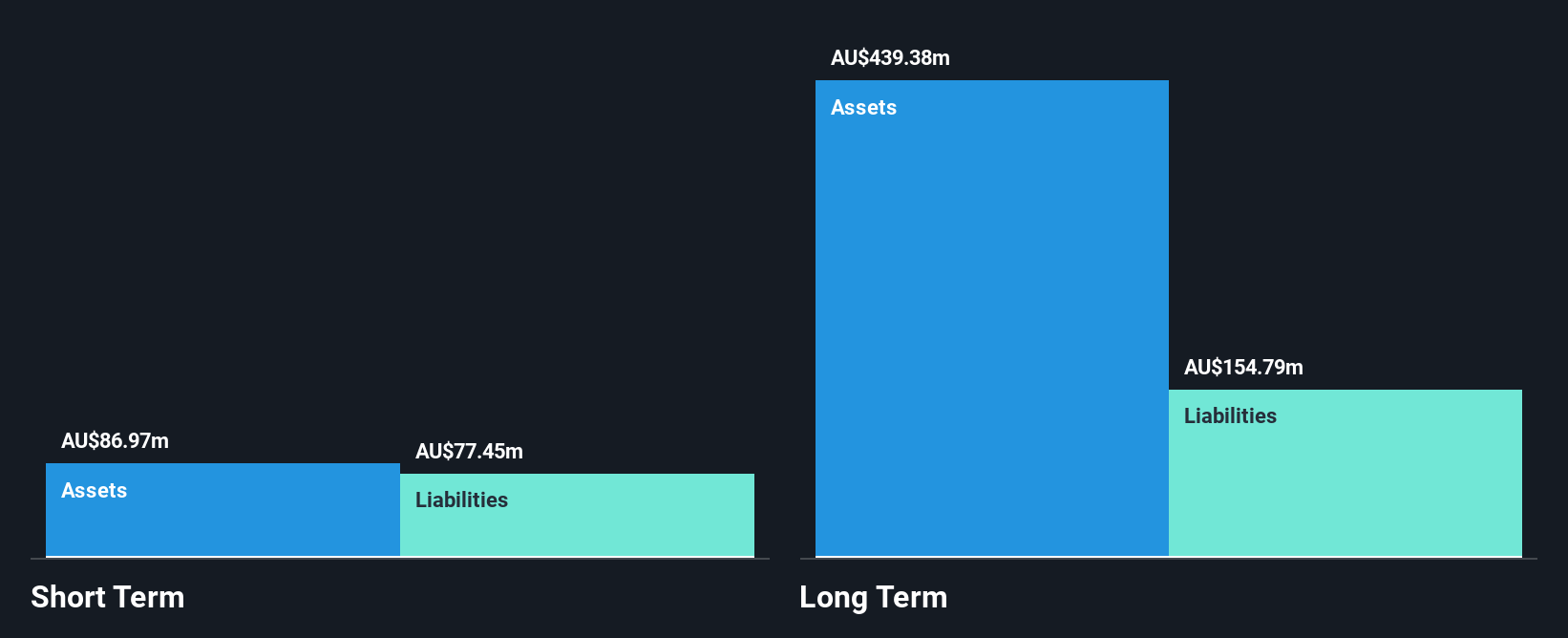

Alkane Resources, with a market cap of A$423.88 million, focuses on gold exploration and production, generating A$206.19 million in revenue from its operations. Despite having no debt and an experienced management team, Alkane faces challenges such as declining profit margins and negative earnings growth over the past year. Recent exploration results reported include promising drill outcomes at Tomingley Gold Operations, indicating potential for future resource expansion. While trading significantly below estimated fair value could attract investors seeking undervalued opportunities in penny stocks, short-term liabilities exceed assets, presenting financial risk considerations.

- Jump into the full analysis health report here for a deeper understanding of Alkane Resources.

- Gain insights into Alkane Resources' outlook and expected performance with our report on the company's earnings estimates.

Duratec (ASX:DUR)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Duratec Limited, listed under the ticker ASX:DUR, operates in Australia providing assessment, protection, remediation, and refurbishment services for steel and concrete infrastructure assets with a market capitalization of A$419.65 million.

Operations: The company's revenue is primarily derived from its Defence segment at A$193.48 million, followed by Mining & Industrial at A$144.05 million, Buildings & Facades at A$113.64 million, and Energy at A$62.54 million.

Market Cap: A$419.65M

Duratec Limited, with a market cap of A$419.65 million, demonstrates financial stability through its diversified revenue streams across Defence, Mining & Industrial, Buildings & Facades, and Energy sectors. Despite negative earnings growth last year compared to the Construction industry average, Duratec maintains high-quality earnings and strong debt coverage with operating cash flow exceeding debt by a very large margin. The company has not diluted shareholders recently and boasts an experienced management team and board. Recent half-year results show stable sales figures and increased net income year-over-year, alongside an interim dividend increase reflecting shareholder returns focus.

- Click to explore a detailed breakdown of our findings in Duratec's financial health report.

- Understand Duratec's earnings outlook by examining our growth report.

Kingsgate Consolidated (ASX:KCN)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Kingsgate Consolidated Limited is involved in the exploration, development, and mining of gold and silver mineral properties, with a market capitalization of A$399.52 million.

Operations: The company generates revenue of A$210.69 million from its Chatree operation, which focuses on gold and silver mining activities.

Market Cap: A$399.52M

Kingsgate Consolidated, with a market cap of A$399.52 million, has shown significant financial improvement, reporting A$136.08 million in sales for the half-year ending December 2024, up from A$58.48 million the previous year. The company transitioned to profitability with a net income of A$2.45 million compared to a loss last year and achieved an outstanding return on equity of 74.4%. Its debt is well-covered by operating cash flow and interest payments by EBIT, while short-term assets exceed liabilities but fall short against long-term obligations. Despite recent executive changes, Kingsgate remains focused on financial leadership continuity.

- Dive into the specifics of Kingsgate Consolidated here with our thorough balance sheet health report.

- Examine Kingsgate Consolidated's earnings growth report to understand how analysts expect it to perform.

Summing It All Up

- Unlock more gems! Our ASX Penny Stocks screener has unearthed 978 more companies for you to explore.Click here to unveil our expertly curated list of 981 ASX Penny Stocks.

- Looking For Alternative Opportunities? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kingsgate Consolidated might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:KCN

Kingsgate Consolidated

Engages in the exploration, development, and mining of gold and silver mineral properties.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives