- Australia

- /

- Metals and Mining

- /

- ASX:ALK

Alkane Resources (ASX:ALK): Valuation Insights After September Quarter Gold Production and FY26 Guidance Update

Reviewed by Simply Wall St

Alkane Resources (ASX:ALK) just released its September quarter gold production numbers along with full-year 2026 guidance, giving investors a fresh look at how the company is tracking and what to expect going forward.

See our latest analysis for Alkane Resources.

After a remarkable run earlier in the year, Alkane Resources' share price has pulled back recently, posting a 1-day share price return of -3.67% and a 7-day drop of -9.09%. The company reaffirmed production guidance and navigated recent boardroom changes. Despite this short-term volatility, Alkane still boasts a robust year-to-date share price return of 98.11% and a 1-year total shareholder return of 76.47%, highlighting strong underlying momentum that has captured investors' attention.

If Alkane’s surge has you wondering where else big moves may be brewing, it could be the perfect moment to broaden your search and discover fast growing stocks with high insider ownership

With the latest results and guidance now on the table, the key question is whether Alkane Resources is trading below its intrinsic value or if the market is already factoring in its growth prospects, which could leave little room for upside.

Price-to-Earnings of 43.4x: Is it justified?

Compared to the last close price of A$1.05, Alkane Resources trades at a high price-to-earnings (P/E) multiple, signaling a premium valuation versus its industry peers.

The price-to-earnings ratio measures how much investors are willing to pay today for a dollar of earnings. It is critical in evaluating whether a company's future growth expectations justify its current price. In the resources sector, a higher multiple can suggest investors anticipate above-average profits and sector-beating performance.

Alkane’s P/E of 43.4x is almost double the 21.9x industry average. This means the market is pricing in much stronger growth or profitability than its peers. However, the fair P/E, estimated at 29.5x, is notably lower than where it currently trades. This difference highlights potential expectations baked into Alkane's future, but also warns the premium may not be easy to sustain over the long term.

Explore the SWS fair ratio for Alkane Resources

Result: Price-to-Earnings of 43.4x (OVERVALUED)

However, continued volatility in gold prices or an unexpected slowdown in earnings growth could quickly shift sentiment and challenge Alkane’s premium valuation.

Find out about the key risks to this Alkane Resources narrative.

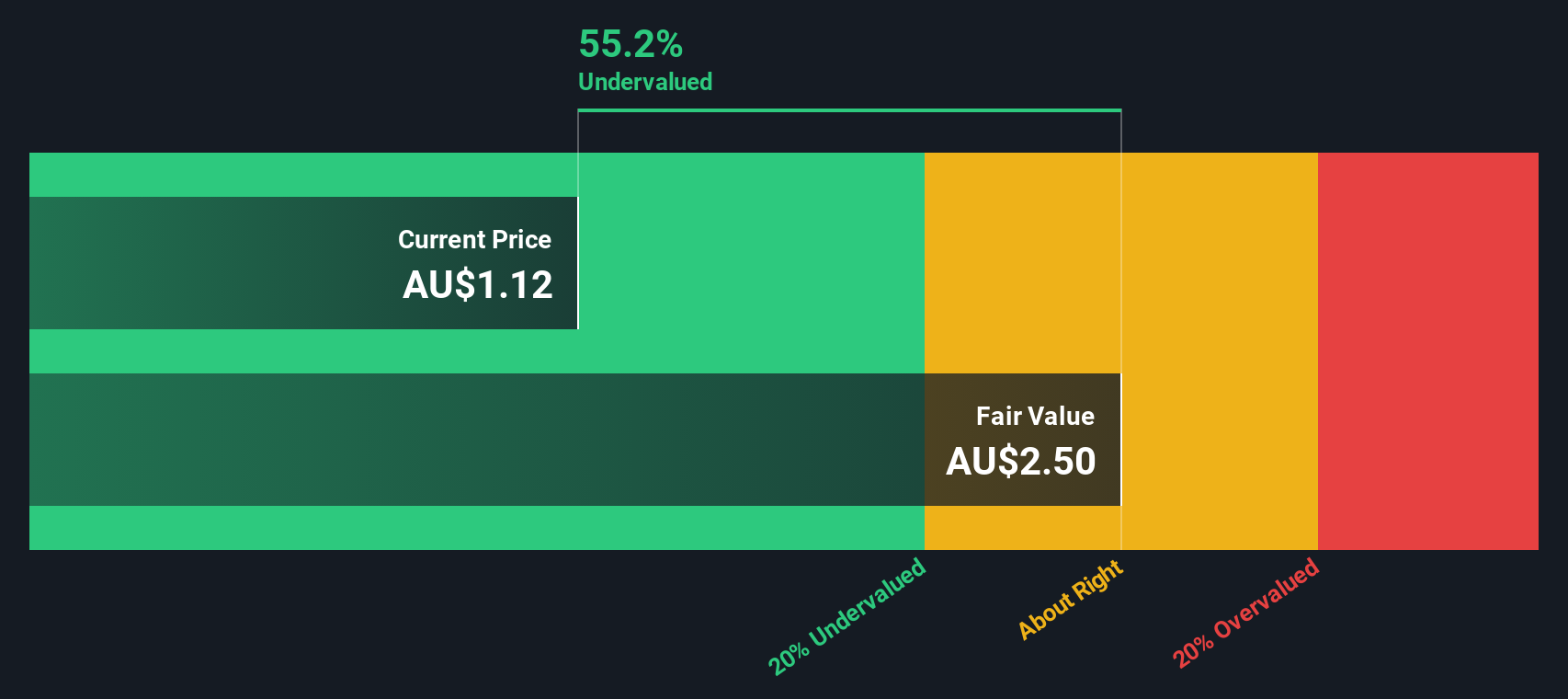

Another View: SWS DCF Model Points to Significant Undervaluation

While the current price-to-earnings ratio suggests Alkane Resources is expensive compared to industry averages and its fair ratio, our DCF model tells a different story. According to this approach, Alkane shares are trading well below fair value, which suggests there could be more upside than the P/E ratio hints.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Alkane Resources for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Alkane Resources Narrative

If you think the story here can be interpreted differently or would rather rely on your own analysis, you can easily pull together your own take in minutes, and Do it your way.

A great starting point for your Alkane Resources research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t let opportunity pass you by. Make your next move with confidence by searching for stocks that fit your strategy using the Simply Wall Street Screener. You could uncover exceptional opportunities where others aren’t looking.

- Capture powerful long-term gains when you track reliable income payers through these 17 dividend stocks with yields > 3% offering yields above 3% and proven stability.

- Seize the future of healthcare by targeting innovation and growth with these 33 healthcare AI stocks focused on medical breakthroughs powered by artificial intelligence.

- Position yourself early in high-potential tech by spotting game-changing companies in these 24 AI penny stocks transforming industries through AI-driven disruption.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:ALK

Alkane Resources

Operates as a gold exploration and production company in Australia.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives