- Australia

- /

- Metals and Mining

- /

- ASX:ALK

Alkane Resources (ASX:ALK) Valuation Check After Appointment of New Independent Director and Audit Chair

Reviewed by Simply Wall St

Alkane Resources (ASX:ALK) has drawn fresh attention after appointing Denise McComish as an independent non executive director and Chair of the Audit and Risk Committee, a governance focused move that investors should not ignore.

See our latest analysis for Alkane Resources.

The timing of this governance upgrade lines up with a powerful year to date share price return of 97.17 percent and a 1 year total shareholder return just over 100 percent, suggesting momentum is still firmly with the bulls despite recent volatility.

If Alkane’s story has your attention, it might be worth seeing which other miners and energy names are catching smart money, starting with fast growing stocks with high insider ownership.

With profits climbing, governance tightening and the share price already doubling, investors now face a tougher call: is Alkane still mispriced relative to its fundamentals, or is the current valuation already baking in the next leg of growth?

Price-to-Earnings of 74.7x: Is it justified?

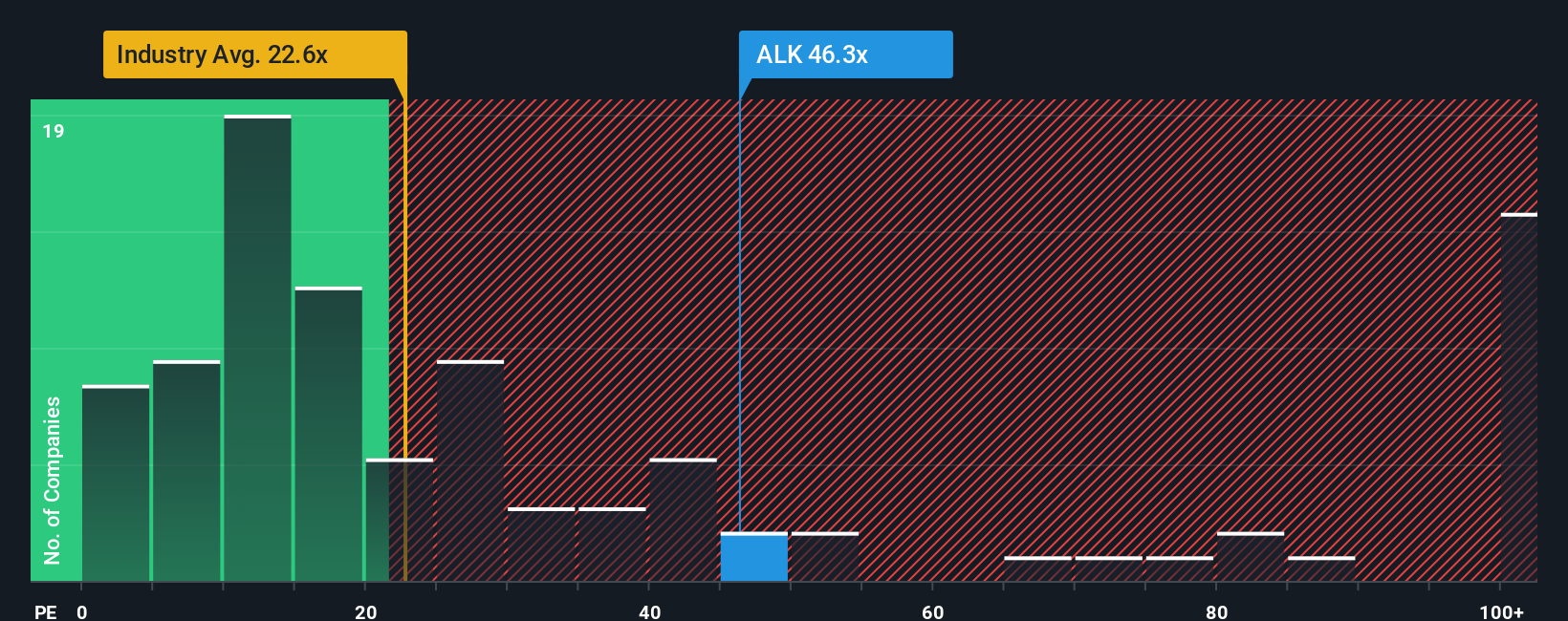

Alkane Resources last closed at A$1.045, yet on a price-to-earnings basis it trades well above both industry and peer benchmarks, implying a demanding valuation.

The price-to-earnings ratio compares the current share price to the company’s earnings per share. It is a quick way to gauge how much investors are paying for each dollar of current profit. For a cyclical, capital intensive business like a metals and mining company, this multiple often reflects how confident the market is that earnings can grow strongly from here.

In Alkane’s case, the current price-to-earnings ratio of 74.7x signals that investors are paying a hefty premium for today’s earnings. This is despite DCF work suggesting the shares are trading at a 56.2 percent discount to an estimated fair value of A$2.39. That gap indicates that the SWS DCF model is factoring in a sharp rebound in profitability from the currently low return on equity of 2.1 percent, along with the forecast 53.1 percent annual earnings growth and a much stronger earnings base a few years out.

Compared to the Australian Metals and Mining industry average price-to-earnings of 21.9x and an estimated fair price-to-earnings ratio of 35.5x, Alkane’s 74.7x looks aggressively priced. This suggests the market is already factoring in a substantial improvement in returns and profitability that goes well beyond sector norms.

Explore the SWS fair ratio for Alkane Resources

Result: Price-to-Earnings of 74.7x (OVERVALUED)

However, investors should watch for setbacks in delivering that ambitious earnings growth, along with commodity price weakness that could quickly compress Alkane’s elevated valuation.

Find out about the key risks to this Alkane Resources narrative.

Another View: Fair Ratio Flags Valuation Risk

Viewed through a fair ratio lens, Alkane’s 74.7x price-to-earnings ratio stands far above the industry at 21.9x and even its own fair ratio of 35.5x. This suggests the share price could fall significantly if sentiment weakens or earnings delivery disappoints.

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Alkane Resources for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 908 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Alkane Resources Narrative

If you see Alkane differently or prefer to dig into the numbers yourself, you can build a custom view in just minutes: Do it your way.

A great starting point for your Alkane Resources research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, give yourself the chance to spot your next standout opportunity using the Simply Wall Street Screener’s most compelling stock collections.

- Capture big potential from small names by scanning these 3571 penny stocks with strong financials that already boast resilient balance sheets and real financial strength behind their low share prices.

- Position your portfolio at the frontier of innovation by targeting these 26 AI penny stocks poised to benefit from rapid adoption of machine learning and intelligent automation.

- Lock in quality at a sensible price by zeroing in on these 908 undervalued stocks based on cash flows where cash flow metrics hint at upside the broader market has not fully recognised yet.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:ALK

Alkane Resources

Operates as a gold exploration and production company in Australia.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026