- Australia

- /

- Metals and Mining

- /

- ASX:AAU

Investors Aren't Buying Antilles Gold Limited's (ASX:AAU) Earnings

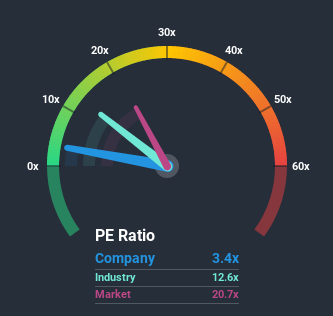

Antilles Gold Limited's (ASX:AAU) price-to-earnings (or "P/E") ratio of 3.4x might make it look like a strong buy right now compared to the market in Australia, where around half of the companies have P/E ratios above 21x and even P/E's above 39x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/E.

For example, consider that Antilles Gold's financial performance has been poor lately as it's earnings have been in decline. One possibility is that the P/E is low because investors think the company won't do enough to avoid underperforming the broader market in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Check out our latest analysis for Antilles Gold

How Is Antilles Gold's Growth Trending?

There's an inherent assumption that a company should far underperform the market for P/E ratios like Antilles Gold's to be considered reasonable.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 22%. At least EPS has managed not to go completely backwards from three years ago in aggregate, thanks to the earlier period of growth. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

This is in contrast to the rest of the market, which is expected to grow by 28% over the next year, materially higher than the company's recent medium-term annualised growth rates.

In light of this, it's understandable that Antilles Gold's P/E sits below the majority of other companies. It seems most investors are expecting to see the recent limited growth rates continue into the future and are only willing to pay a reduced amount for the stock.

The Final Word

Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of Antilles Gold revealed its three-year earnings trends are contributing to its low P/E, given they look worse than current market expectations. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. If recent medium-term earnings trends continue, it's hard to see the share price rising strongly in the near future under these circumstances.

And what about other risks? Every company has them, and we've spotted 2 warning signs for Antilles Gold you should know about.

You might be able to find a better investment than Antilles Gold. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a P/E below 20x (but have proven they can grow earnings).

If you decide to trade Antilles Gold, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ASX:AAU

Antilles Gold

Engages in the exploration, evaluation, and development of mineral properties in Cuba.

Excellent balance sheet moderate.

Market Insights

Community Narratives