- Australia

- /

- Metals and Mining

- /

- ASX:29M

29Metals (ASX:29M): Valuation Insights Following Golden Grove Setback and Production Decline

Reviewed by Kshitija Bhandaru

29Metals (ASX:29M) has attracted attention after its latest quarterly update, where seismic activity restricted access at its Golden Grove mine. This led to a sharp fall in zinc production and raised concerns about operating costs and outlook.

See our latest analysis for 29Metals.

29Metals shares have seen dramatic moves lately, spiking as much as 22.6% lower after the production setback at Golden Grove. Despite a strong year-to-date share price return of 81.6%, the stock's three-year total shareholder return remains deep in negative territory at -73%. This shows that while recent momentum is building, there is still a long way to recover past losses.

If this kind of volatility has you rethinking your strategy, now is the perfect time to broaden your search and discover fast growing stocks with high insider ownership

So with the stock trading well below analyst price targets despite recent gains, investors may wonder whether the negative sentiment is overdone or if the current share price already reflects all the company’s challenges and future potential for growth.

Most Popular Narrative: 46% Overvalued

With 29Metals trading at A$0.45, the most popular narrative suggests the company’s fair value is just A$0.30 per share. This gap signals that the market may be factoring in aggressive assumptions that aren’t fully supported by underlying business fundamentals.

The narrative is pricing in a full and timely realization of expansion and capital delivery at Gossan Valley. However, delays in capex spend, shifting $15 million into 2026, and ongoing regulatory and environmental approval risks suggest the start of incremental production volumes could be pushed back or ramp-up could be slower than modeled. This could hold back expected revenue acceleration.

Curious what future milestones could swing 29Metals’ fair value? There’s a controversial blend of operational execution bets and ambitious margin forecasts powering this narrative. The numbers behind these projections might surprise you. Peek behind the curtain and see which assumptions could tip the scales.

Result: Fair Value of $0.30 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, stable production from Gossan Valley and a successful Capricorn Copper restart could shift sentiment and act as powerful catalysts for a re-rating.

Find out about the key risks to this 29Metals narrative.

Another View: What Does Our DCF Model Say?

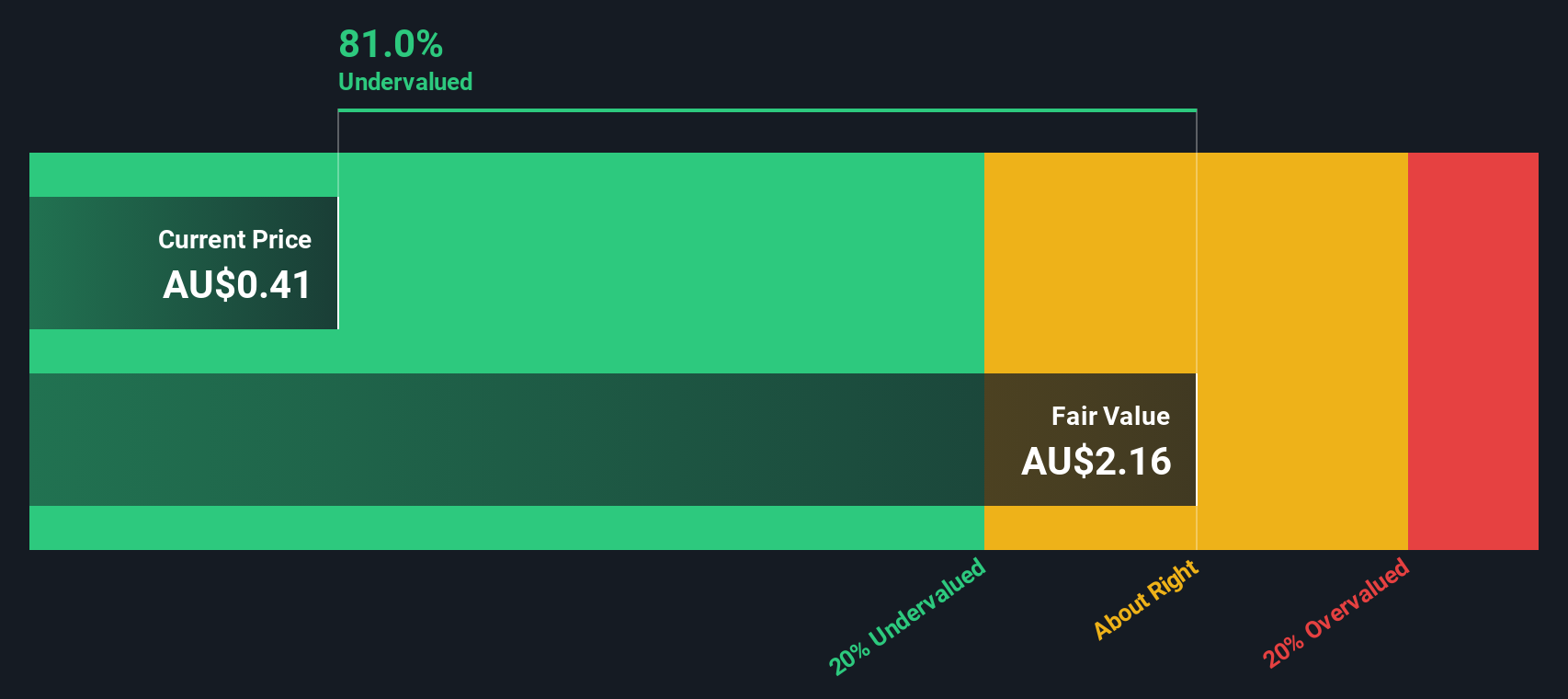

While the popular narrative calls 29Metals overvalued based on analyst targets and business risks, the SWS DCF model paints a much more optimistic picture. According to this method, the shares could be trading at a significant discount to their estimated fair value. This suggests untapped upside if operational improvements succeed. Does this discrepancy reveal opportunity, or is the model too optimistic about future cash flows?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own 29Metals Narrative

If you want to look deeper or chart a different course from the consensus, you're free to dig into the numbers and shape your own view in just a few minutes. Do it your way

A great starting point for your 29Metals research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Step ahead of the crowd and get inspired by unique investment opportunities on Simply Wall Street. Your next winning stock idea could be just a click away.

- Unlock high-potential opportunities among under-appreciated companies by tapping into these 875 undervalued stocks based on cash flows to see which stocks the market may have overlooked.

- Gain exposure to the rapid growth of artificial intelligence with these 24 AI penny stocks, powering advancements in automation, data analysis, and intelligent platforms.

- Secure passive income by checking out these 18 dividend stocks with yields > 3%, which offers attractive yields above 3% to help strengthen your portfolio returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:29M

29Metals

Operates as a copper focused base and precious metals mining company in Australia and Chile.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives