- Australia

- /

- Metals and Mining

- /

- ASX:29M

29Metals (ASX:29M) Valuation in Focus After Profitable Turnaround and Rising Sales

Reviewed by Simply Wall St

29Metals (ASX:29M) has turned heads after announcing a swing from a net loss to a net profit in its half-year results. Sales have risen and earnings per share have moved into the black. For investors deciding what to do next, this financial turnaround brings new angles to consider. While the improvement is clearly meaningful, it also invites questions about how sustainable these gains might be and whether the market is now rethinking the company's prospects.

The strong earnings report has coincided with fresh momentum in the share price. Over the past year, 29Metals has seen its stock move up 50%, with much of that rise coming in just the past three months. The company now stands well above its recent lows, signaling a shift in risk perception and possibly suggesting that investors are starting to believe in its growth story after a period of underperformance.

With the shares up sharply and profits back on the table, is the market giving 29Metals a deserved re-rating, or is future growth already priced in? Could this be an early stage of a lasting recovery, or is caution still warranted?

Most Popular Narrative: 48.7% Overvalued

According to the most widely followed narrative, 29Metals is currently trading at a significant premium to its estimated fair value, with a discount rate of 7.71% applied to the calculations. The narrative points out that optimism about future copper demand and operational improvements may be inflating expectations for the company.

The current valuation appears to reflect optimistic expectations that global electrification will translate into strong, sustained copper demand. However, it may overstate 29Metals' ability to fully capitalize given ongoing challenges at Capricorn Copper, where production remains suspended and restart timelines hinge on regulatory approval for tailings and persistent water management issues. These factors could potentially cap near and mid-term revenue growth versus consensus expectations.

Ready to discover why this forecast says the market might be running ahead of the facts? The narrative teases bold projections about profit margins and future earnings, shaped by ambitious assumptions and unresolved production issues. Want to uncover the big financial leap behind this valuation and what the analysts are really betting on? The answers will surprise you.

Result: Fair Value of $0.28 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, if production ramps up at Capricorn Copper sooner or if persistent cost reductions materialize, bullish expectations could quickly regain traction in the market.

Find out about the key risks to this 29Metals narrative.Another View: What Do the Numbers Say?

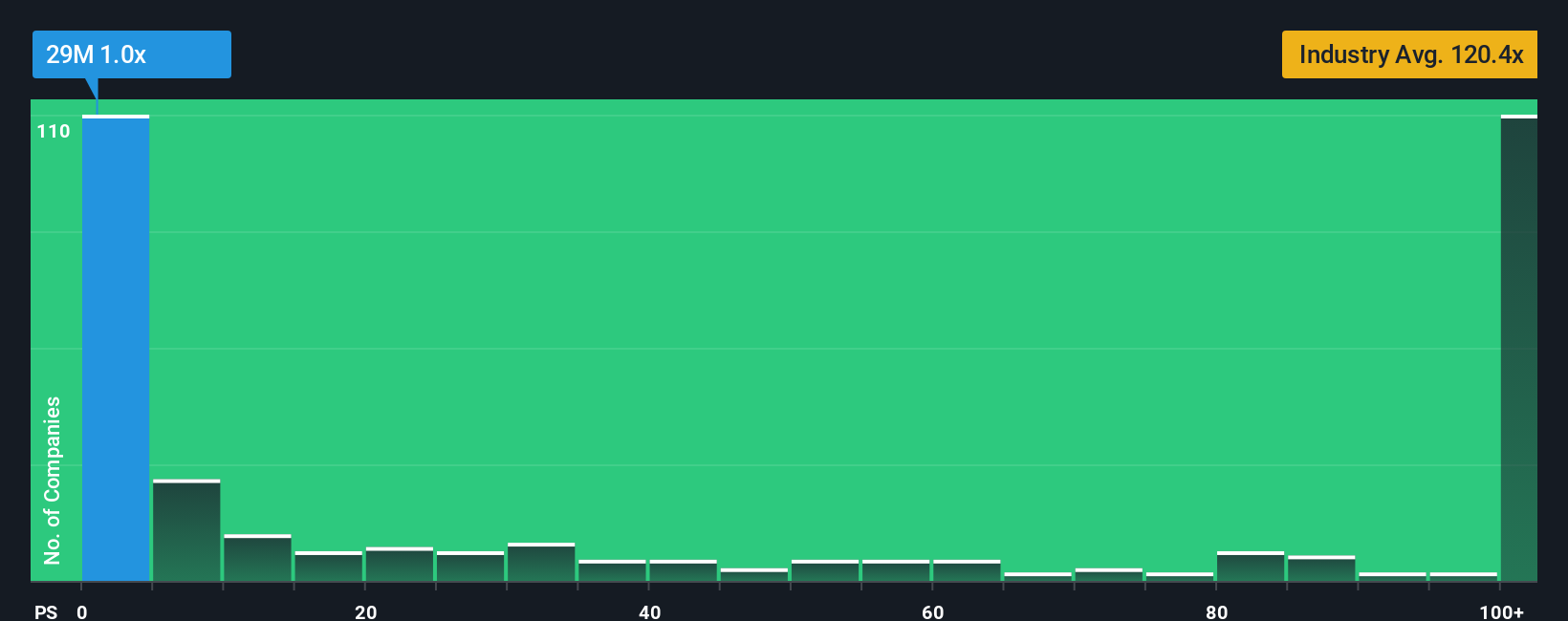

While analysts see 29Metals as overvalued based on future projections, a look at the company's current sales in relation to its industry offers a different perspective. Could the business be stronger than the forecasts allow for?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own 29Metals Narrative

If you have your own take or want to dig deeper into the data, you can easily create and shape your own analysis in just a few minutes by using Do it your way.

A great starting point for your 29Metals research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Set yourself apart from the crowd by spotting tomorrow’s success stories today. Powerful tools like the Screener can surface rare gems, growth engines, and value plays you won't want to miss.

- Unlock hidden value by hunting for undervalued stocks based on cash flows that are generating strong cash flows and currently flying under Wall Street’s radar.

- Tap into the next wave of tech innovation by scanning the market for AI penny stocks that could drive artificial intelligence breakthroughs and disrupt entire industries.

- Secure reliable income potential by choosing dividend stocks with yields > 3% offering attractive yields and the consistency every portfolio needs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About ASX:29M

29Metals

Operates as a copper focused base and precious metals mining company in Australia and Chile.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives