We Ran A Stock Scan For Earnings Growth And QBE Insurance Group (ASX:QBE) Passed With Ease

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

In contrast to all that, many investors prefer to focus on companies like QBE Insurance Group (ASX:QBE), which has not only revenues, but also profits. While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

View our latest analysis for QBE Insurance Group

QBE Insurance Group's Improving Profits

Investors and investment funds chase profits, and that means share prices tend rise with positive earnings per share (EPS) outcomes. So for many budding investors, improving EPS is considered a good sign. Commendations have to be given in seeing that QBE Insurance Group grew its EPS from US$0.21 to US$0.72, in one short year. Even though that growth rate may not be repeated, that looks like a breakout improvement.

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. Not all of QBE Insurance Group's revenue last year was revenue from operations, so keep in mind the revenue and margin numbers used in this article might not be the best representation of the underlying business. Unfortunately, QBE Insurance Group's revenue dropped 9.8% last year, but the silver lining is that EBIT margins improved from -0.5% to 17%. While not disastrous, these figures could be better.

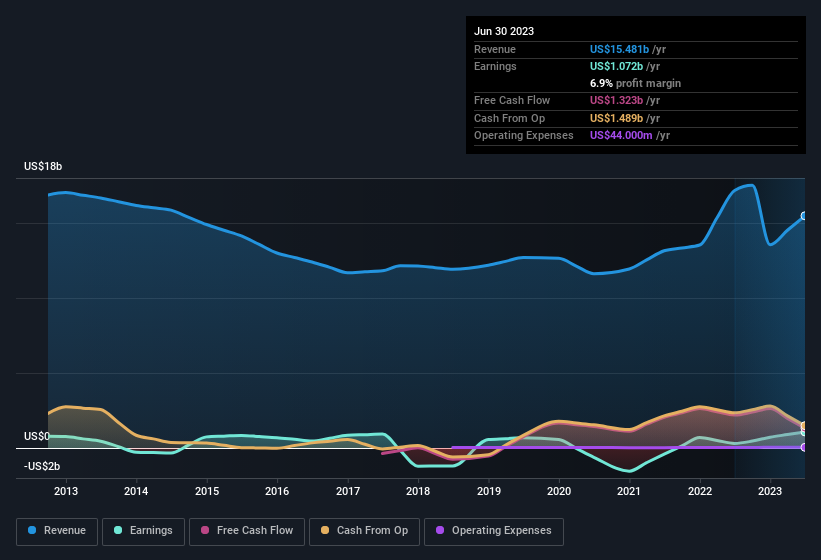

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

While we live in the present moment, there's little doubt that the future matters most in the investment decision process. So why not check this interactive chart depicting future EPS estimates, for QBE Insurance Group?

Are QBE Insurance Group Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

In the last year insider at QBE Insurance Group were both selling and buying shares; but happily, as a group they spent US$110k more on stock, than they netted from selling it. Although some people may hesitate due to the share sales, the fact that insiders bought more than they sold, is a positive thing to note. We also note that it was the Independent Non-Executive Director, Yasmin Allen, who made the biggest single acquisition, paying AU$220k for shares at about AU$12.02 each.

On top of the insider buying, it's good to see that QBE Insurance Group insiders have a valuable investment in the business. As a matter of fact, their holding is valued at US$20m. This considerable investment should help drive long-term value in the business. Despite being just 0.09% of the company, the value of that investment is enough to show insiders have plenty riding on the venture.

Is QBE Insurance Group Worth Keeping An Eye On?

QBE Insurance Group's earnings have taken off in quite an impressive fashion. To make matters even better, the company insiders who know the company best have put their faith in the its future and have been buying more stock. This quick rundown suggests that the business may be of good quality, and also at an inflection point, so maybe QBE Insurance Group deserves timely attention. Now, you could try to make up your mind on QBE Insurance Group by focusing on just these factors, or you could also consider how its price-to-earnings ratio compares to other companies in its industry.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of QBE Insurance Group, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if QBE Insurance Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:QBE

QBE Insurance Group

Engages in underwriting general insurance and reinsurance risks in the Australia Pacific, North America, and internationally.

Undervalued with solid track record and pays a dividend.