QBE Insurance Group (ASX:QBE) Is Paying Out A Larger Dividend Than Last Year

QBE Insurance Group Limited (ASX:QBE) has announced that it will be increasing its dividend on the 24th of September to AU$0.11. Even though the dividend went up, the yield is still quite low at only 0.9%.

View our latest analysis for QBE Insurance Group

QBE Insurance Group's Distributions May Be Difficult To Sustain

If it is predictable over a long period, even low dividend yields can be attractive. While QBE Insurance Group is not profitable, it is paying out less than 75% of its free cash flow, which means that there is plenty left over for reinvestment into the business. This gives us some comfort about the level of the dividend payments.

Recent, EPS has fallen by 31.9%, so this could continue over the next year. This means that the company will be unprofitable, but cash flows are more important when considering the dividend and as the current cash payout ratio is pretty healthy, we don't think there is too much reason to worry.

Dividend Volatility

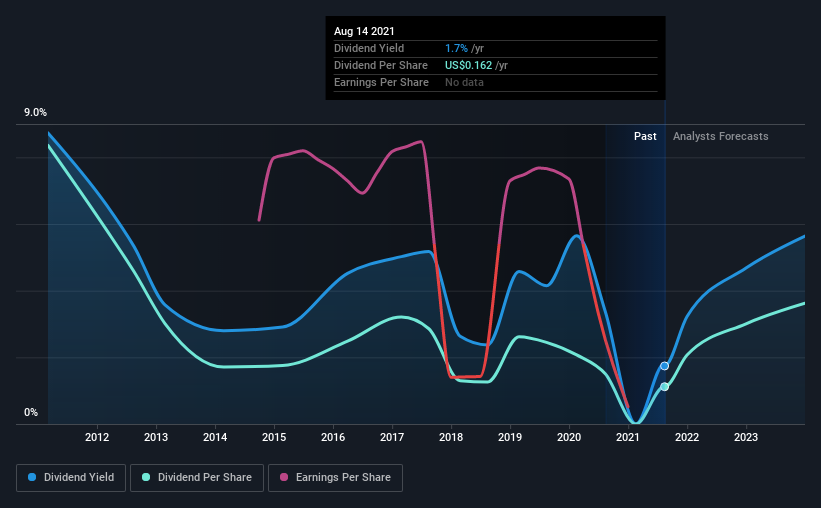

While the company has been paying a dividend for a long time, it has cut the dividend at least once in the last 10 years. Since 2011, the dividend has gone from US$1.21 to US$0.16. Dividend payments have fallen sharply, down 87% over that time. A company that decreases its dividend over time generally isn't what we are looking for.

The Dividend Has Limited Growth Potential

Dividends have been going in the wrong direction, so we definitely want to see a different trend in the earnings per share. Earnings per share has been sinking by 32% over the last five years. Dividend payments are likely to come under some pressure unless EPS can pull out of the nosedive it is in.

QBE Insurance Group's Dividend Doesn't Look Sustainable

Overall, we always like to see the dividend being raised, but we don't think QBE Insurance Group will make a great income stock. The company is generating plenty of cash, which could maintain the dividend for a while, but the track record hasn't been great. Overall, we don't think this company has the makings of a good income stock.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. Without at least some growth in earnings per share over time, the dividend will eventually come under pressure either from competition or inflation. Businesses can change though, and we think it would make sense to see what analysts are forecasting for the company. If you are a dividend investor, you might also want to look at our curated list of high performing dividend stock.

If you decide to trade QBE Insurance Group, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if QBE Insurance Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ASX:QBE

QBE Insurance Group

Engages in underwriting general insurance and reinsurance risks in the Australia Pacific, North America, and internationally.

Excellent balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives