ASX Dividend Stocks Featuring MFF Capital Investments And Two More

Reviewed by Simply Wall St

As the ASX200 closed slightly down by 0.08% at 8,151 points, sectors like Energy and Real Estate showed resilience with a rise of 0.8%, highlighting the diverse performance across the Australian market landscape. In this fluctuating environment, dividend stocks such as MFF Capital Investments offer investors an opportunity to potentially benefit from steady income streams while navigating market volatility.

Top 10 Dividend Stocks In Australia

| Name | Dividend Yield | Dividend Rating |

| Bisalloy Steel Group (ASX:BIS) | 9.94% | ★★★★★☆ |

| IPH (ASX:IPH) | 7.73% | ★★★★★☆ |

| Accent Group (ASX:AX1) | 7.03% | ★★★★★☆ |

| Sugar Terminals (NSX:SUG) | 8.28% | ★★★★★☆ |

| Super Retail Group (ASX:SUL) | 8.98% | ★★★★★☆ |

| MFF Capital Investments (ASX:MFF) | 3.94% | ★★★★★☆ |

| Nick Scali (ASX:NCK) | 3.33% | ★★★★★☆ |

| Lycopodium (ASX:LYL) | 7.20% | ★★★★★☆ |

| Lindsay Australia (ASX:LAU) | 6.67% | ★★★★★☆ |

| Fiducian Group (ASX:FID) | 4.42% | ★★★★★☆ |

Click here to see the full list of 30 stocks from our Top ASX Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

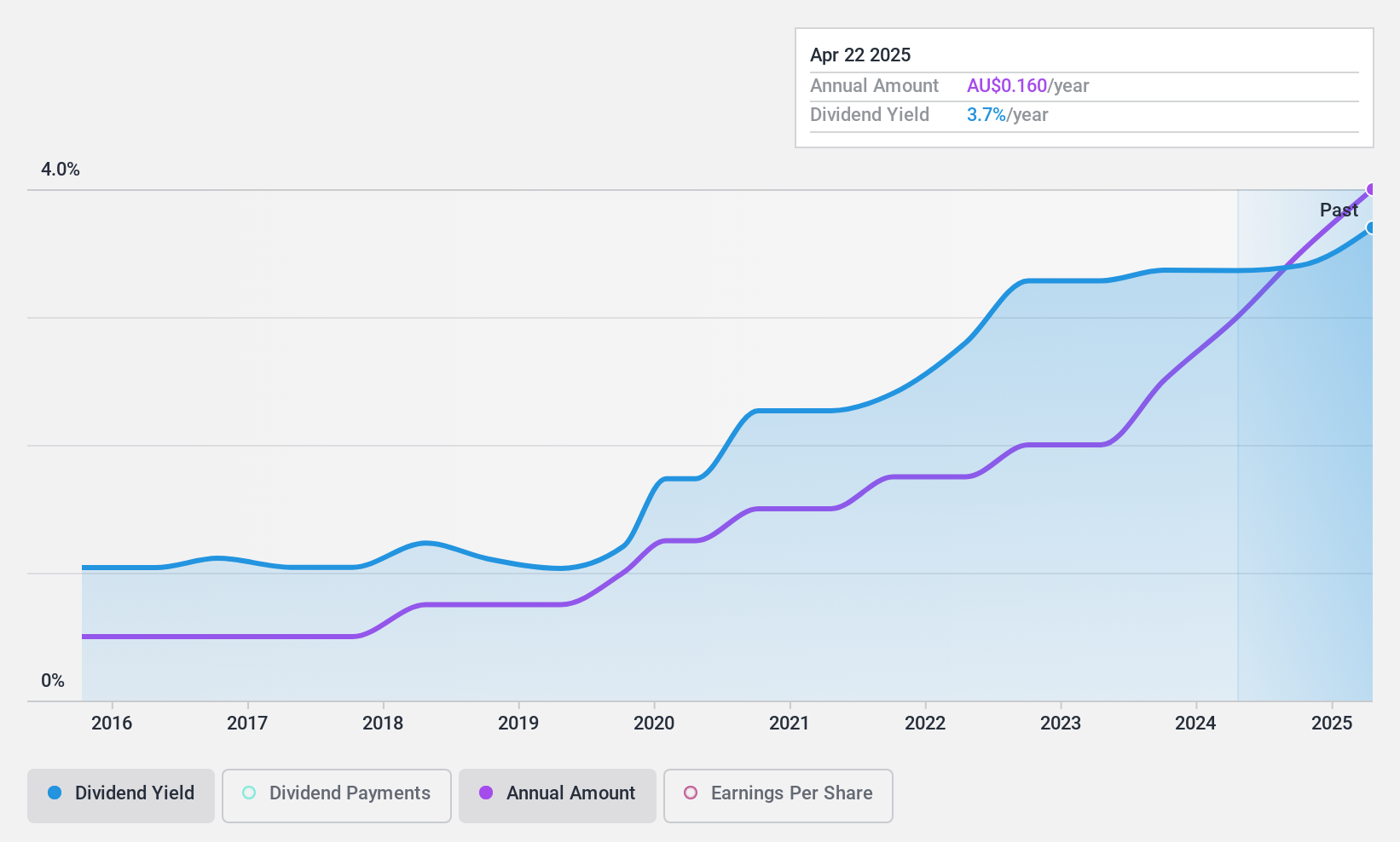

MFF Capital Investments (ASX:MFF)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: MFF Capital Investments Limited is an investment firm manager with a market cap of A$2.36 billion.

Operations: MFF Capital Investments Limited generates revenue primarily through its equity investment segment, totaling A$1.01 billion.

Dividend Yield: 3.9%

MFF Capital Investments offers a stable dividend profile with payments that have grown consistently over the past decade. The company's low payout ratios—12.7% for earnings and 22.8% for cash flows—indicate strong coverage, ensuring sustainability of dividends. Despite trading at A$50 million below its estimated fair value, MFF's dividend yield of 3.94% is lower than the top quartile in Australia, but it remains reliable and supported by significant recent earnings growth of 51.9%.

- Click here and access our complete dividend analysis report to understand the dynamics of MFF Capital Investments.

- The valuation report we've compiled suggests that MFF Capital Investments' current price could be quite moderate.

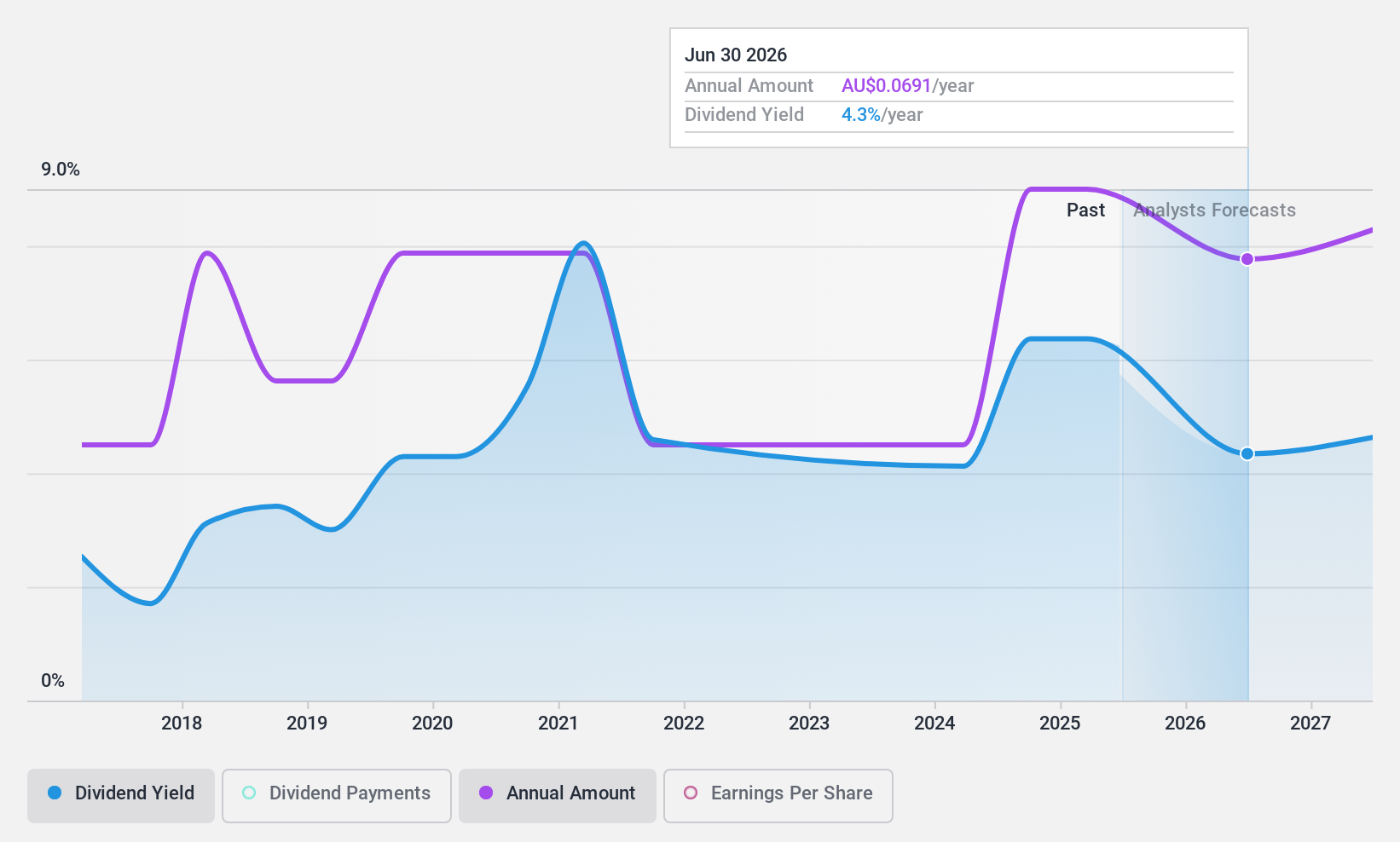

Perenti (ASX:PRN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Perenti Limited is a global mining services company with a market capitalization of A$1.28 billion.

Operations: Perenti Limited generates revenue through its Drilling Services (A$750.65 million), Contract Mining Services (A$2.50 billion), and Mining Services and Idoba (A$229.77 million) segments.

Dividend Yield: 5.8%

Perenti's recent dividend increase to A$0.03 per share reflects confidence in cash generation, though past payments have been volatile and unreliable. Despite a payout ratio of 76% and cash payout at 46.4%, indicating coverage by earnings and cash flows, its dividend yield of 5.8% is lower than the top quartile in Australia. While trading significantly below estimated fair value, declining net income suggests caution for investors prioritizing steady dividends over potential growth prospects.

- Click to explore a detailed breakdown of our findings in Perenti's dividend report.

- According our valuation report, there's an indication that Perenti's share price might be on the cheaper side.

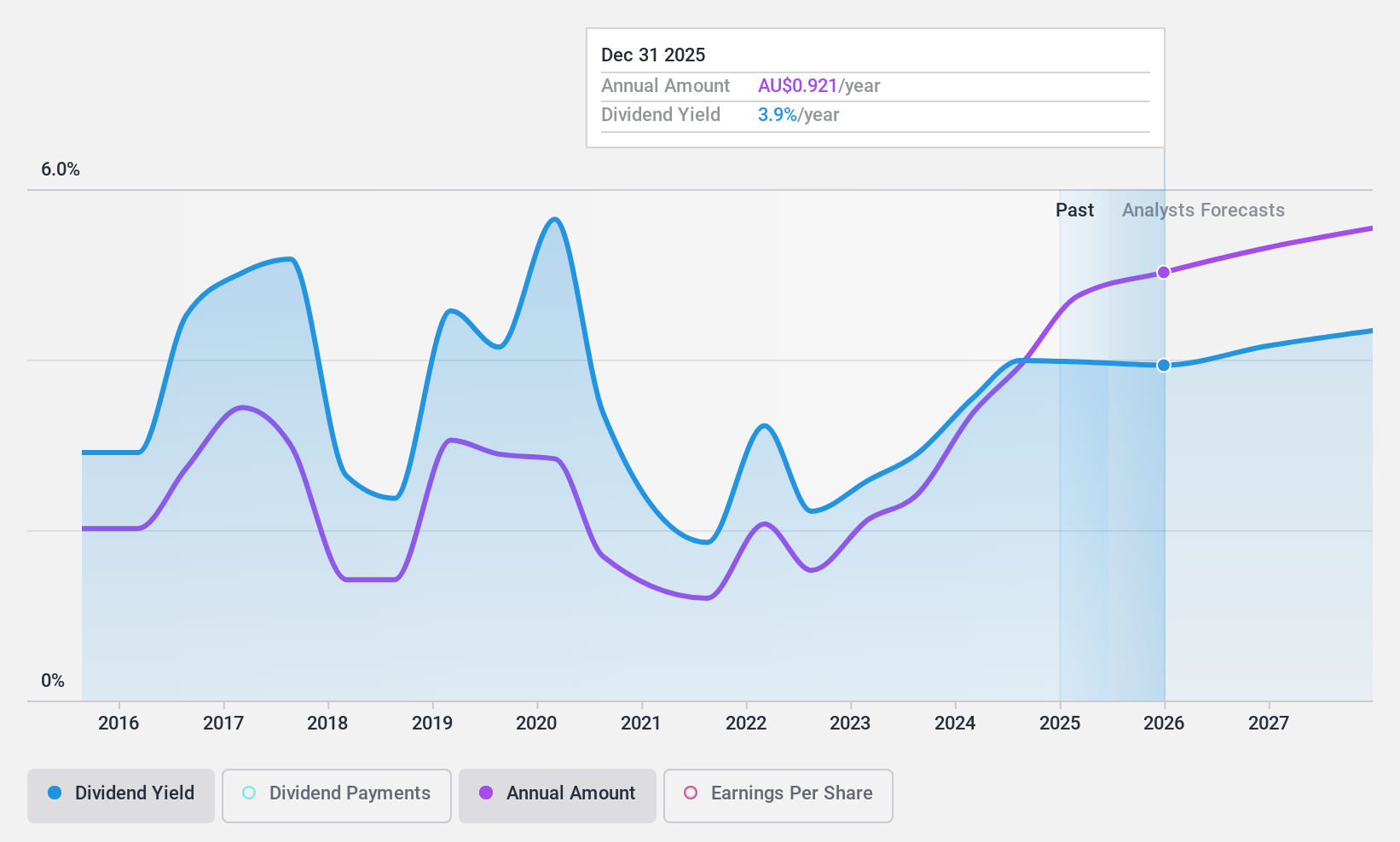

QBE Insurance Group (ASX:QBE)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: QBE Insurance Group Limited is involved in underwriting general insurance and reinsurance risks across the Australia Pacific, North America, and international markets, with a market cap of A$32.24 billion.

Operations: QBE Insurance Group Limited generates revenue through its segments, with $9.82 billion from International, $7.54 billion from North America, and $5.96 billion from Australia Pacific operations.

Dividend Yield: 3.8%

QBE Insurance Group's dividend payments are well-supported by earnings and cash flows, with payout ratios of 46.7% and 32.3%, respectively, although the yield of 3.76% is below Australia's top quartile. The company recently increased its annual dividend to A$0.87 per share, reflecting improved profitability with net income rising to US$1.78 billion in 2024 from US$1.36 billion the previous year; however, its dividend history has been volatile over the past decade.

- Dive into the specifics of QBE Insurance Group here with our thorough dividend report.

- The analysis detailed in our QBE Insurance Group valuation report hints at an deflated share price compared to its estimated value.

Turning Ideas Into Actions

- Embark on your investment journey to our 30 Top ASX Dividend Stocks selection here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if QBE Insurance Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:QBE

QBE Insurance Group

Engages in underwriting general insurance and reinsurance risks in the Australia Pacific, North America, and internationally.

Excellent balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives