- Australia

- /

- Hospitality

- /

- ASX:CKF

3 ASX Dividend Stocks To Consider With At Least 3.4% Yield

Reviewed by Simply Wall St

As the ASX200 experiences a slight downturn, with profit-taking following recent record highs and investors closely watching U.S. jobs data, market participants are assessing how various sectors are performing amid these fluctuations. In this environment, dividend stocks can offer a measure of stability and income potential, particularly those with yields of at least 3.4%, making them an attractive option for investors seeking reliable returns in uncertain times.

Top 10 Dividend Stocks In Australia

| Name | Dividend Yield | Dividend Rating |

| Fortescue (ASX:FMG) | 9.99% | ★★★★★☆ |

| Nick Scali (ASX:NCK) | 4.39% | ★★★★★☆ |

| Super Retail Group (ASX:SUL) | 7.93% | ★★★★★☆ |

| Perenti (ASX:PRN) | 6.23% | ★★★★★☆ |

| Collins Foods (ASX:CKF) | 3.47% | ★★★★★☆ |

| Fiducian Group (ASX:FID) | 4.37% | ★★★★★☆ |

| MFF Capital Investments (ASX:MFF) | 3.23% | ★★★★★☆ |

| National Storage REIT (ASX:NSR) | 4.55% | ★★★★★☆ |

| Premier Investments (ASX:PMV) | 3.81% | ★★★★★☆ |

| New Hope (ASX:NHC) | 8.09% | ★★★★☆☆ |

Click here to see the full list of 31 stocks from our Top ASX Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

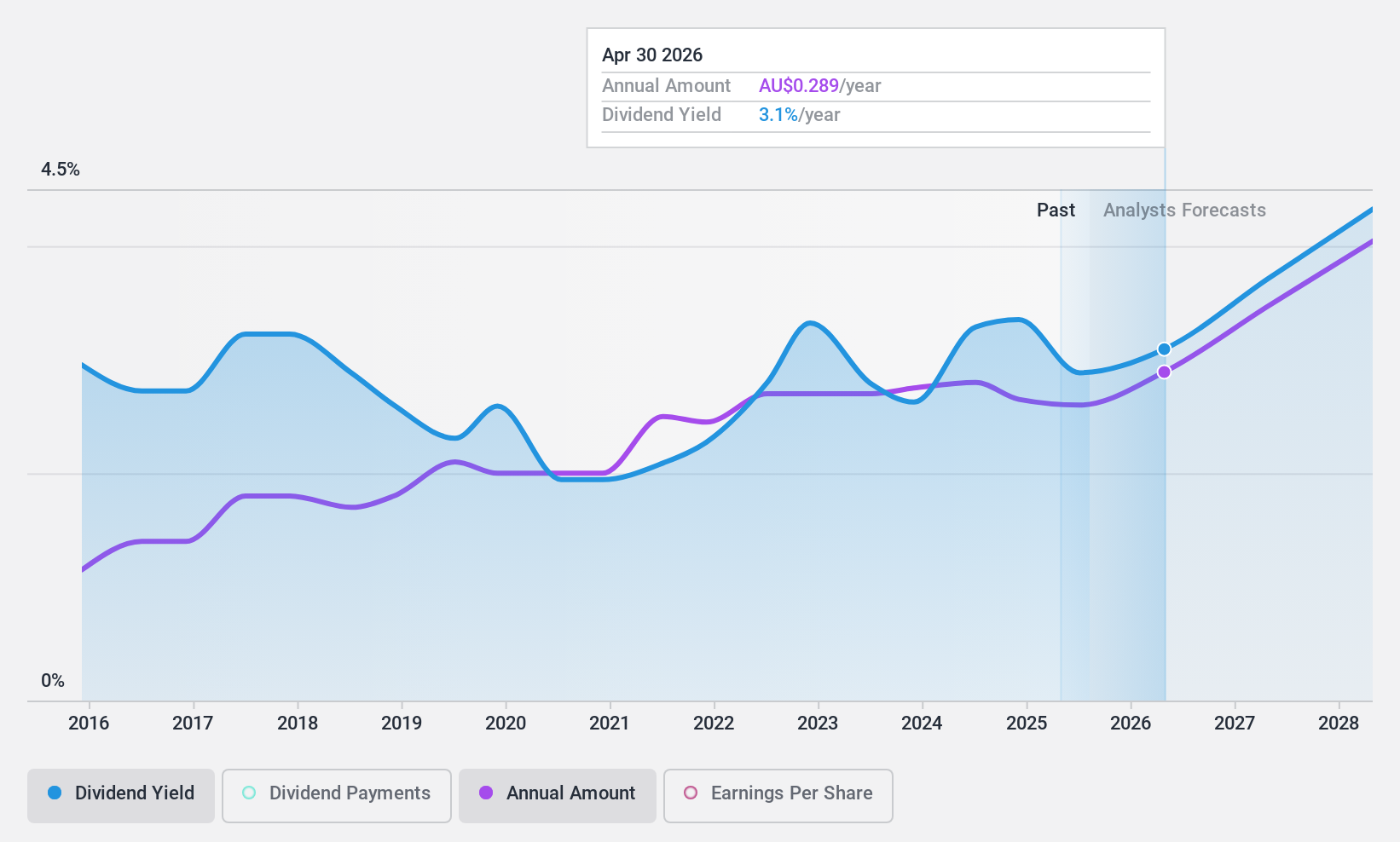

Collins Foods (ASX:CKF)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Collins Foods Limited operates, manages, and administers restaurants in Australia and Europe with a market cap of A$950.76 million.

Operations: Collins Foods Limited generates revenue from its restaurant operations with A$54.38 million from Taco Bell Restaurants, A$313.47 million from KFC Restaurants in Europe, and A$1.12 billion from KFC Restaurants in Australia.

Dividend Yield: 3.5%

Collins Foods offers a stable dividend yield of A$0.11 per share, with dividends reliably paid over the past decade. The payout ratio stands at 59.1%, indicating dividends are well covered by earnings, while a cash payout ratio of 35.2% suggests strong cash flow support. Despite recent earnings decline to A$24.12 million for H1 2024, the stock trades below estimated fair value and presents good relative value compared to peers in the industry.

- Unlock comprehensive insights into our analysis of Collins Foods stock in this dividend report.

- Our valuation report here indicates Collins Foods may be undervalued.

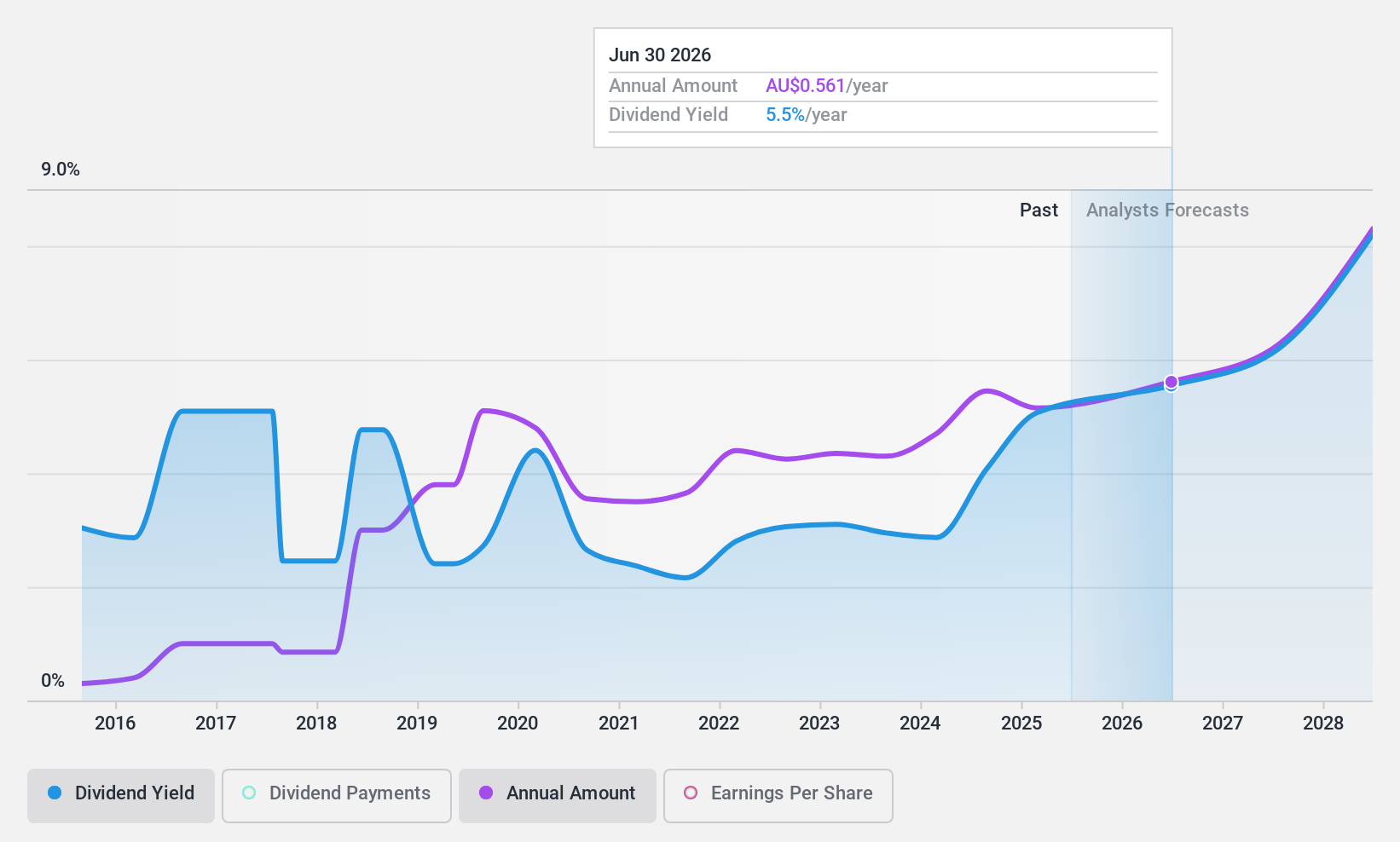

Jumbo Interactive (ASX:JIN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Jumbo Interactive Limited operates in the retail of lottery tickets via internet and mobile platforms across Australia, the United Kingdom, Canada, Fiji, and internationally, with a market cap of A$895.77 million.

Operations: Jumbo Interactive Limited's revenue segments include Lottery Retailing at A$123.40 million, Software-As-A-Service (SaaS) at A$50.73 million, and Managed Services at A$25.84 million.

Dividend Yield: 3.8%

Jumbo Interactive's dividend yield of 3.81% is lower than the top tier in Australia, but dividends are covered by earnings (payout ratio: 79.1%) and cash flows (cash payout ratio: 63.2%). Despite a volatile dividend history, payments have grown over the past decade. The company trades at a discount to its estimated fair value and is exploring M&A opportunities to enhance growth, focusing on technology-enabled businesses in regions like the U.K. and Canada.

- Take a closer look at Jumbo Interactive's potential here in our dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Jumbo Interactive shares in the market.

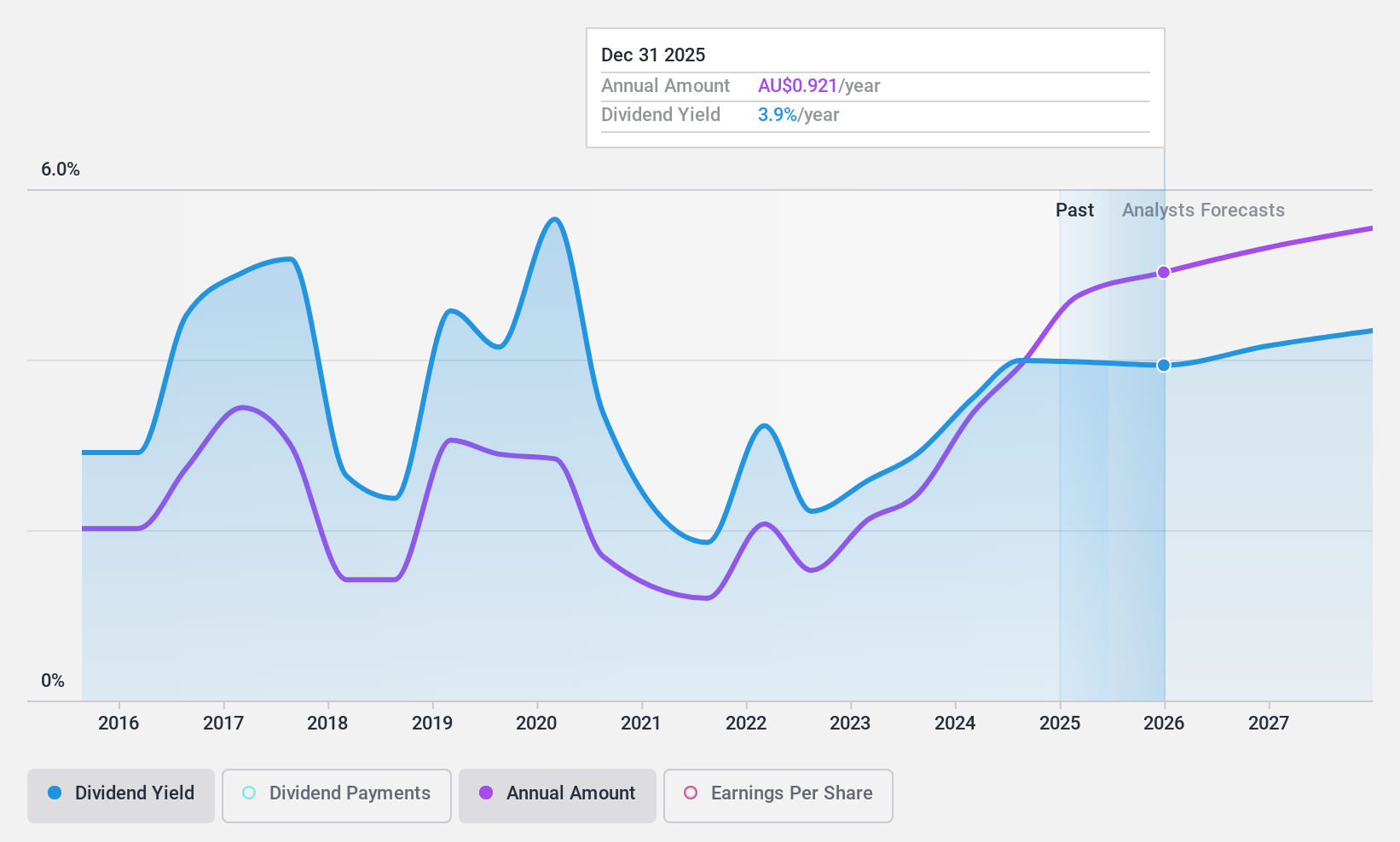

QBE Insurance Group (ASX:QBE)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: QBE Insurance Group Limited underwrites general insurance and reinsurance risks across the Australia Pacific, North America, and international markets, with a market cap of A$29.99 billion.

Operations: QBE Insurance Group Limited generates revenue from several segments, including $9.56 billion from International operations, $7.71 billion from North America, and $5.91 billion from the Australia Pacific region.

Dividend Yield: 3.6%

QBE Insurance Group's dividend yield of 3.61% is below the top quartile in Australia, yet dividends are well covered by earnings (payout ratio: 42.9%) and cash flows (cash payout ratio: 20.1%). Despite a history of volatility, dividend payments have increased over the last decade. Currently trading at a significant discount to estimated fair value, QBE recently announced a A$45 million fixed-income offering to bolster its financial strategy.

- Navigate through the intricacies of QBE Insurance Group with our comprehensive dividend report here.

- The valuation report we've compiled suggests that QBE Insurance Group's current price could be quite moderate.

Seize The Opportunity

- Investigate our full lineup of 31 Top ASX Dividend Stocks right here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:CKF

Collins Foods

Engages in the operation, management, and administration of restaurants in Australia and Europe.

Reasonable growth potential average dividend payer.

Market Insights

Community Narratives