- Australia

- /

- Construction

- /

- ASX:LYL

ASX Dividend Stocks Including Bisalloy Steel Group And Two More

Reviewed by Simply Wall St

As the Australian market faces a potential 0.89% decline at open today, driven by trade concerns from the U.S., investors are keenly observing how these global tensions impact domestic indices like the ASX 200. In such volatile times, dividend stocks can offer a degree of stability and income, making them an attractive option for those looking to navigate economic uncertainties while maintaining portfolio resilience.

Top 10 Dividend Stocks In Australia

| Name | Dividend Yield | Dividend Rating |

| IPH (ASX:IPH) | 7.11% | ★★★★★☆ |

| Lindsay Australia (ASX:LAU) | 7.10% | ★★★★★☆ |

| Bisalloy Steel Group (ASX:BIS) | 9.10% | ★★★★★☆ |

| Accent Group (ASX:AX1) | 6.82% | ★★★★★☆ |

| Sugar Terminals (NSX:SUG) | 8.45% | ★★★★★☆ |

| Super Retail Group (ASX:SUL) | 8.50% | ★★★★★☆ |

| MFF Capital Investments (ASX:MFF) | 3.70% | ★★★★★☆ |

| Nick Scali (ASX:NCK) | 3.20% | ★★★★★☆ |

| Fiducian Group (ASX:FID) | 4.42% | ★★★★★☆ |

| Lycopodium (ASX:LYL) | 7.11% | ★★★★★☆ |

Click here to see the full list of 29 stocks from our Top ASX Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Bisalloy Steel Group (ASX:BIS)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Bisalloy Steel Group Limited manufactures and sells quenched and tempered, high-tensile, and abrasion-resistant steel plates in Australia, Indonesia, Thailand, and internationally with a market cap of A$169.40 million.

Operations: The company's revenue primarily derives from the production and distribution of high-performance steel plates designed for durability and resistance in various markets, including Australia, Indonesia, Thailand, and beyond.

Dividend Yield: 9.1%

Bisalloy Steel Group's dividend yield of 9.1% places it in the top 25% of Australian dividend payers, although its track record has been volatile over the past decade. Despite this instability, recent dividends are well-covered by earnings (payout ratio: 81.2%) and cash flows (cash payout ratio: 66.6%). The company reported a modest increase in net income for H1 FY2025, alongside an ordinary fully franked dividend declaration of A$0.08 per share for the same period.

- Dive into the specifics of Bisalloy Steel Group here with our thorough dividend report.

- Our valuation report unveils the possibility Bisalloy Steel Group's shares may be trading at a discount.

Lycopodium (ASX:LYL)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Lycopodium Limited offers engineering and project delivery services across the resources, rail infrastructure, and industrial processes sectors in Australia, with a market cap of A$421.25 million.

Operations: Lycopodium Limited's revenue segments include A$347.83 million from Resources, A$10.84 million from Process Industries, and A$10.14 million from Rail Infrastructure.

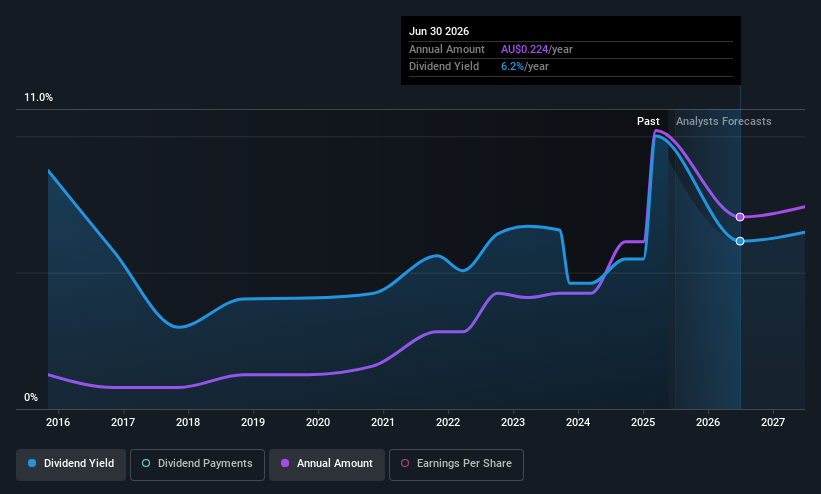

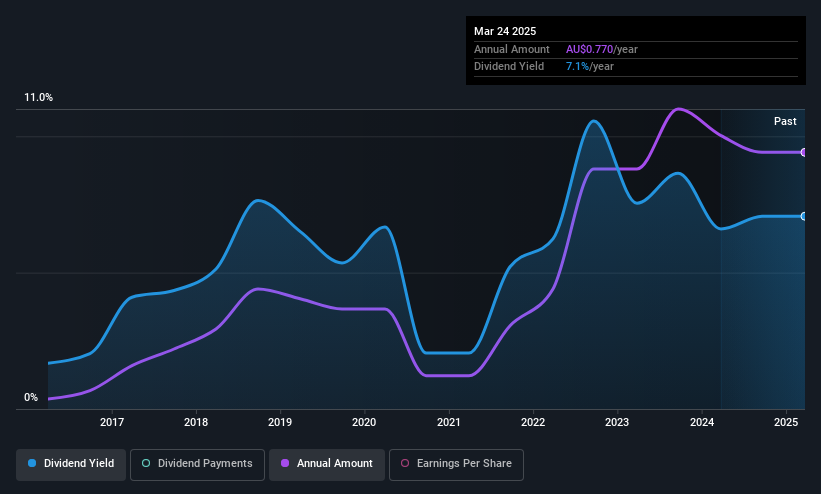

Dividend Yield: 7.1%

Lycopodium's dividend yield of 7.11% ranks it among the top 25% of Australian dividend payers, though its payout history has been inconsistent over the past decade. Despite this volatility, dividends are well-supported by earnings with a payout ratio of 43.2%, and cash flows cover dividends at an 80.8% cash payout ratio. Recently added to the S&P/ASX Emerging Companies Index, Lycopodium trades at a discount to its estimated fair value by 19.7%.

- Delve into the full analysis dividend report here for a deeper understanding of Lycopodium.

- Our comprehensive valuation report raises the possibility that Lycopodium is priced lower than what may be justified by its financials.

Medibank Private (ASX:MPL)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Medibank Private Limited offers private health insurance and health services in Australia, with a market cap of A$13.30 billion.

Operations: Medibank Private Limited generates revenue primarily from its Health Insurance segment, amounting to A$8.06 billion, and Medibank Health services, contributing A$447.10 million.

Dividend Yield: 3.4%

Medibank Private's dividend yield of 3.44% is below the top quartile of Australian dividend payers, with a high payout ratio of 96.7%, indicating dividends are not well-covered by earnings but are supported by cash flows at an 82.6% cash payout ratio. The company has maintained stable and reliable dividends over the past decade, recently increasing its ordinary dividend to A$0.078 per share for the six months ending December 2024 amidst ongoing legal issues from a cybercrime event in 2022.

- Unlock comprehensive insights into our analysis of Medibank Private stock in this dividend report.

- In light of our recent valuation report, it seems possible that Medibank Private is trading beyond its estimated value.

Where To Now?

- Dive into all 29 of the Top ASX Dividend Stocks we have identified here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:LYL

Lycopodium

Provides engineering and project delivery services in the resources, rail infrastructure, and industrial processes sectors in Australia.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives