Should You Be Adding Insurance Australia Group (ASX:IAG) To Your Watchlist Today?

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Insurance Australia Group (ASX:IAG). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Insurance Australia Group with the means to add long-term value to shareholders.

See our latest analysis for Insurance Australia Group

Insurance Australia Group's Improving Profits

Over the last three years, Insurance Australia Group has grown earnings per share (EPS) at as impressive rate from a relatively low point, resulting in a three year percentage growth rate that isn't particularly indicative of expected future performance. As a result, we'll zoom in on growth over the last year, instead. Insurance Australia Group boosted its trailing twelve month EPS from AU$0.34 to AU$0.38, in the last year. This amounts to a 13% gain; a figure that shareholders will be pleased to see.

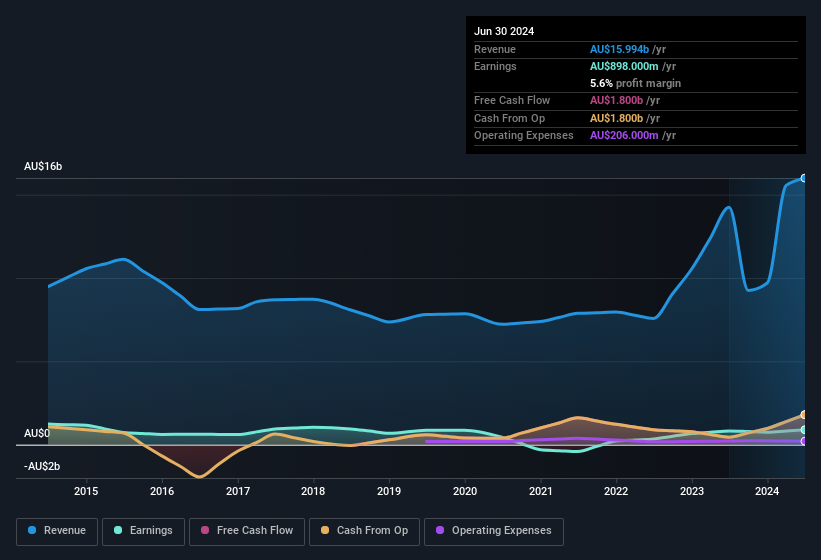

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. Insurance Australia Group maintained stable EBIT margins over the last year, all while growing revenue 12% to AU$16b. That's a real positive.

In the chart below, you can see how the company has grown earnings and revenue, over time. Click on the chart to see the exact numbers.

Fortunately, we've got access to analyst forecasts of Insurance Australia Group's future profits. You can do your own forecasts without looking, or you can take a peek at what the professionals are predicting.

Are Insurance Australia Group Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

We haven't seen any insiders selling Insurance Australia Group shares, in the last year. So it's definitely nice that Independent Non-Executive Director George Sartorel bought AU$38k worth of shares at an average price of around AU$7.69. It seems that at least one insider is prepared to show the market there is potential within Insurance Australia Group.

It's reassuring that Insurance Australia Group insiders are buying the stock, but that's not the only reason to think management are fair to shareholders. Specifically, the CEO is paid quite reasonably for a company of this size. The median total compensation for CEOs of companies similar in size to Insurance Australia Group, with market caps over AU$13b, is around AU$6.7m.

The Insurance Australia Group CEO received AU$5.2m in compensation for the year ending June 2024. That is actually below the median for CEO's of similarly sized companies. CEO compensation is hardly the most important aspect of a company to consider, but when it's reasonable, that gives a little more confidence that leadership are looking out for shareholder interests. Generally, arguments can be made that reasonable pay levels attest to good decision-making.

Is Insurance Australia Group Worth Keeping An Eye On?

As previously touched on, Insurance Australia Group is a growing business, which is encouraging. And there's more to Insurance Australia Group, with the insider buying and modest CEO pay being a great look for those with an eye on the company. The sum of all that, points to a quality business, and a genuine prospect for further research. We should say that we've discovered 1 warning sign for Insurance Australia Group that you should be aware of before investing here.

Keen growth investors love to see insider activity. Thankfully, Insurance Australia Group isn't the only one. You can see a a curated list of Australian companies which have exhibited consistent growth accompanied by high insider ownership.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:IAG

Insurance Australia Group

Insurance Australia Group Limited underwrites general insurance products and provides investment management services in Australia and New Zealand.

Solid track record and good value.

Similar Companies

Market Insights

Community Narratives