Earnings Update: Insurance Australia Group Limited (ASX:IAG) Just Reported And Analysts Are Boosting Their Estimates

It's been a good week for Insurance Australia Group Limited (ASX:IAG) shareholders, because the company has just released its latest half-year results, and the shares gained 8.1% to AU$5.34. Results were roughly in line with estimates, with revenues of AU$3.7b and statutory earnings per share of AU$0.18. This is an important time for investors, as they can track a company's performance in its report, look at what experts are forecasting for next year, and see if there has been any change to expectations for the business. With this in mind, we've gathered the latest statutory forecasts to see what the analysts are expecting for next year.

Check out our latest analysis for Insurance Australia Group

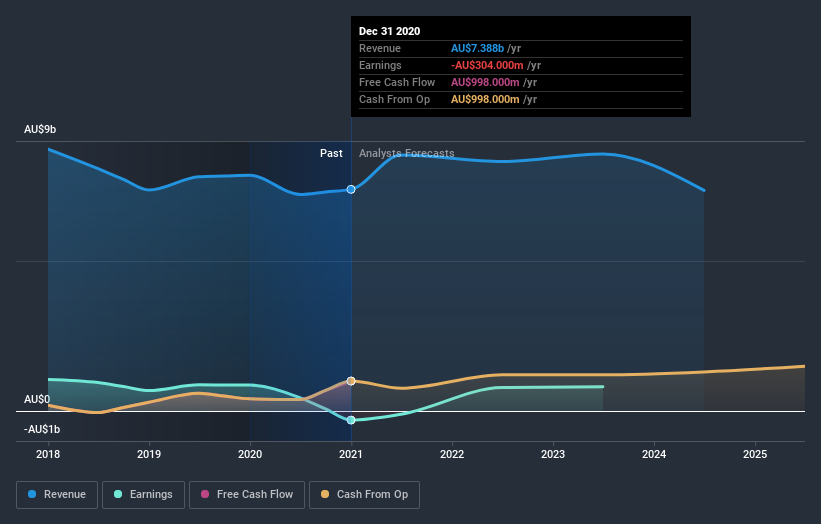

Following the latest results, Insurance Australia Group's eight analysts are now forecasting revenues of AU$8.53b in 2021. This would be a meaningful 15% improvement in sales compared to the last 12 months. Losses are predicted to fall substantially, shrinking 68% to AU$0.042. Before this earnings announcement, the analysts had been modelling revenues of AU$7.44b and losses of AU$0.082 per share in 2021. So there's been quite a change-up of views after the recent consensus updates, with the analysts making a sizeable increase to their revenue forecasts while also reducing the estimated loss as the business grows towards breakeven.

There was no major change to the consensus price target of AU$5.55, perhaps suggesting that the analysts remain concerned about ongoing losses despite the improved earnings and revenue outlook. The consensus price target is just an average of individual analyst targets, so - it could be handy to see how wide the range of underlying estimates is. Currently, the most bullish analyst values Insurance Australia Group at AU$6.20 per share, while the most bearish prices it at AU$5.00. This is a very narrow spread of estimates, implying either that Insurance Australia Group is an easy company to value, or - more likely - the analysts are relying heavily on some key assumptions.

Of course, another way to look at these forecasts is to place them into context against the industry itself. For example, we noticed that Insurance Australia Group's rate of growth is expected to accelerate meaningfully, with revenues forecast to grow 15%, well above its historical decline of 4.1% a year over the past five years. By contrast, our data suggests that other companies (with analyst coverage) in the industry are forecast to see their revenue grow 1.3% per year. So it looks like Insurance Australia Group is expected to grow faster than its competitors, at least for a while.

The Bottom Line

The most obvious conclusion is that the analysts made no changes to their forecasts for a loss next year. Happily, they also upgraded their revenue estimates, and are forecasting revenues to grow faster than the wider industry. There was no real change to the consensus price target, suggesting that the intrinsic value of the business has not undergone any major changes with the latest estimates.

Keeping that in mind, we still think that the longer term trajectory of the business is much more important for investors to consider. We have forecasts for Insurance Australia Group going out to 2024, and you can see them free on our platform here.

Plus, you should also learn about the 2 warning signs we've spotted with Insurance Australia Group .

When trading Insurance Australia Group or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ASX:IAG

Insurance Australia Group

Insurance Australia Group Limited underwrites general insurance products and provides investment management services in Australia and New Zealand.

Good value with adequate balance sheet.