Does Insurance Australia Group's (ASX:IAG) Higher Dividend Signal Enduring Profitability or a New Capital Allocation Approach?

Reviewed by Simply Wall St

- Insurance Australia Group Limited recently reported its full-year results for the period ended June 30, 2025, with net income reaching A$1.36 billion, up from A$898 million the previous year, alongside an announced fully paid dividend of A$0.19 per security and an increased ex-dividend payout date in August 2025.

- This marks a significant improvement in earnings and a boost in shareholder returns, reflecting enhanced profitability and a stronger financial position compared to the previous year.

- We’ll explore how this improvement in net income and the higher dividend informs Insurance Australia Group’s broader investment narrative and outlook.

The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Insurance Australia Group Investment Narrative Recap

At its core, I believe an investment in Insurance Australia Group hinges on the view that its scale, customer stickiness, and efficiency gains will support resilient market share and stable profitability. While the recent jump in net income and dividend is encouraging, it does not significantly alter the major near-term catalyst, successful integration of acquired businesses and digital platforms, nor does it diminish the key risk: heightened claims costs from adverse weather events.

The announced increase in the fully paid dividend to A$0.19 per security for the half year directly connects with these results, showing IAG’s willingness to return more to shareholders as profitability improves. This payout follows the upward earnings surprise and sends a message around capital discipline in the context of IAG’s medium-term growth ambitions.

However, investors should also keep in mind the potentially disruptive risk if severe weather events spike claims and threaten future earnings stability...

Read the full narrative on Insurance Australia Group (it's free!)

Insurance Australia Group's outlook forecasts A$12.4 billion in revenue and A$1.2 billion in earnings by 2028. This is based on a projected annual revenue decline of 10.6% and a decrease in earnings of A$0.2 billion from the current A$1.4 billion.

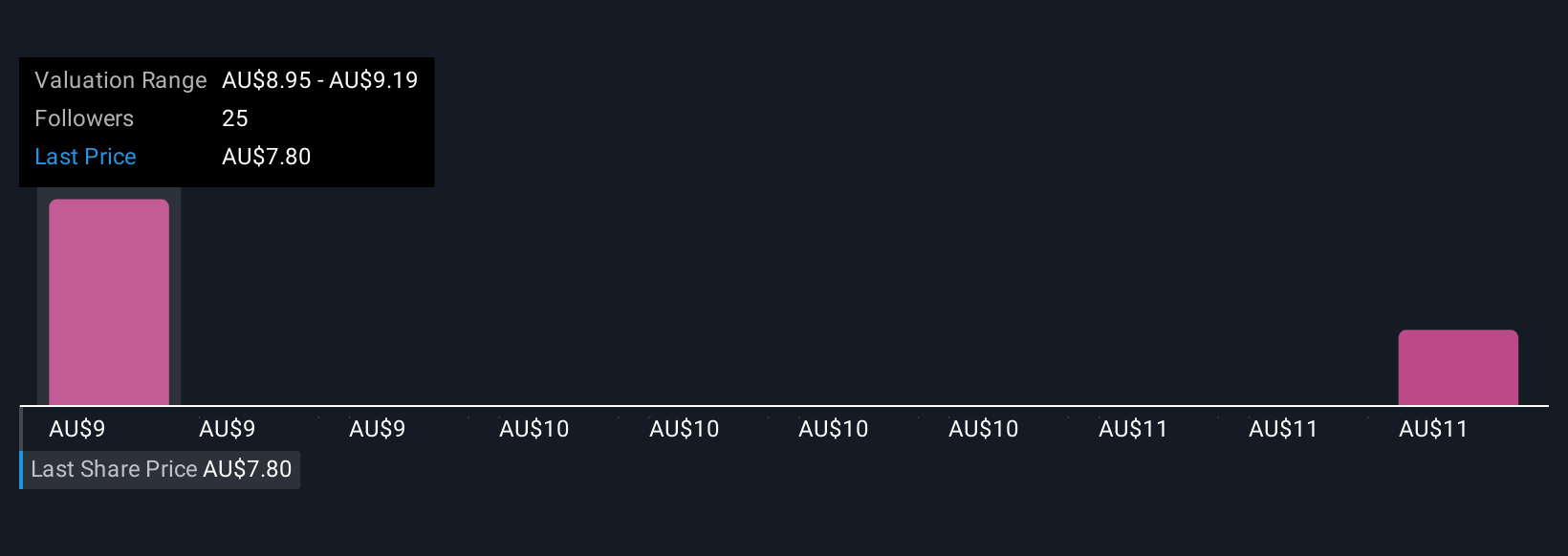

Uncover how Insurance Australia Group's forecasts yield a A$8.98 fair value, a 6% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members provided two estimates for IAG’s fair value, ranging from A$8.98 up to A$11.49 per share. With market participants divided and integration of recent acquisitions still a key catalyst for future growth, you can consider several distinct viewpoints on the road ahead for IAG.

Explore 2 other fair value estimates on Insurance Australia Group - why the stock might be worth as much as 36% more than the current price!

Build Your Own Insurance Australia Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Insurance Australia Group research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Insurance Australia Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Insurance Australia Group's overall financial health at a glance.

Searching For A Fresh Perspective?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 20 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- This technology could replace computers: discover 23 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:IAG

Insurance Australia Group

Insurance Australia Group Limited underwrites general insurance products and provides investment management services in Australia and New Zealand.

Solid track record and good value.

Similar Companies

Market Insights

Community Narratives