A Look at Insurance Australia Group’s (ASX:IAG) Valuation After Surge in Storm Claims and Reinsurance Update

Reviewed by Simply Wall St

Insurance Australia Group (ASX:IAG) received over 10,000 claims in the wake of severe storms across Queensland, New South Wales, and Victoria. The company quickly activated its major event command center and reassured investors about limited net costs due to reinsurance.

See our latest analysis for Insurance Australia Group.

IAG’s share price has pulled back nearly 12% over the last three months, reflecting caution after recent weather events. Its 1-year total shareholder return of 1.4% and a standout 77% gain over three years show long-term momentum is holding up. Short-term pressure has not derailed its bigger-picture performance, especially as risk controls remain front and center.

If you’re interested in broadening your investment research, now’s an ideal time to discover fast growing stocks with high insider ownership

With shares trading below analyst targets and a history of resilience in volatile conditions, the key question is whether Insurance Australia Group is undervalued at current levels or if the market has already priced in future growth potential.

Most Popular Narrative: 12.8% Undervalued

Insurance Australia Group’s most popular narrative assigns a fair value of A$8.95, compared to the last close price of A$7.80. The difference suggests investors may be overlooking drivers supporting a higher valuation, with catalysts and quantitative assumptions powering the story behind the number.

Strong growth momentum, conservative risk management, and ongoing tech investment position IAG for sustained margin expansion, market share gains, and improved shareholder returns.

Want to know what underpins this bullish perspective? The narrative’s foundation is a mix of aggressive forecasts for profitability, ambitious targets for future earnings multiples, and big bets on sector dominance. Don’t miss the sneak peek into the projections fueling this fair value.

Result: Fair Value of $8.95 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising competition and unpredictable climate-related claims remain key risks that could undermine IAG’s margin expansion and future growth story.

Find out about the key risks to this Insurance Australia Group narrative.

Another View: Multiples Tell a Different Story

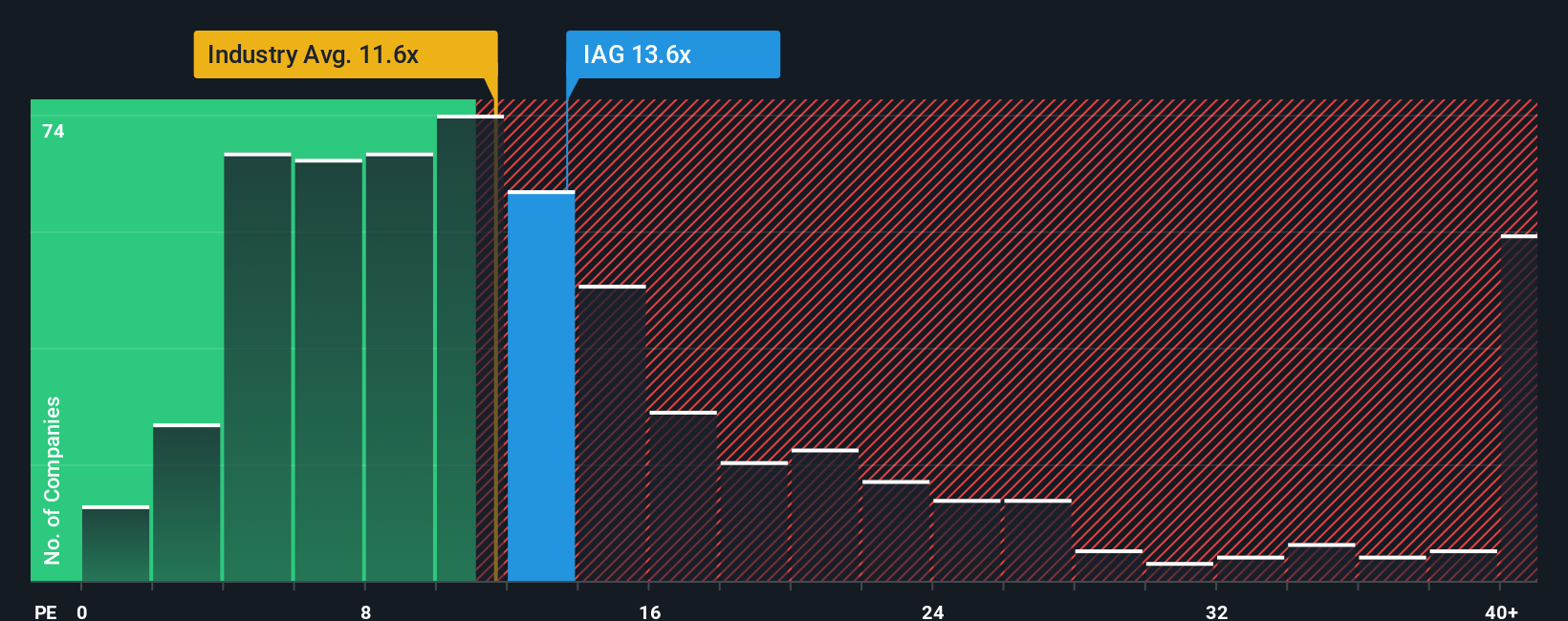

Looking at value through the lens of price-to-earnings, IAG trades at 13.5x earnings, which is cheaper than the peer average of 17x but pricier than the global insurance industry's 11.9x. Meanwhile, our research suggests the fair ratio could be 17.7x, so there is room for the share price to grow if the market re-rates IAG. But with these gaps, is the stock a true bargain or just less expensive than others?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Insurance Australia Group Narrative

If you want to take a different approach or dig into the numbers yourself, it only takes a few minutes to develop your own view and narrative. Do it your way

A great starting point for your Insurance Australia Group research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors widen their net, and the right screener can point you toward hidden gems or industry leaders you never considered before. Give yourself a real edge and avoid missing out on the next big story.

- Tap into potential high-yield opportunities by reviewing these 16 dividend stocks with yields > 3% offering robust payouts in today's market.

- Spot breakthrough innovators at the intersection of healthcare and artificial intelligence with these 31 healthcare AI stocks that are set to transform the sector.

- Capitalize on fast movers in digital finance by checking out these 82 cryptocurrency and blockchain stocks leading the way in blockchain-powered growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:IAG

Insurance Australia Group

Insurance Australia Group Limited underwrites general insurance products and provides investment management services in Australia and New Zealand.

Solid track record and good value.

Similar Companies

Market Insights

Community Narratives