Here's Why I Think AUB Group (ASX:AUB) Is An Interesting Stock

Some have more dollars than sense, they say, so even companies that have no revenue, no profit, and a record of falling short, can easily find investors. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.'

In the age of tech-stock blue-sky investing, my choice may seem old fashioned; I still prefer profitable companies like AUB Group (ASX:AUB). While profit is not necessarily a social good, it's easy to admire a business that can consistently produce it. In comparison, loss making companies act like a sponge for capital - but unlike such a sponge they do not always produce something when squeezed.

View our latest analysis for AUB Group

How Quickly Is AUB Group Increasing Earnings Per Share?

If a company can keep growing earnings per share (EPS) long enough, its share price will eventually follow. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. Over the last three years, AUB Group has grown EPS by 15% per year. That growth rate is fairly good, assuming the company can keep it up.

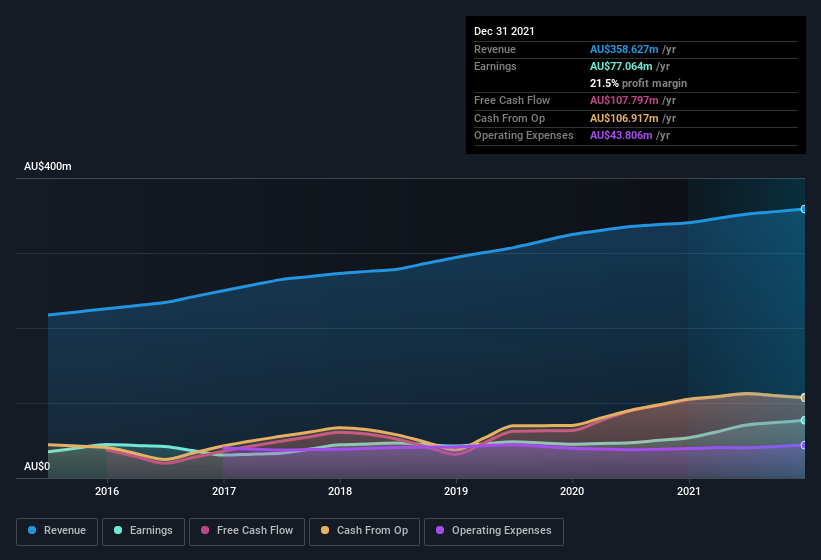

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. I note that AUB Group's revenue from operations was lower than its revenue in the last twelve months, so that could distort my analysis of its margins. While we note AUB Group's EBIT margins were flat over the last year, revenue grew by a solid 5.3% to AU$359m. That's a real positive.

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

The trick, as an investor, is to find companies that are going to perform well in the future, not just in the past. To that end, right now and today, you can check our visualization of consensus analyst forecasts for future AUB Group EPS 100% free.

Are AUB Group Insiders Aligned With All Shareholders?

Like the kids in the streets standing up for their beliefs, insider share purchases give me reason to believe in a brighter future. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

Not only did AUB Group insiders refrain from selling stock during the year, but they also spent AU$146k buying it. That puts the company in a nice light, as it makes me think its leaders are feeling confident. We also note that it was the Independent Non-Executive Chairman, David Clarke, who made the biggest single acquisition, paying AU$58k for shares at about AU$23.28 each.

The good news, alongside the insider buying, for AUB Group bulls is that insiders (collectively) have a meaningful investment in the stock. To be specific, they have AU$18m worth of shares. That shows significant buy-in, and may indicate conviction in the business strategy. Despite being just 1.2% of the company, the value of that investment is enough to show insiders have plenty riding on the venture.

Does AUB Group Deserve A Spot On Your Watchlist?

One positive for AUB Group is that it is growing EPS. That's nice to see. Better yet, insiders are significant shareholders, and have been buying more shares. That makes the company a prime candidate for my watchlist - and arguably a research priority. However, before you get too excited we've discovered 3 warning signs for AUB Group that you should be aware of.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of AUB Group, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:AUB

AUB Group

Engages in the insurance broking and underwriting agency businesses in Australia, the United States, the United Kingdom, Rest of Europe, New Zealand, and internationally.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026