It's only natural that many investors, especially those who are new to the game, prefer to buy shares in 'sexy' stocks with a good story, even if those businesses lose money. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses.

If, on the other hand, you like companies that have revenue, and even earn profits, then you may well be interested in Pental (ASX:PTL). While profit is not necessarily a social good, it's easy to admire a business that can consistently produce it. Conversely, a loss-making company is yet to prove itself with profit, and eventually the sweet milk of external capital may run sour.

View our latest analysis for Pental

How Quickly Is Pental Increasing Earnings Per Share?

If a company can keep growing earnings per share (EPS) long enough, its share price will eventually follow. That means EPS growth is considered a real positive by most successful long-term investors. Pental managed to grow EPS by 11% per year, over three years. That's a good rate of growth, if it can be sustained.

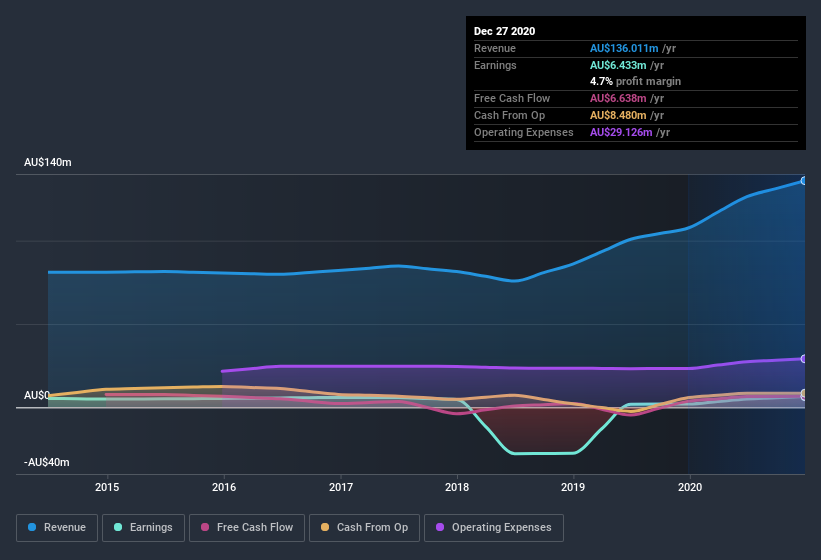

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. Pental shareholders can take confidence from the fact that EBIT margins are up from 4.8% to 6.9%, and revenue is growing. That's great to see, on both counts.

The chart below shows how the company's bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

Since Pental is no giant, with a market capitalization of AU$57m, so you should definitely check its cash and debt before getting too excited about its prospects.

Are Pental Insiders Aligned With All Shareholders?

Like that fresh smell in the air when the rains are coming, insider buying fills me with optimistic anticipation. Because oftentimes, the purchase of stock is a sign that the buyer views it as undervalued. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

The good news for Pental shareholders is that no insiders reported selling shares in the last year. So it's definitely nice that Independent Chairman Mark Hardgrave bought AU$18k worth of shares at an average price of around AU$0.35.

Along with the insider buying, another encouraging sign for Pental is that insiders, as a group, have a considerable shareholding. To be specific, they have AU$17m worth of shares. That shows significant buy-in, and may indicate conviction in the business strategy. Those holdings account for over 30% of the company; visible skin in the game.

Does Pental Deserve A Spot On Your Watchlist?

As I already mentioned, Pental is a growing business, which is what I like to see. On top of that, we've seen insiders buying shares even though they already own plenty. That makes the company a prime candidate for my watchlist - and arguably a research priority. We should say that we've discovered 2 warning signs for Pental that you should be aware of before investing here.

As a growth investor I do like to see insider buying. But Pental isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

When trading Pental or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ASX:PTL

Prestal Holdings

Manufactures, markets, and distributes household chemical, cleaning products, and gift hampers in Australia.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives