- Australia

- /

- Personal Products

- /

- ASX:EXL

Elixinol Global's (ASX:EXL) Stock Price Has Reduced 83% In The Past Three Years

It is a pleasure to report that the Elixinol Global Limited (ASX:EXL) is up 35% in the last quarter. But the last three years have seen a terrible decline. The share price has sunk like a leaky ship, down 83% in that time. So it's about time shareholders saw some gains. Only time will tell if the company can sustain the turnaround.

We really feel for shareholders in this scenario. It's a good reminder of the importance of diversification, and it's worth keeping in mind there's more to life than money, anyway.

See our latest analysis for Elixinol Global

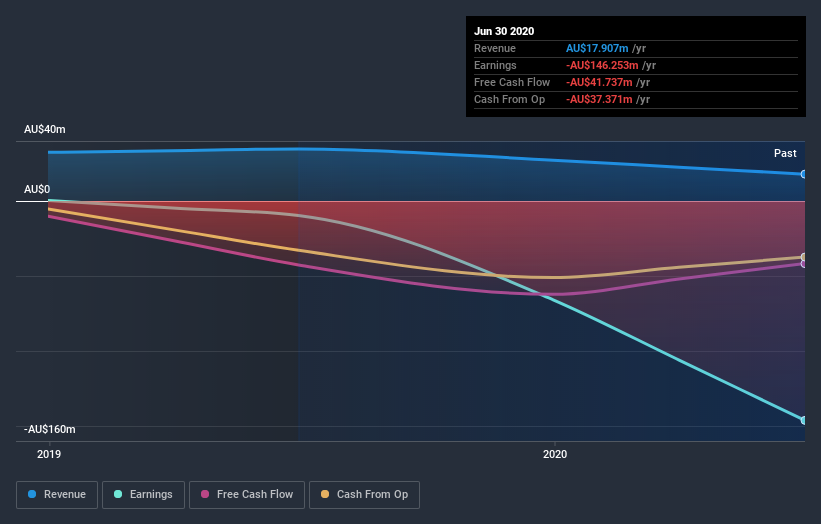

Given that Elixinol Global didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

The last twelve months weren't great for Elixinol Global shares, which cost holders 59%, while the market was up about 4.9%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. The three-year loss of 22% per year isn't as bad as the last twelve months, suggesting that the company has not been able to convince the market it has solved its problems. Although Baron Rothschild famously said to "buy when there's blood in the streets, even if the blood is your own", he also focusses on high quality stocks with solid prospects. It's always interesting to track share price performance over the longer term. But to understand Elixinol Global better, we need to consider many other factors. Take risks, for example - Elixinol Global has 4 warning signs (and 2 which are significant) we think you should know about.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

If you decide to trade Elixinol Global, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Elixinol Wellness might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ASX:EXL

Elixinol Wellness

A holding company, provides healthy products in Australia, the Americas, and internationally.

Slight with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives