- Australia

- /

- Personal Products

- /

- ASX:BIO

Biome Australia Limited's (ASX:BIO) P/S Is Still On The Mark Following 39% Share Price Bounce

Biome Australia Limited (ASX:BIO) shareholders would be excited to see that the share price has had a great month, posting a 39% gain and recovering from prior weakness. The annual gain comes to 138% following the latest surge, making investors sit up and take notice.

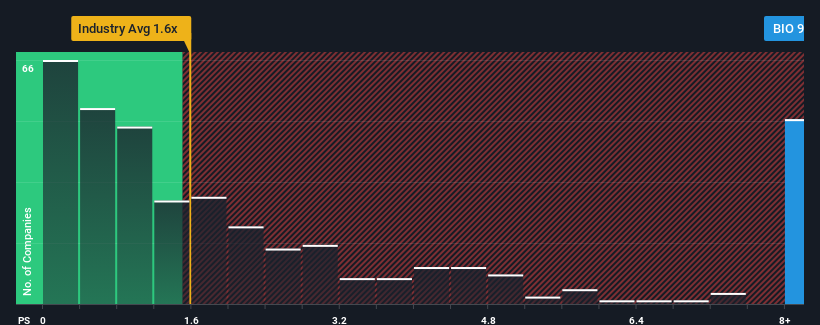

Since its price has surged higher, you could be forgiven for thinking Biome Australia is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 9.9x, considering almost half the companies in Australia's Personal Products industry have P/S ratios below 0.8x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

View our latest analysis for Biome Australia

How Has Biome Australia Performed Recently?

Biome Australia certainly has been doing a good job lately as it's been growing revenue more than most other companies. It seems that many are expecting the strong revenue performance to persist, which has raised the P/S. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Keen to find out how analysts think Biome Australia's future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The High P/S Ratio?

The only time you'd be truly comfortable seeing a P/S as steep as Biome Australia's is when the company's growth is on track to outshine the industry decidedly.

Taking a look back first, we see that the company grew revenue by an impressive 61% last year. The latest three year period has also seen an incredible overall rise in revenue, aided by its incredible short-term performance. So we can start by confirming that the company has done a tremendous job of growing revenue over that time.

Turning to the outlook, the next year should generate growth of 44% as estimated by the lone analyst watching the company. That's shaping up to be materially higher than the 5.7% growth forecast for the broader industry.

In light of this, it's understandable that Biome Australia's P/S sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Final Word

Biome Australia's P/S has grown nicely over the last month thanks to a handy boost in the share price. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of Biome Australia's analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Biome Australia (at least 1 which is a bit concerning), and understanding them should be part of your investment process.

If you're unsure about the strength of Biome Australia's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Biome Australia might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:BIO

Biome Australia

Engages in the development, commercialization, and marketing of various live biotherapeutics and complimentary medicines in Australia and internationally.

Exceptional growth potential with adequate balance sheet.

Market Insights

Community Narratives