- Australia

- /

- Medical Equipment

- /

- ASX:UBI

We Think Universal Biosensors (ASX:UBI) Needs To Drive Business Growth Carefully

There's no doubt that money can be made by owning shares of unprofitable businesses. For example, biotech and mining exploration companies often lose money for years before finding success with a new treatment or mineral discovery. But the harsh reality is that very many loss making companies burn through all their cash and go bankrupt.

So should Universal Biosensors (ASX:UBI) shareholders be worried about its cash burn? In this report, we will consider the company's annual negative free cash flow, henceforth referring to it as the 'cash burn'. Let's start with an examination of the business' cash, relative to its cash burn.

View our latest analysis for Universal Biosensors

Does Universal Biosensors Have A Long Cash Runway?

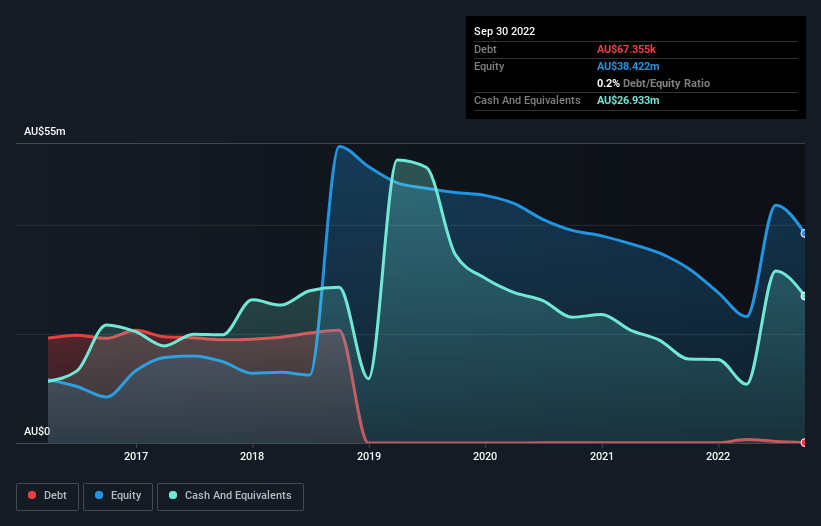

A company's cash runway is calculated by dividing its cash hoard by its cash burn. Universal Biosensors has such a small amount of debt that we'll set it aside, and focus on the AU$27m in cash it held at September 2022. Looking at the last year, the company burnt through AU$16m. So it had a cash runway of approximately 21 months from September 2022. While that cash runway isn't too concerning, sensible holders would be peering into the distance, and considering what happens if the company runs out of cash. You can see how its cash balance has changed over time in the image below.

How Well Is Universal Biosensors Growing?

Universal Biosensors boosted investment sharply in the last year, with cash burn ramping by 62%. As if that's not bad enough, the operating revenue also dropped by 21%, making us very wary indeed. Considering both these metrics, we're a little concerned about how the company is developing. Of course, we've only taken a quick look at the stock's growth metrics, here. You can take a look at how Universal Biosensors has developed its business over time by checking this visualization of its revenue and earnings history.

How Hard Would It Be For Universal Biosensors To Raise More Cash For Growth?

Universal Biosensors seems to be in a fairly good position, in terms of cash burn, but we still think it's worthwhile considering how easily it could raise more money if it wanted to. Companies can raise capital through either debt or equity. Commonly, a business will sell new shares in itself to raise cash and drive growth. By comparing a company's annual cash burn to its total market capitalisation, we can estimate roughly how many shares it would have to issue in order to run the company for another year (at the same burn rate).

Universal Biosensors' cash burn of AU$16m is about 27% of its AU$57m market capitalisation. That's not insignificant, and if the company had to sell enough shares to fund another year's growth at the current share price, you'd likely witness fairly costly dilution.

Is Universal Biosensors' Cash Burn A Worry?

Even though its increasing cash burn makes us a little nervous, we are compelled to mention that we thought Universal Biosensors' cash runway was relatively promising. Summing up, we think the Universal Biosensors' cash burn is a risk, based on the factors we mentioned in this article. On another note, we conducted an in-depth investigation of the company, and identified 4 warning signs for Universal Biosensors (1 is a bit unpleasant!) that you should be aware of before investing here.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies insiders are buying, and this list of stocks growth stocks (according to analyst forecasts)

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:UBI

Universal Biosensors

Through its subsidiaries, designs and develops electrochemical cells (strips) used in conjunction with point-of-use devices in Australia, the Americas, Europe, and internationally.

Excellent balance sheet with slight risk.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026