- Australia

- /

- Medical Equipment

- /

- ASX:SOM

Further weakness as SomnoMed (ASX:SOM) drops 12% this week, taking five-year losses to 66%

While not a mind-blowing move, it is good to see that the SomnoMed Limited (ASX:SOM) share price has gained 14% in the last three months. But that can't change the reality that over the longer term (five years), the returns have been really quite dismal. Indeed, the share price is down 78% in the period. So is the recent increase sufficient to restore confidence in the stock? Not yet. We'd err towards caution given the long term under-performance.

If the past week is anything to go by, investor sentiment for SomnoMed isn't positive, so let's see if there's a mismatch between fundamentals and the share price.

View our latest analysis for SomnoMed

SomnoMed isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. When a company doesn't make profits, we'd generally hope to see good revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

Over five years, SomnoMed grew its revenue at 12% per year. That's a fairly respectable growth rate. So the stock price fall of 12% per year seems pretty steep. The market can be a harsh master when your company is losing money and revenue growth disappoints.

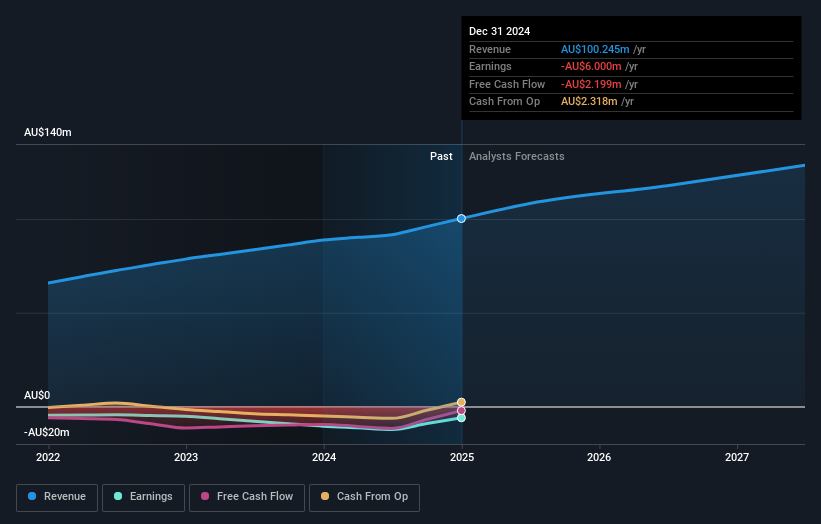

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

We like that insiders have been buying shares in the last twelve months. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. So we recommend checking out this free report showing consensus forecasts

What About The Total Shareholder Return (TSR)?

Investors should note that there's a difference between SomnoMed's total shareholder return (TSR) and its share price change, which we've covered above. Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. SomnoMed hasn't been paying dividends, but its TSR of -66% exceeds its share price return of -78%, implying it has either spun-off a business, or raised capital at a discount; thereby providing additional value to shareholders.

A Different Perspective

It's good to see that SomnoMed has rewarded shareholders with a total shareholder return of 51% in the last twelve months. Notably the five-year annualised TSR loss of 11% per year compares very unfavourably with the recent share price performance. This makes us a little wary, but the business might have turned around its fortunes. It's always interesting to track share price performance over the longer term. But to understand SomnoMed better, we need to consider many other factors. For example, we've discovered 3 warning signs for SomnoMed (2 are a bit concerning!) that you should be aware of before investing here.

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of undervalued small cap companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Australian exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:SOM

SomnoMed

SomnoMed Limited, together with its subsidiaries, produce and sells devices for the oral treatment of sleep related disorders in the Asia Pacific region, North America, and Europe.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives