- Australia

- /

- Healthcare Services

- /

- ASX:SIG

Sigma Healthcare Limited Beat Analyst Estimates: See What The Consensus Is Forecasting For This Year

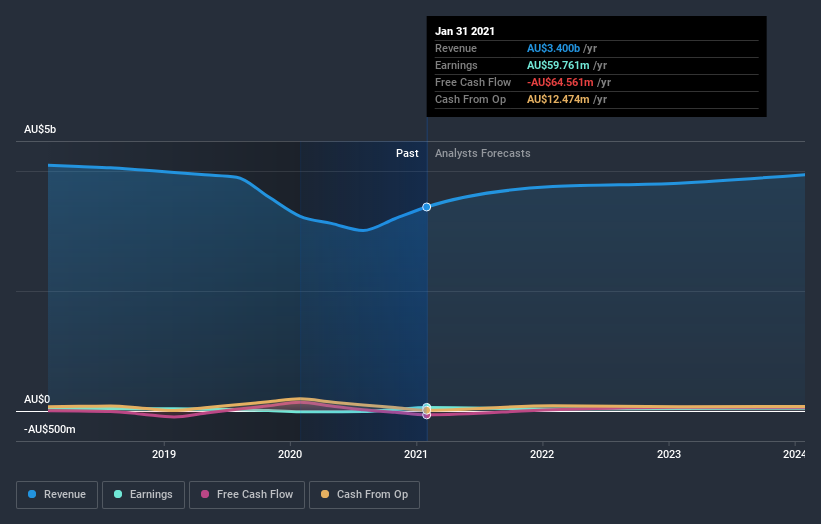

Investors in Sigma Healthcare Limited (ASX:SIG) had a good week, as its shares rose 4.5% to close at AU$0.70 following the release of its full-year results. It looks like a credible result overall - although revenues of AU$3.4b were what the analysts expected, Sigma Healthcare surprised by delivering a (statutory) profit of AU$0.059 per share, an impressive 195% above what was forecast. Following the result, the analysts have updated their earnings model, and it would be good to know whether they think there's been a strong change in the company's prospects, or if it's business as usual. So we gathered the latest post-earnings forecasts to see what estimates suggest is in store for next year.

View our latest analysis for Sigma Healthcare

Taking into account the latest results, the consensus forecast from Sigma Healthcare's five analysts is for revenues of AU$3.74b in 2022, which would reflect a decent 10.0% improvement in sales compared to the last 12 months. Statutory earnings per share are forecast to tumble 47% to AU$0.032 in the same period. In the lead-up to this report, the analysts had been modelling revenues of AU$3.53b and earnings per share (EPS) of AU$0.033 in 2022. There doesn't appear to have been a major change in sentiment following the results, other than the small increase to revenue estimates.

It may not be a surprise to see thatthe analysts have reconfirmed their price target of AU$0.70, implying that the uplift in sales is not expected to greatly contribute to Sigma Healthcare's valuation in the near term. That's not the only conclusion we can draw from this data however, as some investors also like to consider the spread in estimates when evaluating analyst price targets. There are some variant perceptions on Sigma Healthcare, with the most bullish analyst valuing it at AU$0.76 and the most bearish at AU$0.63 per share. Still, with such a tight range of estimates, it suggeststhe analysts have a pretty good idea of what they think the company is worth.

Another way we can view these estimates is in the context of the bigger picture, such as how the forecasts stack up against past performance, and whether forecasts are more or less bullish relative to other companies in the industry. For example, we noticed that Sigma Healthcare's rate of growth is expected to accelerate meaningfully, with revenues forecast to exhibit 10.0% growth to the end of 2022 on an annualised basis. That is well above its historical decline of 4.4% a year over the past five years. Compare this against analyst estimates for the broader industry, which suggest that (in aggregate) industry revenues are expected to grow 1.7% annually. Not only are Sigma Healthcare's revenues expected to improve, it seems that the analysts are also expecting it to grow faster than the wider industry.

The Bottom Line

The most important thing to take away is that there's been no major change in sentiment, with the analysts reconfirming that the business is performing in line with their previous earnings per share estimates. Pleasantly, they also upgraded their revenue estimates, and their forecasts suggest the business is expected to grow faster than the wider industry. There was no real change to the consensus price target, suggesting that the intrinsic value of the business has not undergone any major changes with the latest estimates.

Following on from that line of thought, we think that the long-term prospects of the business are much more relevant than next year's earnings. At Simply Wall St, we have a full range of analyst estimates for Sigma Healthcare going out to 2024, and you can see them free on our platform here..

And what about risks? Every company has them, and we've spotted 2 warning signs for Sigma Healthcare you should know about.

If you’re looking to trade Sigma Healthcare, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ASX:SIG

Sigma Healthcare

Engages in the wholesale distribution of pharmaceutical goods and medical consumables to community pharmacies primarily in Australia.

Flawless balance sheet and good value.