- Australia

- /

- Healthcare Services

- /

- ASX:RHC

Why Investors Shouldn't Be Surprised By Ramsay Health Care Limited's (ASX:RHC) P/E

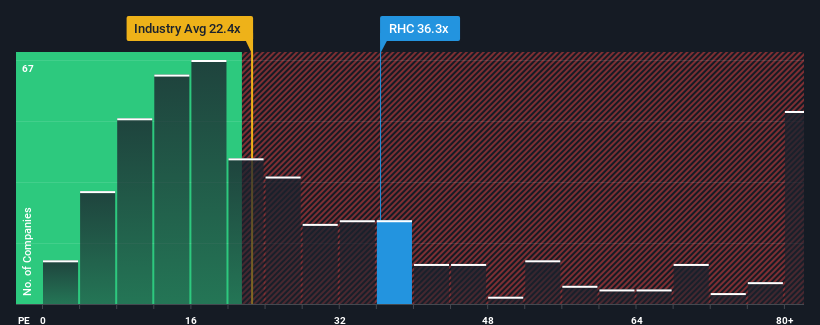

When close to half the companies in Australia have price-to-earnings ratios (or "P/E's") below 19x, you may consider Ramsay Health Care Limited (ASX:RHC) as a stock to avoid entirely with its 36.3x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

While the market has experienced earnings growth lately, Ramsay Health Care's earnings have gone into reverse gear, which is not great. One possibility is that the P/E is high because investors think this poor earnings performance will turn the corner. If not, then existing shareholders may be extremely nervous about the viability of the share price.

View our latest analysis for Ramsay Health Care

Does Growth Match The High P/E?

The only time you'd be truly comfortable seeing a P/E as steep as Ramsay Health Care's is when the company's growth is on track to outshine the market decidedly.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 4.5%. This means it has also seen a slide in earnings over the longer-term as EPS is down 43% in total over the last three years. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Shifting to the future, estimates from the analysts covering the company suggest earnings should grow by 25% per annum over the next three years. Meanwhile, the rest of the market is forecast to only expand by 19% per year, which is noticeably less attractive.

In light of this, it's understandable that Ramsay Health Care's P/E sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Final Word

It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Ramsay Health Care maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. It's hard to see the share price falling strongly in the near future under these circumstances.

We don't want to rain on the parade too much, but we did also find 2 warning signs for Ramsay Health Care (1 can't be ignored!) that you need to be mindful of.

If you're unsure about the strength of Ramsay Health Care's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:RHC

Ramsay Health Care

Owns and operates hospitals in Australia, and internationally.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives