- Australia

- /

- Capital Markets

- /

- ASX:BFG

3 ASX Stocks Estimated To Be 18.8% To 28.8% Below Intrinsic Value

Reviewed by Simply Wall St

The ASX200 closed up 1.25% at 7777.7 points, marking its second consecutive positive session amid a volatile trading period. China’s latest inflation data, which showed the fastest rate of growth in five months, helped lift sentiment across Asian markets and positively impacted Australian sectors such as IT and Real Estate. In this context of fluctuating market conditions, identifying undervalued stocks can offer potential opportunities for investors looking to capitalize on discrepancies between market price and intrinsic value. Here are three ASX stocks currently estimated to be 18.8% to 28.8% below their intrinsic value.

Top 10 Undervalued Stocks Based On Cash Flows In Australia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| LaserBond (ASX:LBL) | A$0.695 | A$1.37 | 49.3% |

| Elders (ASX:ELD) | A$9.14 | A$18.11 | 49.5% |

| Shine Justice (ASX:SHJ) | A$0.685 | A$1.33 | 48.6% |

| Regal Partners (ASX:RPL) | A$3.29 | A$6.39 | 48.5% |

| Nanosonics (ASX:NAN) | A$2.96 | A$5.82 | 49.2% |

| Infomedia (ASX:IFM) | A$1.67 | A$3.06 | 45.4% |

| HMC Capital (ASX:HMC) | A$7.82 | A$13.70 | 42.9% |

| Millennium Services Group (ASX:MIL) | A$1.145 | A$2.24 | 48.9% |

| Little Green Pharma (ASX:LGP) | A$0.091 | A$0.17 | 46.3% |

| Airtasker (ASX:ART) | A$0.29 | A$0.52 | 44.7% |

Here we highlight a subset of our preferred stocks from the screener.

Bell Financial Group (ASX:BFG)

Overview: Bell Financial Group Limited offers broking, online broking, corporate finance, and financial advisory services to private, institutional, and corporate clients with a market cap of A$455.46 million.

Operations: Revenue segments for Bell Financial Group Limited include Retail (A$103.58 million), Institutional (A$50.36 million), Products & Services (A$48.10 million), and Technology & Platforms (A$26.20 million).

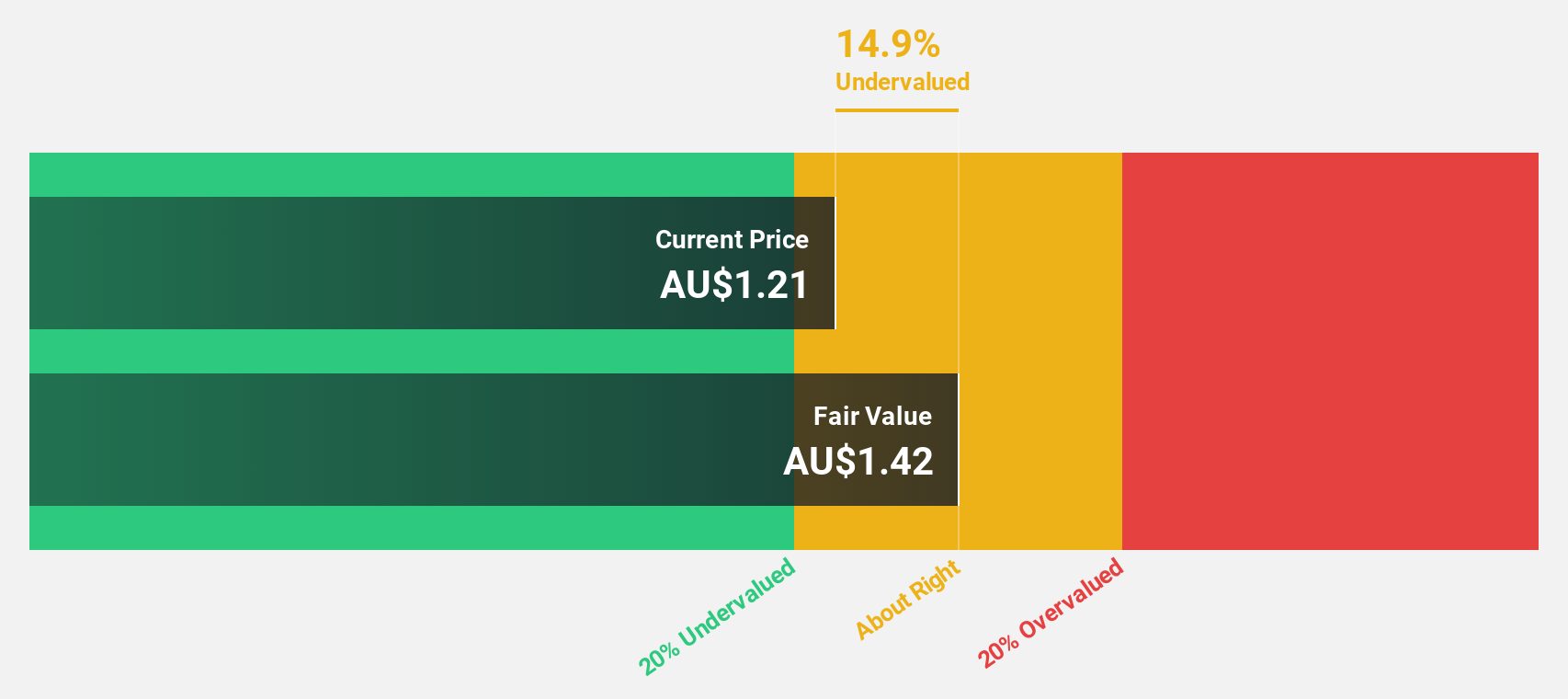

Estimated Discount To Fair Value: 28.5%

Bell Financial Group is trading at A$1.42, significantly below its estimated fair value of A$1.99, indicating it may be undervalued based on discounted cash flows. Earnings are forecast to grow at 26.9% annually, outpacing the Australian market's 12.7%. However, despite this growth potential and trading at a good value compared to peers, the dividend yield of 4.93% is not well covered by earnings or free cash flows, posing some risk for income-focused investors.

- Our growth report here indicates Bell Financial Group may be poised for an improving outlook.

- Get an in-depth perspective on Bell Financial Group's balance sheet by reading our health report here.

Nickel Industries (ASX:NIC)

Overview: Nickel Industries Limited, with a market cap of A$3.34 billion, engages in nickel ore mining and the production of nickel pig iron and nickel matte.

Operations: The company's revenue segments include $36.81 million from nickel ore mining in Indonesia, $32.58 million from HPAL projects in Indonesia and Hong Kong, and $1.81 billion from RKEF projects in Indonesia and Singapore.

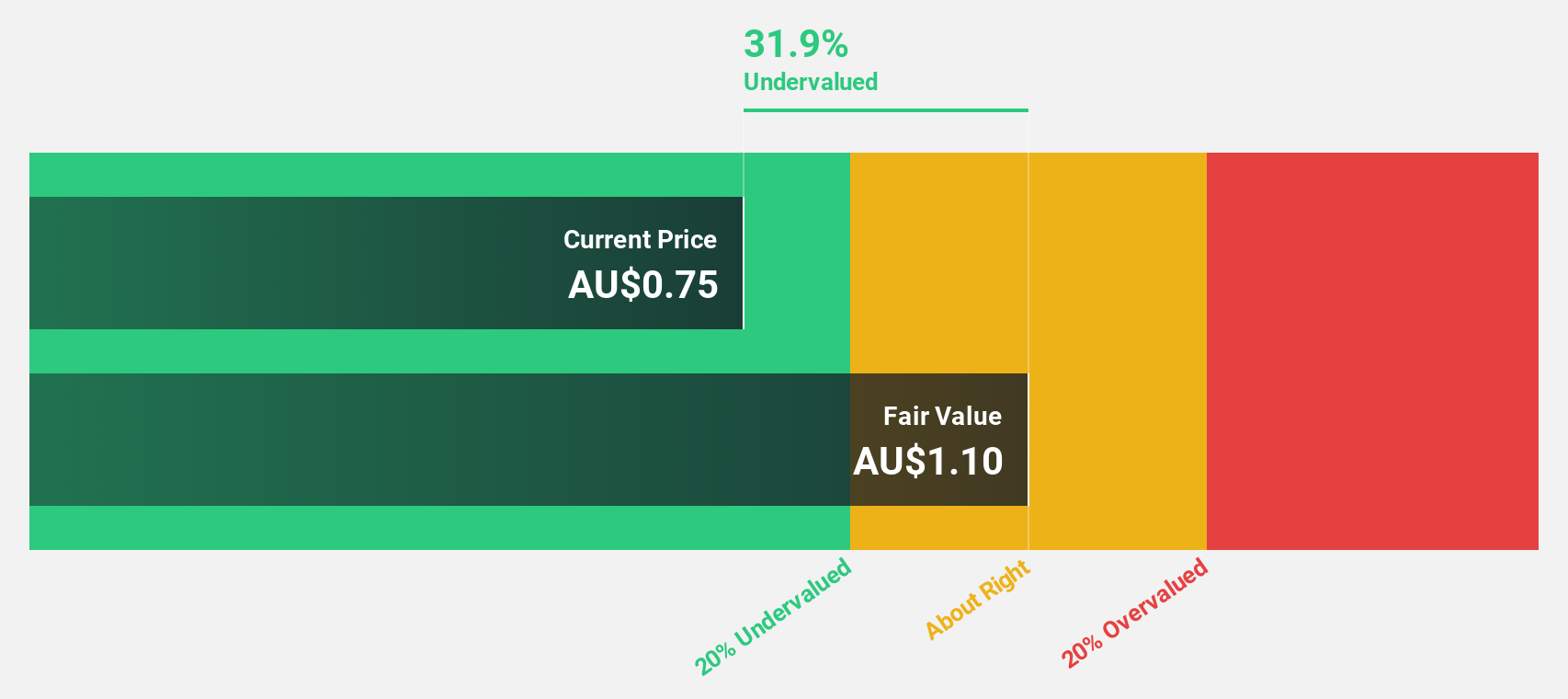

Estimated Discount To Fair Value: 28.8%

Nickel Industries Limited, currently trading at A$0.78, is undervalued based on its estimated fair value of A$1.10. Despite recent shareholder dilution and lower profit margins (6.5% vs 13.1% last year), earnings are forecast to grow significantly at 41.51% annually, outpacing the Australian market's growth rate of 12.7%. The company has secured a new US$250 million term loan facility to support its acquisition in the ENC HPAL Project, enhancing its future cash flow potential despite current dividend sustainability concerns (6.24%).

- Insights from our recent growth report point to a promising forecast for Nickel Industries' business outlook.

- Delve into the full analysis health report here for a deeper understanding of Nickel Industries.

PolyNovo (ASX:PNV)

Overview: PolyNovo Limited develops medical devices internationally, operating in regions including the United States, Australia, New Zealand, the United Kingdom, Ireland, and Singapore with a market cap of A$1.68 billion.

Operations: PolyNovo generates revenue primarily from the development, manufacturing, and commercialization of NovoSorb Technology, amounting to A$83.47 million.

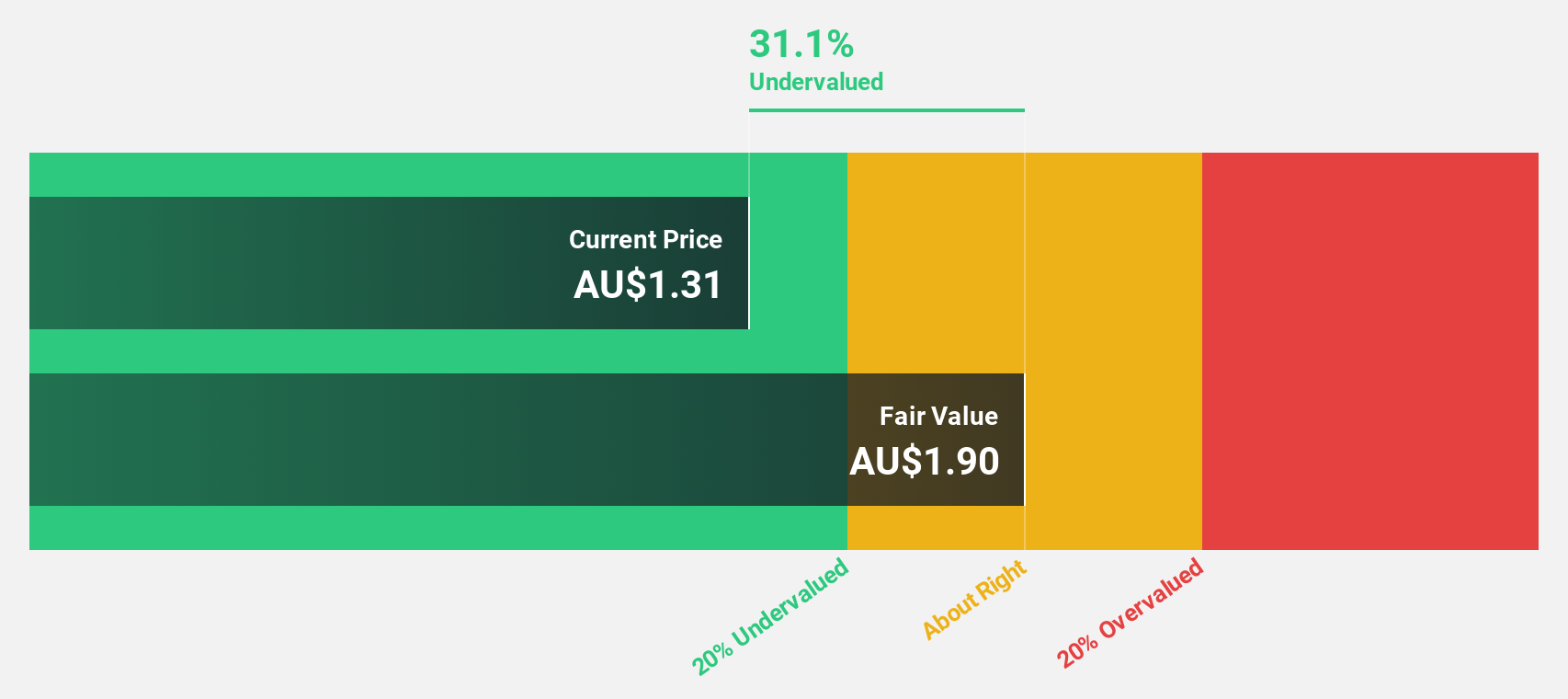

Estimated Discount To Fair Value: 18.8%

PolyNovo Limited, trading at A$2.43, is undervalued based on its estimated fair value of A$2.99. Recent trading results show a significant revenue increase to A$104.8 million for 2024, up 57.5% from the previous year, with full-year sales rising to A$92 million. The company’s earnings are expected to grow significantly at 38.6% annually over the next three years, outpacing the Australian market's growth rate of 12.7%.

- Upon reviewing our latest growth report, PolyNovo's projected financial performance appears quite optimistic.

- Click here to discover the nuances of PolyNovo with our detailed financial health report.

Taking Advantage

- Unlock our comprehensive list of 34 Undervalued ASX Stocks Based On Cash Flows by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bell Financial Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:BFG

Bell Financial Group

Engages in the provision of full-service broking, online broking, corporate finance, and financial advisory services to private, institutional, and corporate clients in Australia, the United States, the United Kingdom, Hong Kong, and Kuala Lumpur.

Good value with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives