High Growth Tech Stocks in Australia Including FINEOS Corporation Holdings

Reviewed by Simply Wall St

The Australian market has been experiencing a period of volatility, with recent developments such as Trump's decision to ease tariffs on China contributing to the ASX's movement back towards the 8,000-point mark. In this dynamic environment, high-growth tech stocks like FINEOS Corporation Holdings are attracting attention for their potential resilience and innovation-driven growth amid broader market fluctuations.

Top 10 High Growth Tech Companies In Australia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Gratifii | 42.14% | 113.99% | ★★★★★★ |

| Pro Medicus | 22.19% | 23.49% | ★★★★★★ |

| WiseTech Global | 20.37% | 25.23% | ★★★★★★ |

| BlinkLab | 65.54% | 64.35% | ★★★★★★ |

| Wrkr | 57.01% | 116.83% | ★★★★★★ |

| AVA Risk Group | 29.15% | 108.15% | ★★★★★★ |

| Pointerra | 50.42% | 159.12% | ★★★★★☆ |

| Echo IQ | 84.54% | 87.08% | ★★★★★★ |

| SiteMinder | 21.09% | 65.36% | ★★★★★★ |

| Advanced Health Intelligence | 166.58% | 178.92% | ★★★★★☆ |

Click here to see the full list of 48 stocks from our ASX High Growth Tech and AI Stocks screener.

We're going to check out a few of the best picks from our screener tool.

FINEOS Corporation Holdings (ASX:FCL)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: FINEOS Corporation Holdings plc develops and sells enterprise claims and policy management software for life, accident, and health insurers as well as employee benefits providers across North America, the Asia Pacific, the Middle East, and Africa with a market cap of A$656.72 million.

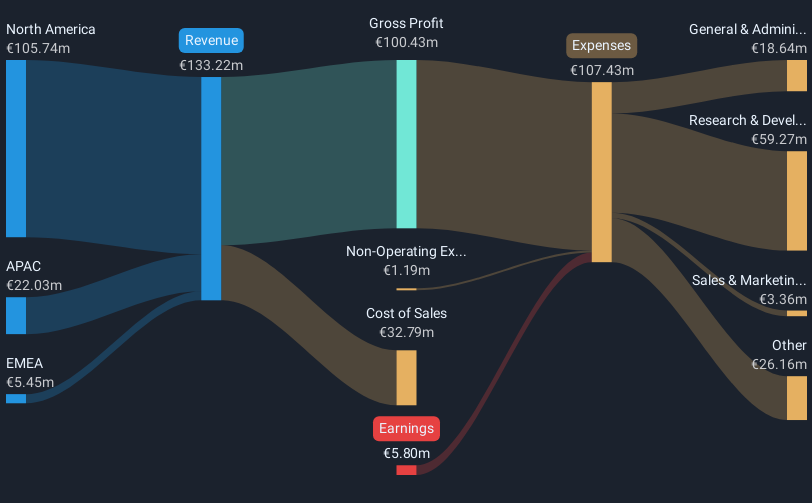

Operations: The company generates revenue primarily from its Software & Programming segment, amounting to €133.22 million. It focuses on providing solutions for claims and policy management tailored to life, accident, and health insurance sectors.

FINEOS Corporation Holdings, a leader in insurance software solutions, has recently announced strategic partnerships that underscore its commitment to modernizing the industry. By integrating with Wellthy and Sutherland, FINEOS aims to enhance efficiency and compliance across benefits management. These collaborations are set to streamline operations by leveraging AI-driven solutions and pre-built integrations, which reduce implementation costs and accelerate market readiness. The company's focus on expanding holistic care offerings aligns with growing market demands for comprehensive services beyond traditional insurance benefits. This strategy not only addresses immediate administrative challenges but also positions FINEOS at the forefront of innovation in a competitive landscape. With projected annual revenue growth of 5.7% and an anticipated shift into profitability within three years, these developments could significantly influence its financial trajectory.

Pro Medicus (ASX:PME)

Simply Wall St Growth Rating: ★★★★★★

Overview: Pro Medicus Limited is a healthcare informatics company that develops and supplies imaging software and radiology information system software to hospitals, imaging centers, and healthcare groups across Australia, North America, and Europe, with a market cap of A$21.80 billion.

Operations: The company generates revenue by producing integrated software applications for the healthcare industry, amounting to A$184.58 million.

Pro Medicus, a trailblazer in medical imaging software, showcases robust growth with a 22.2% annual revenue increase and an impressive 23.5% rise in earnings per year. Recently added to the S&P/ASX 50 Index, the company has committed to a significant share repurchase program, planning to buy back up to 10 million shares by March 2026. This move reflects strong financial health and confidence in sustained growth, underscored by their recent performance with half-year sales jumping from AUD 74.11 million to AUD 97.19 million—a testament to their expanding market presence and innovation-driven approach in healthcare technology.

- Unlock comprehensive insights into our analysis of Pro Medicus stock in this health report.

Examine Pro Medicus' past performance report to understand how it has performed in the past.

SEEK (ASX:SEK)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: SEEK Limited operates as an online employment marketplace service provider across Australia, South East Asia, New Zealand, the United Kingdom, Europe, and other international regions with a market capitalization of A$7.47 billion.

Operations: SEEK Limited generates revenue primarily from its Employment Marketplaces in ANZ, contributing A$821.40 million, and Asia, with A$240.90 million.

SEEK Limited, amidst a challenging Interactive Media and Services industry, has demonstrated resilience with a 9.2% forecasted annual revenue growth and an impressive 26.3% expected rise in earnings per year. Despite a substantial one-off loss of A$119.8 million last fiscal year, the firm's strategic focus on innovation is evident from its R&D commitment, aligning with broader industry trends towards digital transformation and enhanced data analytics capabilities in recruitment services. The recent decision to increase dividends by 26%, paired with robust half-year net income growth from AUD 29.8 million to AUD 143.5 million, underscores management's confidence in sustained profitability and shareholder value creation.

Next Steps

- Reveal the 48 hidden gems among our ASX High Growth Tech and AI Stocks screener with a single click here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:FCL

FINEOS Corporation Holdings

Engages in the development and sale of enterprise claims and policy management software for life, accident and health insurers, and employee benefits providers in North America, the Asia Pacific, the Middle East, and Africa.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives