It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Pro Medicus (ASX:PME). Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

Check out our latest analysis for Pro Medicus

How Fast Is Pro Medicus Growing?

Generally, companies experiencing growth in earnings per share (EPS) should see similar trends in share price. That means EPS growth is considered a real positive by most successful long-term investors. Shareholders will be happy to know that Pro Medicus' EPS has grown 33% each year, compound, over three years. This has no doubt fuelled the optimism that sees the stock trading on a high multiple of earnings.

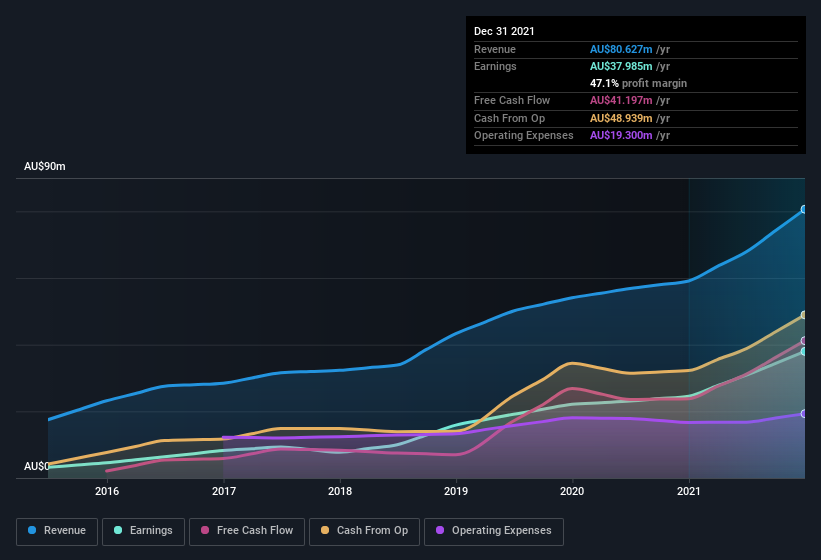

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. The good news is that Pro Medicus is growing revenues, and EBIT margins improved by 7.5 percentage points to 65%, over the last year. That's great to see, on both counts.

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

While we live in the present moment, there's little doubt that the future matters most in the investment decision process. So why not check this interactive chart depicting future EPS estimates, for Pro Medicus?

Are Pro Medicus Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. Because often, the purchase of stock is a sign that the buyer views it as undervalued. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

One positive for Pro Medicus, is that company insiders spent AU$70k acquiring shares in the last year. This might not be a huge sum, but it's well worth noting anyway, given the complete lack of selling.

And the insider buying isn't the only sign of alignment between shareholders and the board, since Pro Medicus insiders own more than a third of the company. In fact, they own 56% of the company, so they will share in the same delights and challenges experienced by the ordinary shareholders. Intuition will tell you this is a good sign because it suggests they will be incentivised to build value for shareholders over the long term. And their holding is extremely valuable at the current share price, totalling AU$2.3b. This is an incredible endorsement from them.

Shareholders have more to smile about than just insiders adding more shares to their already sizeable holdings. That's because Pro Medicus' CEO, Sam Hupert, is paid at a relatively modest level when compared to other CEOs for companies of this size. The median total compensation for CEOs of companies similar in size to Pro Medicus, with market caps between AU$2.9b and AU$9.2b, is around AU$2.9m.

The CEO of Pro Medicus only received AU$508k in total compensation for the year ending June 2021. First impressions seem to indicate a compensation policy that is favourable to shareholders. CEO compensation is hardly the most important aspect of a company to consider, but when it's reasonable, that gives a little more confidence that leadership are looking out for shareholder interests. It can also be a sign of a culture of integrity, in a broader sense.

Is Pro Medicus Worth Keeping An Eye On?

If you believe that share price follows earnings per share you should definitely be delving further into Pro Medicus' strong EPS growth. Not only that, but we can see that insiders both own a lot of, and are buying more shares in the company. These things considered, this is one stock worth watching. What about risks? Every company has them, and we've spotted 1 warning sign for Pro Medicus you should know about.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Pro Medicus, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:PME

Pro Medicus

A healthcare informatics company, engages in the development and supply of healthcare imaging software, and radiology information (RIS) system software and services to hospitals, imaging centers, and health care groups in Australia, North America, and Europe.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives